UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ Annual Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934

For the fiscal year ended December 31, 2018

or

☐ Transition Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER: 000-52446

ACTINIUM PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 74-2963609 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

275 Madison Avenue, 7th Fl.

New York, NY 10016

(Address of principal executive offices) (Zip Code)

(646) 677-3870

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |

| Common stock, par value $0.001 | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of the chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the act): Yes ☐ No ☒

The aggregate market value of voting stock held by nonaffiliates of the registrant as of June 29, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of the common stock on the NYSE AMERICAN on June 29, 2018 was $70,693,197.

As of March 15, 2019, 119,136,036 shares of common stock, $0.001 par value per share, were outstanding.

Table of Contents

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Report, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Report, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Report. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Report could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Report to conform our statements to actual results or changed expectations.

ii

Business Overview

Actinium Pharmaceuticals Inc. is a clinical-stage, biopharmaceutical company focused on developing and potentially commercializing therapies for targeted conditioning prior to cell therapies such as a BMT or Bone Marrow Transplant or CAR-T, a type of cellular therapy that genetically alters a patient’s own T cells to target and kill their cancer cells, and for other adoptive cell therapies. In addition, we are also developing potential therapies for targeting and killing of cancer cells either as single agents or in combination with other drugs. Our targeted therapies are Antibody Radiation-Conjugates or ARC’s, that combine the targeting ability of a monoclonal antibody (mAb) with the cell-killing ability of a radioisotope to deliver radiation internally in a precise manner to potentially generate more potent efficacy and with less toxicity than radiation that is delivered externally. We are developing two clinical stage ARC programs that target the antigens CD45 and CD33, respectively, that are currently being studied in several hematologic indications. We employ our ARCs at higher doses of radioisotope intensity for targeted conditioning prior to a BMT and at lower doses for targeted conditioning which is also known as lymphodepletion prior to CAR-T and other adoptive cell therapies. In addition, we are pursuing development of our ARC’s at low doses in combination with other therapeutic modalities such as chemotherapy, targeted agents or immunotherapy and as a monotherapy. Our ARC based clinical programs are underpinned by our AWE or Antibody Warhead Enabling technology platform where we have data in both liquid and solid tumors, intellectual property and know-how that we intend to use to create additional ARCs targeting new antigens with multiple radioisotopes such as actinium-225 or Ac-225 or and iodine-131 or I-131. Our AWE technology platform is currently being utilized in a research collaboration with Astellas Pharma, Inc. centered around our technology for Ac-225.

Targeted Conditioning Pipeline

Our lead targeted conditioning product candidate is Iomab-B, an ARC that is comprised of the anti-CD45 mAb known as apamistamab or BC8 and the radioisotope iodine-131. CD45 is expressed on leukemia, lymphoma and nucleated immune cells with an average of 200,000 copies per cell but with minimal expression outside of the hematopoietic system. Iomab-B is currently being studied in the pivotal Phase 3 SIERRA or Study of Iomab-B in Elderly Relapsed or Refractory AML clinical trial for targeted conditioning prior to a BMT for patients with active, relapsed or refractory (r/r) Acute Myeloid Leukemia or AML who are over age 55. The SIERRA trial will compare outcomes of patients randomized to receive Iomab-B and a BMT (the study arm) to those patients randomized to receive physician’s choice of salvage chemotherapy (the control arm). Salvage chemotherapy is also defined as conventional care, as no standard of care exists for this patient population. Patients who fail to achieve a CR or Complete Response on the control arm are ineligible to proceed to a BMT but the trial design permits these patients to cross over to the study arm if they meet the eligibility criteria. The primary endpoint of the SIERRA trial is dCR (durable Complete Remission) of 6 months and the secondary endpoint is 1-year Overall Survival (OS). The SIERRA trial is currently active at 18 sites in the U.S and Canada that includes many of the leading BMT sites based on volume.

Safety and feasibility data from the first 38 patients enrolled on the SIERRA trial which represents 25% of the total of 150 patients to be enrolled in the trial, was presented in an oral presentation at the American Society of Hematology (ASH) Annual Meeting in December 2018. It was reported that all patients initially randomized to the study arm that received a therapeutic dose of Iomab-B (18/18) received a BMT, with a median time to BMT of 28 days, and all patients achieved engraftment in a median time of 16 days despite a high median blast count of 30%. On the control arm, 4/19 patients received a BMT after receiving conventional care with a median time to BMT of 67 days and median blast count of 26%. Of the patients failing to achieve a CR with conventional care (15/19), 10 patients were eligible to cross over to the study arm. All cross over patients (10/10) received a BMT after receiving Iomab-B, with a median time to BMT of 66 days and all patients achieved engraftment in a median time of 17 days despite high median blast count of 45% at time of cross over. There was no (0/18) 100-day non-relapse mortality reported in the study arm, while 1 of 4 patients in the control arm and 1 of 10 cross over patients experienced 100-day non-relapse mortality.

Actimab-MDS is our second pivotal program for targeted conditioning. Actimab-MDS is an ARC comprised of the anti-CD33 mAb lintuzumab linked to the radioisotope Actinium-225. CD33 is expressed in a vast majority of patients with MDS. Actimab-MDS is informed by prior experience with our CD33 ARC in multiple trials for patients with AML, MDS and for patients that progressed from MDS to AML, which is also known as secondary AML. Data from these trials showed that our CD33 ARC had single-agent activity capable of producing CRs in certain patients at varying dose levels with minimal extramedullary toxicities. However, dose dependent myelosuppression was seen in many of these patients. Given this safety and efficacy profile, it was decided to pursue a trial in targeted conditioning in high-risk MDS patients with this ARC in combination with RIC or Reduced Intensity Conditioning regimens. RIC regimens are comprised of low doses of highly toxic chemotherapies such as fludarabine, cytarabine, busulfan and melphalan. Actimab-MDS is intended to enable targeted conditioning prior to a BMT in patients with MDS or Myelodysplastic Syndrome with poor or very poor cytogenetics, which is defined as having 3 or more chromosomal abnormalities. A bone marrow transplant is the only curative treatment option for these patients. However, these patients have poor outcomes due to high relapse rates following a BMT. We believe we have developed a pathway to a pivotal trial with input from the FDA that consists of a Phase 1 dose finding clinical trial that will be followed by a Phase 3 pivotal trial. We are currently finalizing the protocol and pathway for this trial with the FDA and expect to initiate the trial in 2019.

1

Our Iomab-ACT construct is a lower dose of Iomab-B (CD45 – I-131) that we are developing as a targeted conditioning or lymphodepletion agent prior to CAR-T and adoptive cell therapies. CD45 is an antigen expressed on many cells that are relevant to the mechanism of CAR-T therapies including lymphocytes, regulatory T cells and macrophages that have been associated with clinical responses that limit the safety and efficacy of these CAR-T therapies including CRS or Cytokine Release Syndrome, neurotoxicity and durability of response. Some of these limitations may be attributable to the chemotherapy based conditioning agents that are being used currently prior to CAR-T therapies. Actinium’s Iomab-ACT program is highly differentiated when compared to Fludarabine and Cyclophosphamide or Flu/Cy or other chemotherapy-based regimens that are used as the standard of practice today for lymphodepletion prior to CAR-T. Unlike chemotherapy, Iomab-ACT is targeted in nature and due to this targeted effect, we expect can improve CAR-T cell expansion more efficiently, potentially resulting in responses that are more durable and also with reduced CAR-T related toxicities. Importantly, the Iomab-ACT program construct enables lymphodepletion through a single-dose, outpatient administration versus Flu/Cy or other chemo-based lymphodepletion regimens that can require multiple infusions in an inpatient setting over several days. Because of this potentially superior profile, the Iomab-ACT construct could result in improved access to CAR-T therapy and also better outcomes.

CD33 ARC Therapeutics and Combinations

We are applying our CD33 targeting ARC product candidate lintuzumab-Ac-225 to multiple hematologic indications as CD33 is an antigen that has been found to be expressed in a vast majority of patients with AML and MDS and 25-35% of patients with Multiple Myeloma. Our CD33 development program is examining the construct at various dose levels and dosing regimens either alone or in combination in these various disease indications. We currently have multiple clinical trials ongoing, in startup phase, or in planning, to use our CD33 ARC in combination with other therapeutic modalities such as chemotherapy, targeted agents or immunotherapy. We believe that radiation can be synergistic when used in combination with these modalities based on our own clinical data, preclinical research and supporting scientific evidence in the literature. We are also studying our CD33 ARC as a monotherapy in the case of multiple myeloma. The construct has been designated as Actimab and we add a suffix to clarify the trial for the disease area and if needed the combination. For example, in AML, our recently concluded phase 2 trial as a single agent named Actimab-A (A for AML) and our ongoing trial in AML in combination with venetoclax is called the Actimab-A: Ven trial. Our CD33 ARC development program encompasses the following ongoing and planned trials:

Combination Trials:

| - | Phase 1 Actimab-A: Ven combination trial with the BCL-2 inhibitor Venetoclax (Abbvie/Genentech) for patients with relapsed or refractory AML at the UCLA Medical center. | |

| - | Phase 1 Actimab-A: CLAG-M combination trial with the salvage chemotherapy regimen CLAG-M (cladribine, cytarabine, filgrastim and mitoxantrone) for patients with relapsed or refractory AML at the Medical College of Wisconsin. | |

| - | Phase 1 Actimab-A: Ven+HMA Combination trial with the BCL-2 inhibitor Venetoclax (Abbvie/Genentech) and a hypomethylating Agent (HMA) for patients with relapsed or refractory AML planned at the MD Anderson Cancer center. |

Therapeutic Trials:

| - | Multi-center Phase 1 Actimab-M trial for patients with penta-refractory multiple myeloma. | |

| - | Planned Phase 1 trial of Actimab-A: MRD for post-remission AML patients with positive MRD or Minimal Residual Disease. |

Antibody Warhead Enabling Technology Platform

Our proprietary Antibody Warhead Enabling or AWE Technology Platform is supported by intellectual property, know-how and trade secrets that cover the generation, development, methods of use and manufacture of ARC or Antibody Radiation-Conjugates and certain of their components. Our AWE technology patent portfolio includes 27 patent families comprised of 110 issued and pending patent applications, of which 11 are issued and 18 pending in the United States, and 81 are issued and pending internationally the useful life of which ranges from 2019 to 2039. Our proprietary technology enables the direct labeling, or conjugation and labeling of a biomolecular targeting agent to a radionuclide warhead and its development and use as a therapeutic regimen for the treatment of diseases such as cancer. Our intellectual property covers ARC compositions of matter, formulations, methods of administration, and radionuclide production. Further, our AWE intellectual property covers various methods of use for ARCs in multiple diseases, including indication, dose and scheduling, radionuclide warhead, and therapeutic combinations. In addition, due to the renewed focus on research and technology development in 2017 and 2018, we expect the useful life of new intellectual property filed by the company, if granted, to extend well beyond the current dates in several key areas including for next-generation ARC’s of approved therapeutics, combination treatments and targeted radiation approaches using the isotopes Ac-225, and I-131.

2

Our proprietary technology includes methods of conjugation, labeling and use of the radionuclides Ac-225 and I-131. Our technology covers the use of the “gold standard” chelator DOTA, (tetracarboxylic acid), an organic compound used to attach, or conjugate, the radionuclide Ac-225 to monoclonal antibodies and any conceivable derivative thereof. Additionally, we possess intellectual property protection, know-how and trade secrets covering efficient methods of chelation and labeling of the targeting agent with Ac-225 as well as newer next-generation methods of chelation or labeling. We are conducting preclinical research with our AWE Technology Platform to demonstrate proof of concept in liquid and solid tumors for various indications including targeted conditioning, lymphodepletion, combinations of ARC’s with other modalities and as monotherapies to enable research collaborations, partnerships and expand our development pipeline. In March 2018, we entered into a collaborative research agreement with Astellas Pharma, Inc. (Astellas) that is utilizing our AWE technology platform to create ARCs using the Ac-225 isotope and select targeting agents owned by Astellas. In January 2019, we initiated the second module of our research collaboration with Astellas.

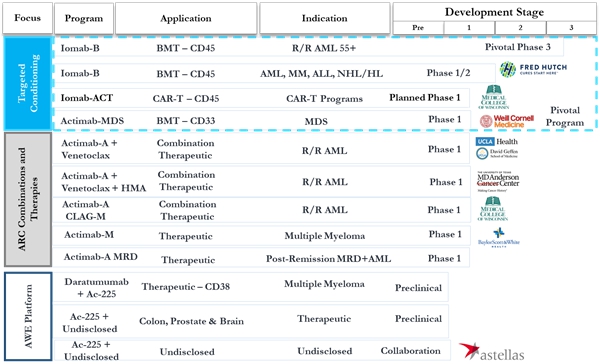

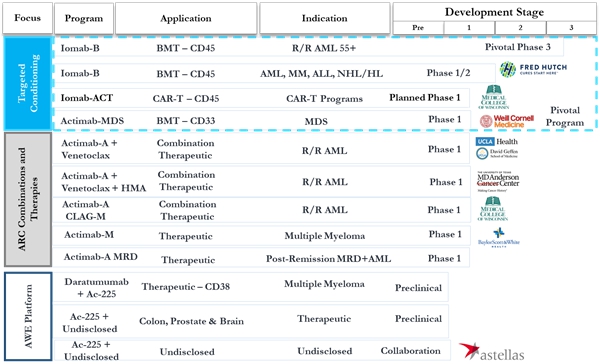

Our research pipeline including ongoing and planned clinical trials are summarized below:

Fred Hutchinson Cancer Research Center is currently studying the BC8 antibody in clinical trials. Trials at the Medical College of Wisconsin, UCLA Health and MD Anderson Cancer Center are investigator-initiated trials using our product candidates. We have entered into a collaborative research partnership with Astellas for the use of our AWE Technology Platform.

Business Strategy

We intend to develop our product candidates for targeted conditioning (Iomab-B and Actimab-MDS) and lymphodepletion (Iomab-ACT) through registration studies and approval either alone or in partnership. If our efforts are successful, we may elect to commercialize our targeted conditioning products on our own, or in partnership in the United States and out-license the rights to develop and commercialize these products to one or more strategic partners outside of the United States. If we elect to commercialize one or more of our targeted conditioning product candidates independently, we intend to scale up our existing supply chain capabilities, which currently supplies in excess of 18 BMT Centers and major hospitals across our pipeline, into a commercial distribution network that can supply the top 50-80 bone marrow transplant centers in the U.S., where a majority of patients are conditioned and receive their transplants. In the case of our CD33 program trials excluding the Actimab-MDS opportunity, we intend to potentially develop these up to proof-of-concept and then seek collaborators both inside and out of the U.S. We also have the option, assuming successful monetization of one or more targeted conditioning assets via commercialization or collaboration, of developing and commercializing all or certain parts of the CD33 program ourselves. We believe this is a viable strategy as it affords operating leverage from our supply chain and presence at the largest BMT centers which also account for a significant portion of cancer treatments. In parallel, we intend to continue to identify development opportunities with our AWE Technology Platform and extend our leadership position in the use of the radioisotope Ac-225. Our efforts at further developing our platform center around arming additional targeting agents for various cancers and rare diseases, producing next generation ARC’s of approved therapies, and exploring novel combination approaches that have the potential of replacing external beam radiation with ARC’s that enable delivery of targeted radiation directly to desired site of action. We will continue to monetize our AWE platform via collaborations and partnerships as we have done with Astellas Inc. We intend to retain marketing rights for our products in the United States whenever possible and out-license marketing rights to our partners for the rest of the world. We may also seek to in license other applicable opportunities should such technology become available.

3

Market Opportunity

We believe that targeted conditioning prior to a BMT could result in improved access and outcomes for patients, as well as provide a pharmacoeconomic benefit. The Center for International Blood and Marrow Transplant Research (CIBMTR) estimates that more than 23,000 patients received an autologous or allogeneic BMT in the United States in 2018. The American Cancer Society estimates that approximately 174,250 patients will be diagnosed with leukemia, lymphoma or multiple myeloma and that approximately 1.34 million patients in the United States are living with or are in remission from these diseases. According to the European Bone Marrow Transplantation, over 35,000 autologous and allogeneic BMTs were performed in 2016. BMT is a potentially curative or potentially best treatment option for certain patients with these blood-borne cancers, blood disorders and inherited immune system disorders and we intend to develop our ARC product candidates with the goal of improving BMT access and outcomes for these patients. We believe that eliminating or reducing chemotherapy-based conditioning prior to BMT can significantly increase the number of patients receiving BMT and that targeted conditioning can result in less toxicities that could lead to better outcomes. According to a study published in the Journal of Medical Economics, real-world economic burden of hematopoietic cell transplantation among a large US commercially insured population with hematologic malignancies, the healthcare cost for patients receiving an autologous BMT were $390,000 while the healthcare costs for patients receiving an allogeneic BMT were $745,000. We believe that reduction in toxicities and resulting hospital stays associated with current chemotherapy-based conditioning regimens could reduce these costs. We intend to collect pharmacoeconomic data in our current and future clinical trials for Iomab-B and other targeted conditioning product candidates to determine if our therapies result in a cost benefit. Iomab-B has demonstrated efficacy in targeted conditioning prior to a BMT for blood cancer indications, including AML, MDS, Acute Lymphoblastic Leukemia (ALL), Hodgkin’s Lymphoma, Non-Hodgkin’s Lymphoma (NHL) and Multiple Myeloma. These are indications for which Iomab-B can be developed and it is our intention to explore these opportunities.

We are also developing our Iomab-ACT program, which uses a lower dose of Iomab-B, as a targeted conditioning or lymphodepletion agent prior to CAR-T and adoptive cell therapies. There are currently two approved CAR-T therapies and several dozen CAR-T and adoptive cell therapies in development for multiple hematologic and solid tumor indications. We intend for Iomab-ACT to be utilized as a lymphodepletion agent prior to CAR-T and adoptive cell therapy that can replace or displace the chemotherapy based lymphodepletion regimens that are used in standard practice today.

For our CD33 program drug candidates, we would compete in the marketplace for cancer treatments estimated to have reached over $83 billion in 2016 sales, according to “The Global Use of Medicines: Outlook Through 2016 Report by the IMS Institute for Healthcare Informatics, July 2012”. While surgery, radiation and chemotherapy remain staple treatments for cancer, their use is limited by the fact that they often cause substantial damage to normal cells. On the other hand, targeted monoclonal antibody therapies exert most or all of their effect directly on cancer cells, but often lack sufficient killing power to eradicate all cancer cells with just the antibody. A relatively newer approach for treating cancer is to combine the precision of antibody-based targeting agents with the killing power of radiation, or chemotherapy, by attaching powerful killing agents to precise molecular carriers called monoclonal antibodies. We use mAbs labeled with radioisotopes to deliver potent doses of radiation directly to cancer cells while sparing healthy tissues. The radioisotopes we use are the alpha emitter Ac-225 and the beta emitter I-131. I-131 is among the best known and well characterized radioisotopes. It is used very successfully in the treatment of papillary and follicular thyroid cancer as well as other thyroid conditions. I -131 is used in combination with a monoclonal antibody in treatment of NHL and is used in the approved drug AZEDRA® (iobenguane I -131) for the treatment of certain neuroendocrine tumors. It is also used experimentally with different carriers in other cancers. Ac-225 has many unique properties and we believe we are a leader in developing this alpha particle emitting radioisotope for clinical applications using our proprietary AWE technology platform.

Clinical Trials

Targeted Conditioning

We are focused on applying our ARC product candidates for targeted conditioning prior to cell therapies such as BMT and CAR-T to improve access and outcomes to these important and potentially curative treatments. A BMT may be the only potentially curative treatment option or the best treatment option for patients with blood cancers such as leukemias, lymphomas and multiple myeloma, benign blood or marrow disorders such as inherited immune system disorders, sickle cell disease and severe aplastic anemia. Conditioning is an integral step prior to BMT or an adoptive cell therapy such as CAR-T where the current standard practice is chemotherapy and/or total body irradiation via external radiation. In the case of BMT, conditioning is intended to eliminate a patient’s bone marrow and immune system to allow transplanted bone marrow stem cells the ability to engraft and reconstitute the patient’s blood counts and immune function. We are currently conducting two clinical trials for product candidates focused on targeted conditioning for BMT, a pivotal phase 3 trial for Iomab-B and our pivotal Actimab-MDS program, both of which are first in their class. In our Iomab-ACT program we are studying a lower dose of apamistamab – I-131 for targeted conditioning prior to CAR-T and cell therapy to enable lymphodepletion, which eliminates lymphocytes and other immune cells but spares bone marrow stem cells.

4

Iomab-B Pivotal Phase 3 Program – SIERRA Trial

We licensed Iomab-B from the Fred Hutchinson Cancer Research Center, or FHCRC, where it was developed and studied extensively in numerous clinical trials in a range of hematologic indications and patient populations. Iomab-B consists of the anti-CD45 monoclonal antibody apamistamab (BC8) and the beta emitting radioisotope Iodine-131 (I-131). Apamistamab has been studied in over 10 Phase 1 and Phase 2 clinical trials in patients with AML, MDS, ALL, multiple myeloma and lymphomas in patients with newly diagnosed, relapsed or refractory and first remission disease.

Previous Iomab-B clinical trials leading to our current pivotal Phase 3 trial included:

| Indications | N | Key Findings | ||

| Advanced ALL, AML, MDS | 44 | - 95% engraftment rate | ||

| (age 16 – 55) | ||||

| Advanced AML/ALL | 21 | – Median overall survival 2.8 years | ||

| (age 15 – 55) | ||||

| AML 1st remission/1st relapse | 46 | – 100% engraftment rate | ||

| (age 16-50) | – 63% 3-year overall survival | |||

| Relapsed/Refractory AML/High-risk MDS | 68 in dose escalation study | –100% engraftment rate | ||

| (age 50+) | 31 treated at MTD | –1-year survival ~40% for all patients | ||

| Relapsed/Refractory AML and High-risk MDS (age 18–50) |

16 | -94% engraftment rate - Median overall survival 4.4 years | ||

| Relapsed/Refractory lymphoma | 15 | – 100% engraftment rate – 18-month median overall survival | ||

| Relapsed/Refractory AML/Advanced ALL, HR MDS | 25 | - 100% engraftment rate - 42% 1-year overall survival | ||

| Multiple Myeloma | 15 | - 100% engraftment rate - 77% 2-year overall survival | ||

| Relapsed/Refractory AML and HR MDS | 15 | - 100% engraftment rate - 66% 1-year overall survival | ||

High-risk lymphoma (with BEAM chemotherapy) |

19 | - 100% engraftment rate - 63% 1-year progression free survival | ||

| High-risk AML, ALL or MDS | Ongoing |

5

The indication selected for our pivotal phase 3 trial is bone marrow conditioning for patients with active, relapsed or refractory AML over the age of 55. We selected this indication because of the compelling data from the phase 2 proof of concept trial that showed improved survival after Iomab-B and a BMT compared to historical clinical outcomes when they received conventional care or salvage chemotherapy. In addition, the choice of this indication is also attractive due to a combination of factors including; the lack of available effective treatment options for this population of patients who have a very poor survival prognosis of 3.3 months and who are currently ineligible for a bone marrow transplant due to their poor condition and advanced state of disease.

Pivotal Phase 3 SIERRA Trial

We are currently studying Iomab-B in the SIERRA or Study of Iomab-B in Elderly Relapsed or Refractory AML clinical trial, a 150-patient pivotal Phase 3 multi-center randomized trial that will compare outcomes of patients who receive Iomab-B and a BMT (the study arm) to those patients receiving physician’s choice of salvage chemotherapy (the control arm). Salvage chemotherapy is defined as conventional care, as no standard of care exists for this patient population. Patients randomized to receive the control arm who do not achieve a Complete Remission (CR) are able to cross over to the study arm and receive Iomab-B and a BMT if they meet certain eligibility criteria. Patients with active, relapsed or refractory AML have dismal prognoses and are typically not offered potentially curative transplant as an option, largely because salvage treatments have a limited ability to produce a complete remission, which is necessary prior to conventional BMT if conventional BMT is to be successful. The SIERRA trial is the only pivotal trial offering BMT as an option to patients with active, relapsed or refractory Acute Myeloid Leukemia age 55 and above. The primary endpoint of the SIERRA trial is dCR or durable Complete Remission of 6 months and the secondary endpoint is 1-year Overall Survival (OS). The SIERRA trial is currently enrolling patients at 18 sites in the U.S and Canada that includes many of the leading BMT sites based on volume.

Safety and feasibility data from the first 38 patients (25% of planned enrollment) in the SIERRA trial were presented in an oral presentation at the 61st American Society of Hematology (ASH) Annual Meeting & Exposition and in a late breaking oral session at the 2019 Transplantation & Cellular Therapy Meetings™ of ASBMT and CIBMTR (TCT Meetings). It was reported that all patients receiving a therapeutic dose of Iomab-B engrafted despite active disease with high blast counts with median blast counts of 30% for patients randomized to the Iomab-B arm and a median of 45% for patients that crossed over to receive Iomab-B. 15 of 19 (79%) patients in the control arm failed to achieve a complete response and 67% (10/15) of these patients were eligible for crossover with all (10/10) being successfully transplanted after treatment with Iomab-B. Patients receiving Iomab-B received a BMT more quickly post-randomization (28 days) than patients receiving conventional care (67 days) and in the conventional care arm, there was no difference in time to BMT for patients that crossed over to Iomab-B (66 days) compared to those achieving complete remission with conventional care (67 days). No Grade 3 or 4 Iomab-B infusion related reactions with all Iomab-B infusions completed and there was no 100-Day non-relapse mortality in patients randomized to Iomab-B arm. Approximately 94% of patients initially randomized to receive Iomab-B and a BMT (17/18) achieved Full Donor Chimerism and 90% of patients who crossed-over to receive Iomab-B and a BMT (9/10), after salvage chemotherapy in the control arm failed to produce a CR or Complete Response, also achieved Full Donor Chimerism prior to day 100. Additional safety and feasibility analyses will occur when 76 (50%) and 114 (75%) of patients have been enrolled.

Actimab-MDS Program

Our Actimab-MDS pivotal program is studying our CD33 ARC that consists of the anti-CD33 mAb lintuzumab conjugated with the radioisotope Ac-225, which has been studied in multiple Phase 1 and Phase 2 clinical trials in patients with AML and MDS. In 2018, we completed the Phase 2 Actimab-A clinical trial of our CD33 ARC in patients newly diagnosed with AML age 60 and above ineligible for standard induction therapy. Each patient in a dose cohort received fractionated doses a week apart. Single agent activity was reported with an Overall Response Rate or ORR of 69% for patients receiving 2.0 µCi/kg/fraction and 22% in patients receiving 1.5 µCi/kg/fraction. Minimal extramedullary toxicities were observed; however, myelosuppression was a Dose Limiting Toxicity (DLT) that was observed at both dose cohorts. The Actimab-MDS pivotal program is designed to leverage the observed myelosuppression capabilities and minimal extramedullary toxicities of our CD33 ARC as a targeted conditioning agent prior to a BMT in MDS patients with poor or very poor cytogenetics, which is defined as having 3 or more chromosomal mutations. In this patient population, BMT is the only treatment option with curative potential and a BMT also has the ability to reverse myelosuppression as transplanted cells can reconstitute the patient’s blood and immune function.

6

We met with the FDA to discuss our Actimab-MDS program and based on these discussions we will conduct a Phase 1 dose confirming study that will be followed by a pivotal, randomized registration trial. The Phase 1 trial will enroll 7-18 patients where patients will receive 2.0 – 4.0 µCi/kg of lintuzumab – Ac-225 in a single infusion. The pivotal, randomized registration trial will study our CD33 ARC in combination with RIC or Reduced Intensity Conditioning regimens prior to bone marrow transplant. RIC regimens are comprised of low doses of highly toxic chemotherapies such as fludarabine, cytarabine, busulfan and melphalan.

Iomab-ACT Program

Our Iomab-ACT program uses a lower dose of Iomab-B (CD45 – I-131) that we are developing as a targeted conditioning agent for lymphodepletion prior to CAR-T and adoptive cell therapies. Currently, lymphodepletion for CAR-T and adoptive cell therapies utilizes Fludarabine and Cyclophosphamide or Flu/Cy and other chemotherapies. The dose range for the Iomab-ACT program is supported by clinical data with Iomab-B, pharmacokinetic modeling and preclinical data supporting its effectiveness at selective targeting of cells necessary to achieve effective lymphodepletion. In February 2019, we presented data from our preclinical findings at the 2019 Transplantation & Cellular Therapy Meetings™ of ASBMT and CIBMTR (TCT Meetings) that showed that a single infusion of an anti-CD45 antibody labelled with Iodine-131 can effectively deplete greater than 90% of lymphocytes, including CD4 and CD8 T cells, CD19 B cells and NK cells, which is necessary for adoptive cell therapies like CAR-T to expand and persist. Tregs or regulatory T cells, including CD4+, CD25+ and FoxP3+ Tregs, which can exert negative pressure on cell therapy expansion and persistence, were suppressed for at least 21 days post lymphodepletion with Iomab-ACT. The multi-modal mechanism of action directed at CD45 expressing cells also depleted macrophages, which are implicated in the development of CRS or Cytokine Release Syndrome, and splenocytes while red blood cells, platelets, neutrophils and bone marrow stem cells were preserved. Additionally, MicroSPECT/CT imaging showed that Iomab-ACT homed to immune privileged sites including lymph nodes, spleen, liver and bone marrow. Finally, an in vivo animal model showed that adoptively transferred cytotoxic T cells persisted in mice following administration of CD45 targeted lymphodepletion and were able to control tumor cells compared to untreated mice. We intend to study our Iomab-ACT program in a human clinical trial in 2019. We are currently speaking with potential investigators and collaborators from academia and industry and evaluating possible clinical trial protocols.

CD33 ARC Therapeutics and Combinations

We are developing our ARC product candidate that consists of the anti-CD33 mAb lintuzumab and the radioisotope Ac-225 for multiple hematologic malignancies including AML, MDS and Multiple Myeloma. The CD33 development program is examining the construct at various dose levels and dosing regimens either alone or in combination in these various disease indications. Our CD33 ARC is a second-generation construct that was developed at the Memorial Sloan Kettering Cancer Center, or MSKCC. The first-generation product consisted of the same monoclonal antibody lintuzumab but utilized the radioisotope bismuth-213 or Bi-213. In preclinical and Phase 1 clinical studies lintuzumab-Ac-225 has demonstrated at least 500-1000 times higher potency than the first-generation predecessor lintuzumab-Bi-21 upon which it is based. This difference is due to intrinsic physicochemical properties of lintuzumab-Ac-225 that were first established in vitro, in which lintuzumab-Ac-225 killed multiple cell lines at doses at least 1,000 times lower based on LD50 values than lintuzumab-Bi-213 analogs. Key factors in lintuzumab-Ac-225’s higher potency is the yield of 4 alpha-emitting isotopes per Ac-225 compared to 1 alpha decay for bismuth 213 and much longer half-life of 10 days for Ac-225 vs 46 minutes for Bi-213.

We currently have multiple clinical trials ongoing, in startup phase, or in planning, to use our CD33 ARC in combination with other therapeutic modalities such as chemotherapy, targeted agents or immunotherapy. We believe that radiation can be synergistic when used in combination with these modalities based on our own clinical data, preclinical research and supporting scientific evidence in the literature. We are also studying our CD33 ARC as a monotherapy in the case of multiple myeloma. The construct has been designated as Actimab and we add a suffix to clarify the trial for the disease area and if needed the combination. For example, in AML, our recently concluded phase 2 trial as a single agent named Actimab-A (A for AML) and our ongoing trial in AML in combination with venetoclax is called the Actimab-A: Ven trial. Our CD33 ARC development program encompasses the following ongoing and planned trials.

7

Combination Trials:

Phase 1 Actimab-A combination trial with the BCL-2 inhibitor Venetoclax for patients with relapsed or refractory AML

We have initiated a Phase 1 investigator initiated clinical trial at the UCLA Medical Center that will study our CD33 ARC in combination with Venetoclax (VEN), a BCL-2 inhibitor that is jointly developed and marketed by Abbvie and Genentech. Venetoclax is approved for patients with CLL or Chronic Lymphocytic Leukemia and SLL or Small Lymphocytic Leukemia as well as patients newly diagnosed with AML who are 75 and older who are ineligible for standard chemotherapy in combination with a hypomethylating agent or low-dose cytarabine. BCL-2 is one of several proteins encoded by the BCL2 gene family, which regulates apoptosis or programmed cell death. MCL-1 is another protein encoded by the BCL2 gene family that is also overexpressed in cancers, including relapsed or refractory AML, that prevents apoptosis and promotes resistance to venetoclax, which does not bind to MCL-1. It has been demonstrated that MCL-1 levels can be depleted with radiation but only external radiation was used in these studies. In our preclinical studies, it was demonstrated that our CD33 ARC combined with venetoclax resulted in increased cancer cell death than either agent alone. Our Actiamb-A: VEN trial will study our CD33 ARC in combination with Venetoclax alone and will be a 3+3 dose-escalation study that is intended to determine the MTD or maximum tolerable dose of our CD33 ARC, determine ORR and evaluate OS.

Phase 1 Actimab-A combination trial with salvage chemotherapy regimen CLAG-M (cladribine, cytarabine, filgrastim and mitoxantrone) for patients with relapsed or refractory AML

We are conducting a Phase 1 investigator initiated clinical trial at the Medical College of Wisconsin that is studying our CD33 ARC in combination with the CLAG-M salvage chemotherapy regimen in patients with relapsed or refractory AML. Our Actimab-A: CLAG-M trial is a 3+3 design, dose escalation study evaluating safety and tolerability, response rates, rates of BMT, PFS or progression-free survival and OS. Dosing began at 0.25 uCi/kg and in February 2019, we announced that we successfully completed the first patient cohort and that no dose limiting toxicities (DLTs) were observed. We have initiated the second patient cohort in which patients will receive 0.50 uCi/kg of Actimab-A. Assuming no DLTs are observed in the second cohort, the study will progress to the third and final cohort where patients will receive a dose of 0.75 uCi/kg.

Phase 1 Actimab-A Combination trial with BCL-2 inhibitor Venetoclax and a Hypomethylating Agent for patients with relapsed or refractory AML

We intend to initiate a Phase 1 investigator-initiated trial at the University of Texas MD Anderson Cancer Center that will study our CD33 ARC in combination with Venetoclax and a hypomethylating agent for patients with relapsed or refractory AML. Venetoclax is approved for patients newly diagnosed with AML who are 75 and older who are ineligible for standard chemotherapy in combination with a hypomethylating agent or low-dose cytarabine. Similar to our combination trial with Venetoclax alone, this Actimab-A: VEN+HMA trial will study the potential for our CD33 ARC to reduce MCL-1 levels thereby removing a potential resistance mechanism to Venetoclax making the AML cells susceptible to apoptosis or programmed cell death. This trial will be a 3+3 design, dose-escalation study that is intended to determine the MTD or maximum tolerable dose of our CD33 ARC, determine ORR and evaluate OS.

Therapeutic Trials:

Multi-center Phase 1 Actimab-M trial for patients with penta refractory multiple myeloma

CD33 expression has been identified in 25-35% of patients with multiple myeloma. Like other hematologic malignances, multiple myeloma is sensitive to radiation. Therefore, we are studying our CD33 ARC in patients with penta refractory multiple myeloma in the multi-center Phase 1 Actimab-M open label, dose escalation trial which is a 3+3 design, dose-escalation study. This trial was initiated as an investigator sponsored study at one site but the was subsequently brought in house and is now being pursued under company IND as a multi-center trial. Per the protocol, patients are administered a starting dose level of 0.5 μCi/Kg via infusion on day 1 of each cycle for up to 8 cycles with each cycle lasting 42 days. Assuming safety at this dose level, escalation to a second dose level of 1.0 μCi/kg for up to 4 cycles, also of 42 days per cycle is planned. The total dose received per patient is not to exceed 4.0 μCi/kg. In the event of dose limiting toxicities (DLTs) at the 0.5 μCi/Kg dose level, a dose level of 0.25 μCi/Kg will be explored. The Phase 1 trial will estimate maximum tolerated dose (MTD), assess adverse events, measure response rates (objective response rate, complete response rate, stringent complete response rate, very good partial response rate and partial response rate) as well as progression free survival (PFS) and overall survival (OS). To our knowledge, we are the only company developing a CD33 targeting agent for patients with multiple myeloma and the only company studying an alpha-particle (Actinium-225) radioisotope in this indication.

8

Phase 1 trial of Actimab-A for post-remission AML patients with positive MRD or Minimal Residual Disease

We are planning a Phase 1 clinical trial that will study our CD33 ARC in patients with AML that have achieved remission but have detectable MRD. Patients with detectable MRD after achieving remission with induction therapy have a higher probability of relapse and therefore poorer long-term outcomes. Consolidation therapy often follows induction therapy that today consists of chemotherapy, HMAs, targeted agents, BMT or supportive care. However, following induction therapy patients may be ineligible or unable to tolerate these therapies. This planned Actimab-A: MRD trial will be a 3+3 design, dose escalation study where patients will receive a single infusion of a low dose (0.5 – 1.0 μCi/Kg) of our CD33 ARC for up to 4 cycles with patients being assessed for MRD status on day 29 ± 7 days. This study will evaluate safety and tolerability and establish MTD as well as assess effect on MRD, PFS and OS. The goal of our efforts in patients with detectable MRD is to use our CD33 ARC to prevent relapse and put the patient’s disease in a manageable chronic state with a chemotherapy free treatment that is well tolerated with minimal extramedullary toxicities.

Antibody Warhead Enabling Technology Platform and Program

Our proprietary Antibody Warhead Enabling or AWE Technology Platform is supported by intellectual property, know-how and trade secrets that cover the generation, development, methods of use and manufacture of ARC or Antibody Radiation-Conjugates and certain of their components. As of March 2019, we have 27 patent families comprising 110 issued and pending patent applications, of which 11 are issued and 18 are pending in the United States that are related to our AWE Technology Platform in the U.S. having expirations between 2019 and 2039 and 81 issued or pending patents outside of the U.S. Our proprietary technology enables the direct labeling, or conjugation and labeling of a biomolecular targeting agent to a radionuclide warhead and its development and use as a therapeutic regimen for the treatment of diseases such as cancer. Our intellectual property covers ARC compositions of matter, formulations, methods of administration, and radionuclide production. Further, our AWE intellectual property covers various methods of use for ARCs in multiple diseases, including indication, dose and scheduling, radionuclide warhead, and therapeutic combinations. In addition, due to the renewed focus on research and technology development in 2017 and 2018, we expect the useful life of new intellectual property filed by the company, if granted, to extend well beyond the current dates in several key areas including for next generation ARCs, combination treatments and targeted radiation approaches using the isotopes Ac-225 and I-131.

In March 2017, we announced the availability of our proprietary AWE Technology Platform for partnerships and collaborations. In tandem, we demonstrated the utility of the AWE Technology Platform intellectual property, know-how and trade secrets to generate a next generation ARC of an approved therapeutic molecule by generating preclinical results showing the dramatic enhancement in anti-tumor potency following the conjugation and labeling of a therapeutic antibody, daratumumab, with Ac-225. Daratumumab is an anti-CD38 antibody which is marketed by Johnson & Johnson (JNJ) under the trade name Darzalex® for the treatment of multiple myeloma. We successfully demonstrated the efficient labeling daratumumab with Ac-225 without compromising CD38 target engagement and antibody effector function. Furthermore, pre-clinical testing of the Ac-225-daratumumab asset in an in vivo xenograft tumor model was also performed. Specifically, Ac-225-daratumumab was well tolerated in mice and was shown to increase the in vivo potency over naked daratumumab by at least 30-fold and led to a survival advantage in this model.

9

We applied our AWE Technology Platform to the development of our Iomab-ACT program. The patent estate related to our Iomab-ACT program covers composition of matter, formulation and methods of use. Actinium believes this patent estate is important to potential partners in industry and academia as it may enable the optimization of CAR-Ts through improved lymphodepletion, which may not be possible with Flu/Cy given patents that exist on its use in conjunction with CAR-T. In addition, the patent estate is broad and is applicable to indications where CAR-Ts have already been approved and to emerging indications that the growing field of CAR-T developers are pursuing such as solid tumors. Key filings of the estate cover claims including composition and methods of use in targeted lymphodepletion prior to adoptive cell therapies such as CAR-T with autologous and allogeneic cell therapy in solid or hematologic cancer indications. The filings also include methods of use for targeted lymphodepletion in combination with genetically engineered CAR cells, including those that lack expression of endogenous checkpoint receptors or T cell receptors and targeted conditioning in preparation for administration of gene edited cell therapy for the treatment of non-malignant inherited genetic disorders.

We have led and successfully demonstrated the adaptability and robust labeling that can be achieved with the AWE Technology Platform. AWE-derived ARCs provide versatility in use as demonstrated by the applicability as anti-cancer therapies as single agents or in combination, but also as modalities for targeted conditioning prior to cell therapies such as bone marrow transplant or adoptive cell therapies. Moreover, the AWE Program provides a potential partner with access to the technology, the know-how, and the capabilities and facilities to execute on ARC generation and development. The studies with daratumumab-Ac-225 provides one example of the enhanced therapeutic effect that can be achieved from the utilization of our core platform technology to potently radiolabel an asset with a radionuclide warhead, positioning the generation of ARCs as a viable therapeutic approach. Iomab-ACT demonstrates how our AWE Technology Platform can be applied to create ARCs for specific indications and applications as we were able to use our apamistamab-I-131 construct and develop a lower dose version when compared to Iomab-B that is intended to be used for lymphodepletion as opposed to myeloablation.

In March 2018, we entered into a collaborative research partnership with Astellas Pharma, Inc. (Astellas) to utilize our AWE Technology Platform with selected targeting agents owned by Astellas. Under the agreement, we are conducting preclinical validation studies. In exchange, we received an upfront fee and Astellas provides funding for the ongoing preclinical research. In January 2019, we announced that we successfully completed the first module of and that we initiated the second module of the collaboration.

We intend to utilize our AWE technology platform to enable future additional collaborations and partnerships. In addition to our CSO, we have 3 PhD level employees that contribute to our efforts related to AWE in addition to an external VP of R&D and post-doctoral associate. We also utilize a network of external R&D facilities and personnel that perform work on our behalf.

Operations

Our current operations are primarily focused on furthering the development of our clinical drug candidates for targeted conditioning, our CD33 program combination and monotherapy trials, supporting investigator-initiated clinical trials that use our drug candidates, actively managing our current supply chain, supporting collaborations and further developing our AWE platform and supporting our pre-commercial market development and supply chain activities.

Operations related to Iomab-B include progressing the ongoing multi-center Phase 3 pivotal trial (a trial that leads to registration trial marketing approved by the FDA), which includes investigator engagement, site activation and supporting patient enrollment. In addition, we are focused on commercial-scale manufacturing of apamistamab suitable for an approval trial and preparation of appropriate regulatory submissions. We are also focused on producing final Iomab-B drug product material that consists of apamistamab labelled with the isotope I-131. We have secured access to I-131 from multiple commercial global suppliers. We project that these suppliers have sufficient I-131 production capacity to meet our commercial needs for the Iomab-B program. We are aware of other global manufacturers and suppliers of I-131with whom we believe we can secure commercial supply agreement if necessary. Operations related to our Actimab-MDS pivotal program include preparation for appropriate regulatory submissions, protocol development and investigator engagement. For our Iomab-ACT program we are producing preclinical data supporting its use as a targeted conditioning agent to enable lymphodepletion prior to CAR-T and other adoptive cell therapies, evaluation potential clinical trials and related protocols and developing a regulatory strategy for our planned clinical development.

10

In the case of our CD33 program, key ongoing activities include planning, initiating and progressing our Phase 1 trials including our two combination trials with venetoclax, our combination trial with CLAG-M, Actimab-M trial in for patients with multiple myeloma and our MRD trial, managing isotope and other materials supply chain and managing the manufacturing of the finished drug candidate product. We have secured access to Ac-225 through a renewable contractual arrangement with the United States Department of Energy, or DOE. We project that these quantities are sufficient to support early stages of commercialization of actinium isotope-based products and that the DOE’s accelerator route of production of Ac-225 has the potential to provide commercial quantities of Ac-225. We have also developed our own proprietary process for industrial-scale Ac-225 production in a cyclotron in quantities adequate to support full product commercialization. In addition, we are aware of numerous sources from which we may secure additional quantities of the Ac-225 isotope.

In addition to our clinical programs, we are conducting research and development with our AWE Technology Platform to support existing clinical programs and develop new clinical opportunities. We are also executing on our collaborative research partnership with Astellas. Related to our supply chain, we are undertaking planning and evaluation activities to support our future needs related to infrastructure, commercialization or clinical trial site expansion. Activities related to market development are ongoing and include physician engagement and education, referral pattern analysis, site evaluation and patient advocacy engagement.

Intellectual Property Portfolio and Regulatory Protections

Intellectual Property

We have developed or in-licensed numerous patents and patent applications and possess substantial know-how and trade secrets related to the development and manufacture of our products. As of March 2019, our patent portfolio includes: 28 patent families comprised of 111 issued and pending patent applications, of which 12 are issued and 18 are pending in the United States, and 81 are issued and pending internationally. Several non-provisional patent applications are expected to be filed in 2019 based on provisional patent applications filed in 2018. This is part of an ongoing strategy to strengthen our intellectual property position. About one fifth of our patents are in-licensed from third parties and the remainder are Actinium-owned. These patents cover key areas of our business, including use of actinium-225 and other alpha- or beta-emitting isotopes attached to cancer specific carriers like monoclonal antibodies, methods for manufacturing key components of our product candidates including actinium-225, an alpha particle emitting radioisotope and carrier antibodies, or Iodine-131, a beta particle emitting radioisotope, and methods for manufacturing finished product candidates for use in cancer treatment.

We own five issued patents including one divisional patent in the United States and 47 patents outside of the United States, including one divisional patent related to the manufacturing of actinium-225 in a cyclotron, that will expire between 2024 – 2030. Four related global patents are pending. We own or have licensed the rights to six issued patents in the United States and 14 issued patents outside of the United States related to the generation of radioimmunoconjugates that will expire between 2019 and 2030. Nine related United States or global patents are pending, Further, we own the rights to 20 additional pending patents in the United States and abroad related to radioimmunoconjugate composition, formulation administration, and methods of use in solid or liquid cancers. This matter includes composition, administration, and methods of treatment for our products Actimab-A and Iomab-B. In addition, for Iomab-ACT, we own 4 patents pending and 1 provisional patent application covering methods of use and composition in cancer and non-malignant disease.

Regulatory Protections

The indications for which we are developing our product candidates for are orphan drug designations, which are disease indications that affect fewer than 200,000 patients in the United States and less than 5 in 10,000 patients in the European Union (“EU”). We have received orphan drug designation for Iomab-B and our lintuzumab-CD33 ARC for patients with AML in both the United States and the EU. As a result, if our products are to be approved, they may receive 7 years and 10 years of market exclusivity in the US and EU, respectively. In addition, our product candidates are biologics combined with radioisotopes. The Hatch-Waxman Act requires that a manufacturer of generic drugs, for which a biologic drug is called a biosimilar, requires that the manufacturer demonstrate bioequivalence. We believe that due to the nature of radioisotopes having half-lives combined with the complexities of biologic drugs would make it difficult for a manufacturer to demonstrate bioequivalence of our product candidates.

11

Competition Overview

In the field of targeted conditioning, pharmaceuticals currently used for myeloablation prior to a bone marrow transplant or lymphodepletion prior to CAR-T are largely generic chemotherapeutic agents and/or radiation. In targeted conditioning, we face competition from Magenta Therapeutics, Inc., who is developing an anti-CD45 and anti-117 Antibody Drug Conjugate (ADC) and Allogene Therapeutics who is developing an anti-CD52 monoclonal antibody. However, both programs are at the preclinical stage. To our knowledge, we are the only company with a pivotal Phase 3 trial for a targeting conditioning agent and the only anti-CD45 ARC in clinical development.

For our CD33 ARC, there are several companies developing drugs for AML, MDS and Multiple Myeloma based on numerous approaches/modalities including chemotherapy, targeted agents, antibody drug conjugates naked monoclonal antibodies, bispecific antibodies, immunotherapies and cellular therapies. Specific to CD33, Mylotarg™, an ADC developed and marketed by Pfizer is the only FDA approved CD33 targeted therapy for adult patients and children two years and older with relapsed or refractory CD33-positive AML. Seattle Genetics was developing SGN-CD33A, a CD33 targeting ADC, but discontinued the development of its clinical trials associated with this product candidate in June 2017. Immunogen is also developing a CD33 targeting ADC, IMGN779, that is currently in a Phase 1 clinical trial for r/r AML patients age 18 and above. Amgen is developing a CD3/CD33 bispecific BiTE (AMG330) as is Amphivena (AMV-564), both of which are in Phase 1 clinical trial for r/r AML patients age 18 and above. Boehringer Ingelheim is developing a CD33 targeting naked antibody (BI836858) for patients with r/r AML or MDS age 18 and above. These drugs have different safety profiles and mechanisms of action compared to our drug candidates. AML in older patients remains an area of high medical need that could accommodate many new products with favorable safety and efficiency profiles. We have begun studying our CD33 ARC in combination with the salvage chemotherapy regimen CLAG-M for patients with relapsed or refractory AML. Combination therapies are commonly used in hematologic indications, but we believe we are the only Ac-225 based product candidate that is being explored in combination studies in hematologic indications. To our knowledge, we are the only company with a CD33 targeting drug and the only AC-225 based ARC product candidate for patients with multiple myeloma.

Government Regulation

Governmental authorities in the United States and other countries extensively regulate, among other things, the research, development, testing, manufacture, labeling, promotion, advertising, distribution and marketing of radioimmunotherapy pharmaceutical products such as those being developed by us. In the United States, the FDA regulates such products under the Federal Food, Drug and Cosmetic Act (FDCA) and implements regulations. Failure to comply with applicable FDA requirements, both before and after approval, may subject us to administrative and judicial sanctions, such as a delay in approving or refusal by the FDA to approve pending applications, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions and/or criminal prosecution.

U.S. Food and Drug Administration Regulation

Our research, development and clinical programs, as well as our manufacturing and marketing operations, are subject to extensive regulation in the United States and other countries. Most notably, products that may in the future be sold in the United States are subject to regulation by the FDA. Certain of our product candidates in the United States require FDA pre-marketing approval of a BLA pursuant to 21 C.F.R. § 314. Foreign countries may require similar or more onerous approvals to manufacture or market these products.

Failure by us or by our suppliers to comply with applicable regulatory requirements can result in enforcement action by the FDA, the Nuclear Regulatory Commission or other regulatory authorities, which may result in sanctions, including but not limited to, untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties; customer notifications or repair, replacement, refunds, recall, detention or seizure of our products; operating restrictions or partial suspension or total shutdown of production; refusing or delaying our requests for BLA premarket approval of new products or modified products; withdrawing BLA approvals that have already been granted; and refusal to grant export.

12

Employees

As of March 15, 2019, we have 30 full-time employees. None of these employees are covered by a collective bargaining agreement, and we believe our relationship with our employees is good. We also engage consultants on an as-needed basis to supplement existing staff.

In analyzing our company, you should consider carefully the following risk factors, together with all of the other information included in this Annual Report on Form 10-K. Factors that could cause or contribute to differences in our actual results include those discussed in the following subsection, as well as those discussed above in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere throughout this Annual Report on Form 10-K. Each of the following risk factors, either alone or taken together, could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our company. The risks and uncertainties described below are not the only ones we face. Additional risks not currently known to us or other factors not perceived by us to present significant risks to our business at this time also may impair our business operations.

Risks Related to Our Business

Recurring losses and negative cash flows from operations raise substantial doubt about our ability to continue as a going concern and we may not be able to continue as a going concern.

Our recurring losses from operations and negative cash flows from operations raise substantial doubt about our ability to continue as a going concern and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our consolidated financial statements for the year ended December 31, 2018 with respect to this uncertainty. Substantial doubt about our ability to continue as a going concern may create negative reactions to the price of the common shares of our stock and we may have a more difficult time obtaining financing.

We have prepared our financial statements on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts of liabilities that might be necessary should we be unable to continue in existence.

We are a clinical-stage company and have generated no revenue from commercial sales to date.

We are a clinical-stage biopharmaceutical company with a limited operating history. We have no products approved for commercial sale and have not generated any revenue from product sales to date. We will encounter risks and difficulties frequently experienced by early-stage companies in rapidly evolving fields. If we do not address these risks successfully, our business will suffer.

We have incurred net losses in every year since our inception and anticipate that we will continue to incur net losses in the future.

We are not profitable and have incurred losses in each period since our inception. As of December 31, 2018, we had an accumulated deficit of $186.9 million. For the years ended December 31, 2018 and 2017, we reported a net loss of $23.7 million and $26.6 million, respectively. We expect to continue to operate at a net loss as we continue our research and development efforts, continue to conduct clinical trials and develop manufacturing, sales, marketing and distribution capabilities. There can be no assurance that the products under development by us will be approved for sale in the United States or elsewhere. Furthermore, there can be no assurance that if such products are approved they will be successfully commercialized, which would have an adverse effect on our business prospects, financial condition and results of operation.

If we fail to obtain additional financing, we will be unable to continue or complete our product development and you will likely lose your entire investment.

We do not currently have sufficient funding for the completion of development nor commercialization of our product candidates and we will need to continue to seek capital from time to time to continue development of our product candidates and to acquire and develop other product candidates. Our first product candidate is not expected to be commercialized, if approved, until at least 2020 and any partnering revenues that it may generate may not be sufficient to fund our ongoing operations. Our cash balance as of December 31, 2018 was $13.7 million. During the year ended December 31, 2018, we raised total net proceeds of approximately $17.0 million from the sale of our common stock and warrants.

Presently, with no further source of capital either via a financing or a collaboration, we project that we may run out of funds in 2019. We currently do not have any additional source of capital secured. If we are unable to raise additional funds, we could be required to reduce our spending plans, reduce our workforce, license one or more of our products or technologies that we would otherwise seek to commercialize ourselves, sell all or some of our assets, cease operations or even declare bankruptcy. We will require additional cash in order to maximize the commercial opportunity and continue clinical development of our product candidates. Alternatives available to us to sustain our operations include collaborative agreements, equity financing, debt and other financing arrangements with potential corporate partners and other sources. However, there can be no assurance that any such collaborative agreements or other sources of funding will be available to us on favorable terms, if at all.

13

Our business or operations may change in a manner that would consume available funds more rapidly than anticipated and substantial additional funding may be required to maintain operations, fund expansion, develop new or enhanced products, acquire complementary products, business or technologies or otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment or a change in preferred cancer treatment modalities. However, we may not be able to secure funding when we need it or on favorable terms or indeed on any terms. In addition, from time to time, we may not be able to secure enough capital in a timely enough manner which may cause the generation of a going-concern opinion from our auditors which can and may impair our stock market valuation and also our ability to finance on favorable terms or indeed on any terms.

To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

If we cannot raise adequate funds to satisfy our capital requirements, we will have to delay, scale back or eliminate our research and development activities, clinical studies or future operations. We may also be required to obtain funds through arrangements with collaborators, which arrangements may require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing, including rights to future product candidates or certain major geographic markets. We may further have to license our technology to others. This could result in sharing revenues which we might otherwise have retained for ourselves. Any of these actions may harm our business, financial condition and results of operations.

The amount of funding we will need depends on many factors, including the progress, timing and scope of our product development programs; the progress, timing and scope of our preclinical studies and clinical trials; the time and cost necessary to obtain regulatory approvals; the time and cost necessary to further develop manufacturing processes and arrange for contract manufacturing; our ability to enter into and maintain collaborative, licensing and other commercial relationships; and our partners’ commitment of time and resources to the development and commercialization of our products.

We have limited access to the capital markets and even if we can raise additional funding, we may be required to do so on terms that are dilutive to you.

We have limited access to the capital markets to raise funds. The capital markets have been unpredictable in the recent past for radioisotope and other oncology companies and unprofitable companies such as ours. In addition, it is generally difficult for development-stage companies to raise capital under current market conditions. The amount of capital that a company such as ours is able to raise often depends on variables that are beyond our control. As a result, we may not be able to secure financing on terms attractive to us, or at all. If we are able to consummate a financing arrangement, the amount raised may not be sufficient to meet our future needs. If adequate funds are not available on acceptable terms, or at all, our business, including our technology licenses, results of operations, financial condition and our continued viability will be materially adversely affected.

We are highly dependent on the success of Iomab-B and the SIERRA trial and we many not able to complete the necessary clinical development or our development efforts may not result in the data necessary to receive regulatory approval

Iomab-B, which we licensed from the Fred Hutchinson Cancer Research Center, in June 2012 is our lead program to which we allocate a significant portion of our resources. We are currently enrolling patients in the pivotal Phase 3 SIERRA trial (Study of Iomab-B in Elderly Relapsed or Refractory AML), a 150-patient multi-center randomized trial that will compare outcomes of patients who receive Iomab-B and a BMT to those patients receiving physician’s choice of salvage chemotherapy, defined as conventional care, as no standard of care exists for this patient population. The SIERRA trial may be unsuccessful and fail to demonstrate a safety and efficacy profile that is necessary to receive favorable regulatory approval. The trials DMC or Data Monitoring Committee may recommend that the trial be stopped early for safety or efficacy concerns, which could prevent us from completing the SIERRA trial. Even if Iomab-B receives favorable regulatory approval, we may not be successful in securing adequate reimbursement or establishing successful commercial operations. Any or all of these factors could have a material adverse impact on our business and ability to continue operations.

14

We may be unable to establish sales, marketing and commercial supply capabilities

We do not currently have, nor have we ever had, commercial sales and marketing capabilities. If any of our product candidates become approved, we would have to build and establish these capabilities in order to commercialize our approved product candidates. The process of establishing commercial capabilities will be expensive and time consuming. Even if we are successful in building sales and marketing capabilities, we may not be successful in commercializing any of our product candidates. Any delays in commercialization or failure to successfully commercialize any product candidate may have material adverse impacts on our business and ability to continue operations.

Risks Related to Regulation

The FDA or comparable foreign regulatory authorities may disagree with our regulatory plans and we may fail to obtain regulatory approval of our product candidates.