UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A INFORMATION

________________

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

Actinium Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

November 21, 2022

Dear Fellow Actinium Shareholder:

It is with great enthusiasm that we share the tremendous progress we have made in 2022. The success of our Iomab-B pivotal trial, the strong overall survival data from our earlier stage Actimab-A+CLAG-M trial and exciting pre-clinical data from our R&D collaborations, have laid a strong foundation for a bright future for the company. We believe the clinical data sets for Iomab-B and Actimab-A, which we expect to share in more detail by year-end, are the harbinger of a potential paradigm change in the treatment of relapsed/refractory AML (r/r AML), an area of high unmet need, as these patients have a very poor survival prognosis. We have also made significant strides in building our leadership team with key recent hires in core functional areas in anticipation of these key milestones and they are energized by this data and the opportunity to realize its full potential.

Investment dollars keep pouring into our niche radiotherapy sector. While the number of companies is growing, the majority feature undifferentiated, nascent, or at best very early-stage clinical programs. Actinium is truly differentiated by our clinical focus on late-stage, hematological malignancies, a growing number of earlier programs in solid tumors, a well-established supply chain into major oncology centers of excellence, and an industry leading intellectual property portfolio. We are at an inflection point in the Company’s history with the opportunity to establish ourselves as a leader in the radiotherapeutics industry and are excited to provide you with this update on our Iomab-B and Actimab-A clinical programs, R&D, partnerships, and overall organizational development.

We were thrilled to announce highly positive topline results from the pivotal Phase 3 SIERRA trial for our lead asset Iomab-B last week. The SIERRA trial met its primary endpoint of durable Complete Remission (dCR) of 6 months post-initial remission after a bone marrow transplant (BMT) with high statistical significance (p<0.0001) compared to the control arm. The trial was conducted in patients 55 years of age or older with r/r AML who typically cannot access a potentially lifesaving BMT as they are deemed unfit and thus unable to tolerate standard chemotherapy-based conditioning. Trial results showed that with Iomab-B conditioning, these patients have increased access to a BMT with a clinically meaningful duration of complete remission, along with a favorable safety profile, potentially establishing a new treatment option for the majority of the 10,000 r/r AML patients in the U.S. who are deemed unfit for BMT with current approaches. Driven by strong encouragement from SIERRA trial investigators who represent the leading transplant physicians at the largest volume transplant hospitals, we expect to present detailed SIERRA trial data at upcoming BMT focused medical conference(s). We look forward to unveiling this data in a setting that will maximize the impact of our trial results for our target audience of transplant physicians as our team works assiduously toward a Biologics License Application (BLA) filing and Early Access Program in 2023.

We strongly believe that based on these results and prior clinical data in over 12 trials and several hundred patients in other blood cancers, Iomab-B has the potential to establish a new standard of care and to increase access to BMT with improved patient outcomes not only in AML but in MDS, ALL, Hodgkin’s and Non-Hodgkin’s Lymphoma and Multiple Myeloma. These results from our well-controlled SIERRA trial will help drive development of the broader opportunity for the Iomab-B clinical program that includes label expansion and also for Iomab-ACT, a low dose version of the Iomab-B construct that is focused on lymphodepletion and reduced intensity conditioning prior to CAR-T and gene and cellular therapies. We look forward to sharing additional details on our Iomab-B expansion strategy and sharing more on our Iomab-ACT trial with Memorial Sloan Kettering and the broader development program next year.

We are also excited to report results from our industry leading Actinium-225 based radiotherapeutic program Actimab-A which has been tested in six trials and ~150 AML patients demonstrating high response rates and good tolerability as a single agent. Actimab-A is being developed in combination with other regimens to exploit mechanistic synergies with the objective of establishing it as a backbone therapy. The Actimab-A + CLAG-M Phase 1 trial was conducted in high-risk, r/r AML patients who had failed two or more lines of therapy, many of whom had TP53 mutations or have failed venetoclax, and consequently have dismal survival of approximately two months. Previously reported data showed an Overall Response Rate of 67%, 83% at the recommended Phase 2 dose, high rates of MRD negativity or undetectable AML, and a clear improvement in survival for this difficult to treat patient population.

We are elated to update these results and report a meaningful improvement in median Overall Survival of 53% and 32% at one and two years. These survival outcomes are exciting as they are as much as double the one- and two-year survival rates r/r AML patients can expect with current therapies. We are enthused by this compelling proof of

concept data as it validates our strategy of developing Actimab-A as a backbone therapy and sets the foundation for advanced development. The full data set will be presented at the annual meeting of the American Society of Hematology in December, and we will provide a program update on future development in 2023.

R&D at Actinium is robust, differentiated and practical and given the competitive environment, we are glad that we made the strategic decision years ago to avoid programs with low competitive differentiation potential where multiple radiotherapy companies are focused. Our research collaborations with Astellas, AVEO Oncology and EpicentRx establish our work with immunotherapies and in solid tumors. Our R&D team has ably supported advancement of our Iomab-B and Actimab-A programs in hematology. The Iomab-ACT and Actimab-A combination strategy programs have been informed by their efforts. Solid tumor programs with partner Astellas and the HER3 targeted radiotherapy are novel and cutting edge, as is our work with daratumumab-Ac-225 and other radiotherapy combinations with the immunotherapy magrolimab-CD47 checkpoint inhibitor in both liquid and solid tumors. Underpinning these programs is our expanded patent portfolio of over 195 issued patents and pending patent applications worldwide. Our IP includes several patent families to manufacture Actinium-225 in a cyclotron, and valuable know-how. When appropriate, we are well-positioned to leverage this technology to produce Actinium-225. We look forward to sharing updates as these programs advance to the next phase.

Our balance sheet is strong with the $111.8 million cash reported at the end of 3Q:2022 expected to fund us well into 2025 and enable us to achieve several more value creating milestones. Our partnership with Immedica Pharma AB to commercialize Iomab-B in the EUMENA region provided a $35 million payment upfront and has the potential for up to $452 million in milestone payments and mid-twenty percent royalties. The market potential is extremely compelling in the EU and approximately 50% larger with 15,000 patients with r/r AML and double the number of BMTs performed than in the US.

Our achievements this year provide a stellar foundation upon which we can execute on our corporate strategy as we continue the momentum into 2023. We are hyper focused on delivering a successful BLA filing to obtain approval for Iomab-B and building the capabilities for a successful commercial launch. We will continue to advance our clinical programs by focusing on the Iomab-B lifecycle management plan, Actimab-A combination trials and Iomab-ACT program in cell and gene therapies. We will continue to advance our R&D programs and partnerships into the next phases of development.

We have continued to bolster our leadership team this year to execute and deliver on our strategic plan. Despite the competitive hiring market in the industry, we have continued to attract key talent, including senior leaders across the clinical, commercial, manufacturing, and G&A functions. Additional details on the profiles of our expanded team are included in the Appendix. We will need to continue to hire great talent and in order to attract such individuals to drive value creation, we request that you support the options plan proposal recommended by your Board of Directors in the proxy statement. We ask for your much-needed support, which will enable us to deliver value to you, our shareholders.

As we race toward a very eventful end of year, we are energized to forge forward with the same intensity to prepare for a monumental year for the company in 2023. Your continued support has made this year possible, and TEAM Actinium thanks you for your unwavering support to helping us achieve our goal to bring innovative medicines to people who urgently need new treatment options.

Sincerely and on Behalf of TEAM ACTINIUM,

Sandesh Seth

Chairman and Chief Executive Officer

Appendix — Review and Outlook

In this section, we share our vision for building a leading specialty radiotherapeutics company, following a pivotal (pun intended) year for the Company with positive Phase 3 SIERRA trial results that could establish a new treatment paradigm for the difficult-to-treat r/r AML population. Iomab-B has the potential to greatly improve the patient journey and the way patients are being managed to provide them greater access to BMTs. Additional label enhancing and life cycle management studies are needed to further develop Iomab-B to establish it as a universal conditioning agent for various hematological malignancies. The compelling data from the Actimab-A + CLAG-M combination trial validates our strategy of developing Actimab-A as a backbone therapy in AML and other hematological malignancies, and we look forward to a comprehensive update on this program next year. Recent additions to our senior leadership team positions us well to execute seamlessly in the coming year, with details highlighted in their biographies.

The Transformational Opportunity for Targeted Conditioning

Remissions in the r/r AML population are difficult to achieve. Preparation of the bone marrow for transplant requires conditioning with either high dose or reduced intensity chemotherapy and/or external radiation. Patients are often unable to achieve a remission or are not medically fit to tolerate current conditioning regimens — their prognosis is poor. This results in disease relapse or limited access to BMT, the only curative treatment option for the r/r AML population. Iomab-B represents a potential paradigm shift as patients with active disease can be effectively conditioned and access BMT with universal engraftment.

Of the nearly 21,000 patients diagnosed with AML each year, ~50% of patients will become relapsed or refractory, yet less than 500 r/r AML or just 4.5% of patients received a BMT. Typically, r/r AML patients are not transplanted as they are unfit and cannot withstand highly toxic chemotherapy-based conditioning regimens to myeloablate their bone marrow before receiving the hematopoietic stem cells. With survival of two to four months expected for this population without a potentially lifesaving BMT, our focus is on increasing patient access to a BMT and improving their outcomes via Iomab-B, which is well tolerated due to its highly targeted nature. We believe that Iomab-B can address this initial market of ~10,000 r/r AML patients who do not have access to potentially curative BMT with existing treatment approaches.

The recently announced topline results from the SIERRA (Study of Iomab-B in Elderly Relapsed or Refractory AML) trial showed that Iomab-B met the primary endpoint of durable complete remission (dCR) of 6-months following initial complete remission after HCT with a high degree of significance (p<0.0001) compared to the control arm. The SIERRA trial is a randomized, multi-center, controlled study which compared Iomab-B as a conditioning regimen prior to a BMT versus a control arm which allowed all current means of conventional care with the intent to transplant these patients. Iomab-B improved BMT access, and produced a statistically higher number of durable remissions, a major clinical benefit, in patients not considered eligible for BMT.

The positive Iomab-B Phase 3 SIERRA trial results support continued expansion of targeted conditioning for BMT in other blood cancers, cellular therapy and gene therapy indications. We plan to leverage this clinical data, alongside our prior clinical experience in multiple r/r hematological malignancies to disrupt today’s conditioning regimens, with a potential game-changer that can improve access and outcomes for hard-to-treat patients who have no options. We believe leveraging our experience developing Iomab-B and prior clinical data to expand our conditioning program into cell and gene therapy indications, an evolving and high-growth area of treatment innovation, can significantly expand the number of patients who could benefit from Iomab-B or Iomab-ACT. We intend to continue to develop the Iomab-ACT program as a low-dose version of Iomab-B designed specifically for use prior to CAR-T and gene therapies, ultimately with the same value proposition as Iomab-B — to improve overall access and outcomes for patients who need cellular or gene therapies.

With the highly positive topline data in hand and strong investigator support, we look forward to highlighting additional SIERRA data at upcoming BMT focused conferences to convey Iomab-B’s value proposition to our target physician community. Our team is hard at work and focused on submitting a BLA in 2023, with the intent of securing what we hope will be the first of many approved indications for Iomab-B. We are also progressing our efforts to initiate an Early Access Program that will broaden the real-world experience with Iomab-B. In 2023, we are excited to build upon the promise of Iomab-B by further developing the lifecycle plan and continue to make progress on Iomab-ACT.

Discovering High Potential of Actimab-A in r/r AML

Our Actimab-A program demonstrates our leadership in the clinical development of Ac-225 therapeutics, as we focus this industry leading alpha-isotope based radiotherapy program as a backbone therapy for novel combinations in r/r AML. Actimab-A is the first radiotherapeutic for r/r AML and has the unique value proposition of broad applicability, a differentiated mechanism of action, and targeted precision that is well-tolerated with minimal toxicity. Specifically, Actimab-A targets CD33, which is expressed in virtually all AML patients regardless of cytogenetics or mutations and enables potent alpha radiation to be directed against radiosensitive AML cells that have no known resistance or repair mechanism when hit with the Ac-225 isotope payload that causes double stranded breaks in DNA.

We believe that Actimab-A in combination with chemotherapy, targeted agents or immunotherapy, in r/r AML as a backbone therapy, represents a significant opportunity to improve patient outcomes in AML based on the data being generated thus far. We have demonstrated preclinically that combinations of Actimab-A and venetoclax, a BCL-2 inhibitor, have mechanistic synergies. Overexpression of MCL-1, an anti-apoptotic protein, is associated with resistance to venetoclax in AML. Actimab-A kills tumors cells with DNA double-strand breaks and downregulates MCL-1, which can (re-)sensitize AML cells or reduce tumor resistance to venetoclax. In our ongoing clinical trial with Actimab-A and venetoclax, we are exploring the optimal dose of Actimab-A, as well as the dosing regimen of the combination. The more advanced Actimab-A + CLAG-M clinical trial has yielded data that demonstrate favorable outcomes with improved survival when Actimab-A is combined with this intensive chemotherapy regimen. The scientific rational for this combination is to use sequential administration of CLAG-M, a powerful chemotherapy regimen, followed by Actimab-A for its precision targeting ability that produces double-strand-DNA breaks that lead to cancer cell death to mop up residual disease.

We are advancing Actimab-A in combination with CLAG-M in a phase I/II study, which has produced strong results in fit r/r AML patients. The data suggest a manageable safety profile and promising response rates. The study, enrolled patients with multiple prior treatments (Median 2 lines of prior therapy (range: 1 – 5)), including prior BMT and Venetoclax. The patient population represented a subset of patients who are extremely difficult to treat and have very poor outcomes on available therapies. Patients were a median age of 63 years and 57% had adverse cytogenetics with 52% having TP53 mutations. 55% of patients had failed prior BMT, 55% received prior Venetoclax therapy and 52% had secondary AML. As we reported earlier, the trial showed an Overall Response Rate (ORR) of 67% from all dose cohorts including subtherapeutic doses of Actimab-A and an 83% ORR at the recommended Phase 2 dose. Importantly, MRD negativity, which indicates a deep remission with no detectable disease, was 72% with Actimab-A + CLAG-M.

To provide context for this analysis, the median OS in patients who relapse post venetoclax is less than 3 months and the median OS in patients who relapse with a TP53 mutation is less than 2 months.

We recently announced that Overall Survival (OS) data from the Actimab-A + CLAG-M combination trial has been accepted for oral presentation at the American Society of Hematology (ASH) Annual Meeting & Symposium in December. The ASH abstract reported a 12-month median OS among all patients, and a 1-year OS of 53% and 2-year OS of 32%, which are as much as double or more what can be expected with available therapies in this setting. Overall survival has been dismal in r/r AML patients, especially those who have adverse cytogenetics or failed venetoclax based treatment. These results are highly encouraging and show that the high rates of responses and MRD negativity are translating to a meaningful survival benefit as can be evidenced in the figure below.

Improved Survival Outcomes with Actimab-A + CLAG-M

Overall survival reported in abstract accepted for oral presentation at ASH adapted

to include results in comparable patients from other studies

The complete data will be presented at ASH, and we look forward to sharing more on our plans for advanced development of this very promising treatment regimen next year.

Further Bolstering of Our Senior Leadership Team

Our people make the foundation to our success, and we are extremely proud that we continue to attract top talent to Actinium as we effectively navigate the challenges in the talent market. We are delighted to have welcomed the following key additions to our team in anticipation of expected positive news we have now received on both Iomab-B and Actimab-B as they will significantly enhance our ability to execute our corporate plan across key functions:

|

Leadership Position |

Relevant Qualifications and Recent Accomplishments |

|

|

Caroline Yarbrough Chief Commercial Officer |

• Portfolio General Manager US Oncology at Novartis Innovative Medicines with full P&L responsibility for a $1.5BN revenue group of oncology brands and development assets • Led the commercial team that successfully launched SCEMBLIX in CML. Led strategic account management during the launch of KYMRIAH, the first approved CAR-T product • Held leadership roles in both Global and US businesses, across Oncology and specialty medicines at companies including GSK, BMS, Viropharma and Merck |

|

Leadership Position |

Relevant Qualifications and Recent Accomplishments |

|

|

Jenny Hsieh Chief Strategy Officer |

• Nearly two decades of experience in leading and developing corporate strategies across the healthcare and life sciences industries • Led Corporate Strategy at Immunomedics to help transform the clinical-stage company into a commercial organization (acquired by Gilead for $21BN following the FDA approval of Trodelvy® in triple-negative breast cancer) • Advised payers, providers, and life sciences companies as a management consultant at several firms |

|

|

Sunitha Lakshminarayanan SVP, CMC and Product Development |

• 20+ years of experience and technical expertise across biologics, biosimilars, vaccines and cell/gene therapy products. Previously responsible for global licensure of two autologous cell therapies, Breyanzi® and Abecma® as Executive Director, Global Process Engineering at BMS for Cell Therapy • Led several BLA fillings, including approvals for Breyanzi®, Abecma®, Releuko® and Fylnetra® • Responsible for new cell therapy facility build-outs for network expansions, technology transfers, product life-cycle management, new technology commercialization, comparability, and Global MS&T labs • Held leadership roles at Kashiv BioSciences, Progenics, Laureate Pharma and BioReliance |

|

|

Akash Nahar, MD VP, Clinical Development |

• Over 15 years of hematology-oncology research and development experience in academia and industry • Held positions of increasing responsibilities, most recently serving as Global Product Development Lead for hematology programs at Merck, leading a team of physicians responsible for the development of the Keytruda® in Hodgkin’s lymphoma, and other developmental products for hematological malignancies, in addition to successfully filing two sBLA for Keytruda® • Board-certified in pediatrics, hematology/oncology, and oncology. Faculty member at St. Christopher’s Hospital for Children in Philadelphia and an Associate Professor in pediatrics at Drexel University |

|

|

Madhuri Vusirikala, MD VP, Clinical Development, |

• Accomplished bone marrow transplant physician and hematologist with over 20 years of clinical experience and board-certified in internal medicine, hematology and oncology • Professor of Internal Medicine in the Division of Hematology/Oncology and Medical Director of the Adult Allogeneic BMT Program at UT Southwestern Medical Center in Dallas. Primary investigator for most clinical trials at UT Southwestern related to BMT • Member on the NCCN panels for Hematopoietic Cell Transplantation and Acute Lymphoblastic Leukemia committees |

|

Leadership Position |

Relevant Qualifications and Recent Accomplishments |

|

|

Patrik Brodin, MSc, PhD VP, Radiation Sciences |

• Board-certified Medical Physicist & American Board of Radiology Therapeutic Medical Physics Diplomat. Previously Assistant Professor/Senior Physicist at Montefiore/Einstein (Radiation Oncology) • Spearheaded development of new approaches in radiation-driven immunotherapy and solutions to reduce risk of severe treatment complications associated with high-dose radiation therapy • Authored over 60 peer-reviewed publications and presented at national and international meetings including oral presentations at ESTRO, ASTRO, AAPM and PTCOG |

|

|

Steve Dressel VP, Strategic Finance and Analysis |

• Nearly 20 years of corporate finance and commercial experience • Previously, was the Senior Director, FP&A at Dewpoint Therapeutics responsible for budgeting, long-term planning, and analyses • Held finance leadership roles at Akebia Therapeutics that developed and marketed Auryxia®, and spent 10 years at Regeneron in finance roles with increasing responsibility supporting Praulent and EYLEA • Began career at Bio-IB, a life science focused investment bank |

|

|

Elaina Haeuber VP, Head of Clinical Operations |

• Over 20 years of clinical research operations and project management experience • Previously, the Vice President, Operations at WCG, overseeing data safety monitoring boards and independent event adjudication for clinical studies • As Executive Director, Operations Management at Syneos Health, led regional and global project and clinical management teams of up to 300 staff for oncology and hematology trials • Supported programs in including Tecentriq for multiple indications, Zynteglo, the first cell-based gene therapy approved for beta-thalassemia, and Skysona, a gene therapy for early, active cerebral ALD |

More about the company is available on our web site www.actiniumpharam.com in general and with investor related materials accessible at https://ir.actiniumpharma.com.

November 21, 2022

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Actinium Pharmaceuticals, Inc. to be held at 9:30 a.m., Eastern Time, on December 8, 2022, at The Garden City Hotel, 45 Seventh St, Garden City, NY 11530.

Annual Meeting Details

Enclosed with this letter are your Notice of Annual Meeting of Stockholders (the “Notice of Annual Meeting”), proxy statement and proxy card. Also provided is the Company’s 2021 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2021. The proxy statement describes the business that will be acted upon at the Annual Meeting. Accordingly, we urge you to review the accompanying material carefully and to promptly return the enclosed proxy card or voting instruction form. Our proxy statement and the 2021 Annual Report are also available at www.viewproxy.com/actiniumpharma/2022.

While as of the date of this proxy statement we are intending to hold the Annual Meeting in a physical format, as part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so as soon as practicable via a press release that will also be filed with the Securities and Exchange Commission (the “SEC”) as proxy material, as well as by posting details on our website at https://www.actiniumpharma.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

You are required to register in advance of the Annual Meeting if you plan to attend the Annual Meeting in person. If you wish to register in advance of the Annual Meeting, please contact our investor relations office by no later than November 28, 2022, by e-mail to investorrelations@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to be present at the Annual Meeting, after receiving the Notice of Annual Meeting please vote as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. As an alternative to voting in person at the Annual Meeting, you may vote via the Internet, by telephone, or by signing, dating and returning the proxy card that is enclosed with the Notice of Annual Meeting. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person at the Annual Meeting. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting. On behalf of the Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the meeting in person.

On behalf of the team at Actinium,

Sincerely,

|

/s/ Sandesh Seth |

||

|

Sandesh Seth |

||

|

Chairman and Chief Executive Officer |

ACTINIUM PHARMACEUTICALS, INC.

275 Madison Avenue, 7th Floor

New York, New York 10016

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Actinium Pharmaceuticals, Inc. (the “Company”) will be held on Thursday, December 8, 2022, at 9:30 a.m. (Eastern Time) at The Garden City Hotel, 45 Seventh St, Garden City, NY 11530. You are required to register in advance of the Annual Meeting if you plan to attend the Annual Meeting in person. If you wish to register in advance of the Annual Meeting, please contact our investor relations office by no later than November 28, 2022, by e-mail to investorrelations@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

While as of the date of this proxy statement we are intending to hold the Annual Meeting in a physical format, as part of our precautions regarding the coronavirus, or COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so as soon as practicable via a press release that will also be filed with the SEC as proxy material, as well as by posting details on our website at https://www.actiniumpharma.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

We are holding the Annual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

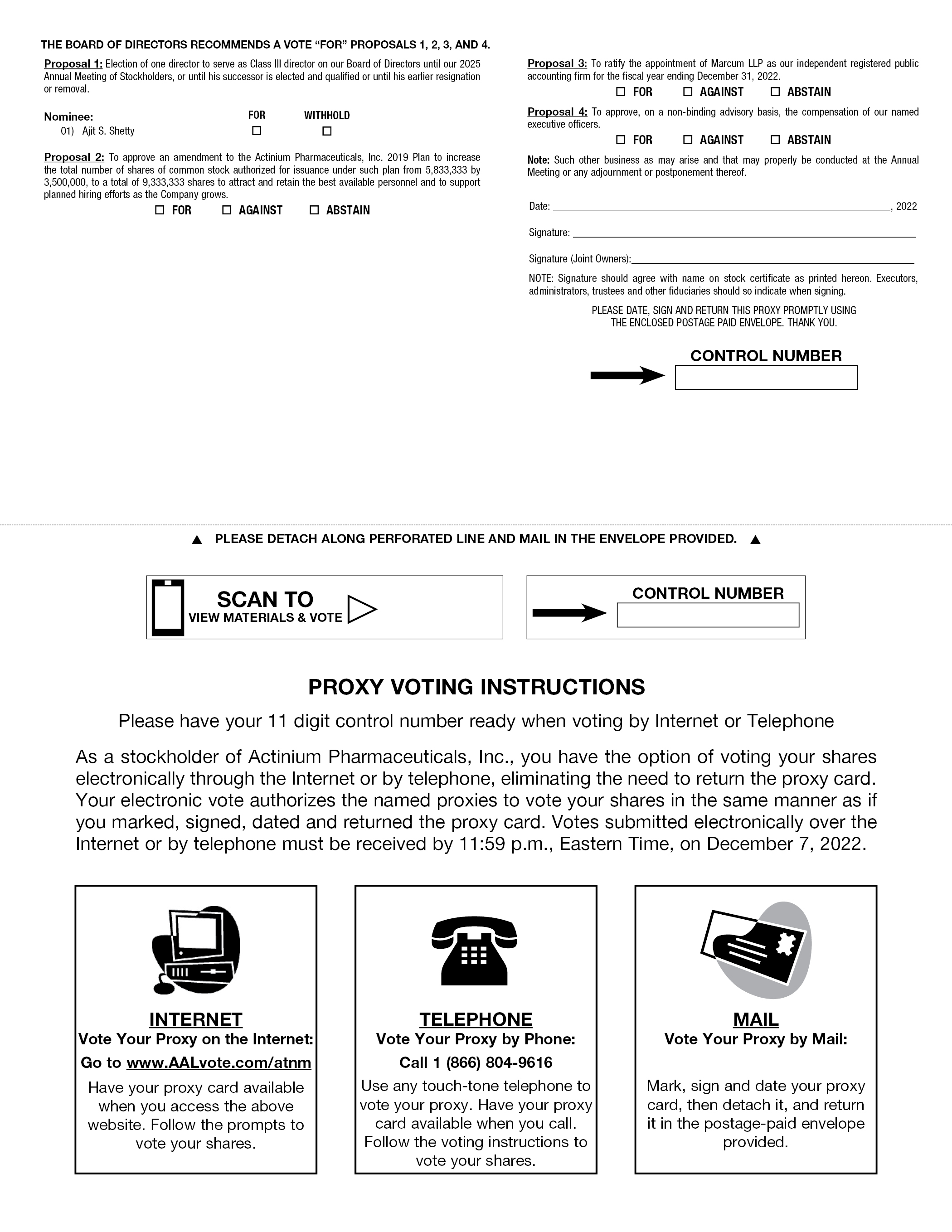

1. To elect Ajit S. Shetty as a Class III director to serve for a three-year term that expires at the 2025 Annual Meeting of Stockholders, or until his successor is elected and qualified or until his earlier resignation or removal;

2. To approve an amendment to the Actinium Pharmaceuticals’ Inc. 2019 Plan to increase the total number of shares of common stock authorized for issuance under such plan from 5,833,333 by 3,500,000, to a total of 9,333,333 shares to attract and retain the best available personnel and to support planned hiring efforts as the Company grows;

3. To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

4. To approve, on a non-binding advisory basis, the compensation of our named executive officers.

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. After careful consideration, the Board of Directors unanimously recommends a vote “FOR” Proposals 1, 2, 3 and 4.

Only stockholders of record as of November 14, 2022 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. For ten calendar days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available during ordinary business hours at our principal executive offices for examination by any stockholder for any purpose relating to the Annual Meeting. If you want to inspect the stockholder list prior to the meeting, please contact us by e-mail to investorrelations@actiniumpharma.com or by mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016. The email should state the purpose of the request and provide proof of ownership of our voting securities as of the Record Date. Such list of the stockholders will also be available during the Annual Meeting.

Your vote as an Actinium Pharmaceutical, Inc. stockholder is very important. With respect to all matters that will come before the Annual Meeting, each holder of shares of common stock is entitled to one vote for each share of common stock held as of the Record Date. For questions regarding your stock ownership, if you are a registered holder, you can contact our transfer agent, Action Stock Transfer by phone at (801) 274-1088.

If your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the Annual Meeting in person, we request that you vote via the Internet, by telephone, or by signing, dating and returning the enclosed proxy card to ensure that your shares will be represented at the Annual Meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting.

|

By Order of our Board of Directors, |

||

|

/s/ Sandesh Seth |

||

|

Chairman and Chief Executive Officer |

||

|

New York, NY |

||

|

November 21, 2022 |

Stockholders Should Read the Entire Proxy Statement Carefully Prior to Submitting Their Proxies

i

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

GENERAL

Unless the context otherwise requires, references in this proxy statement to “we,” “us,” “our,” “the Company,” or “Actinium” refer to Actinium Pharmaceuticals, Inc., a Delaware corporation, and its subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our common stock, par value $0.001 per share.

The enclosed proxy is solicited on behalf of the Board of Directors of Actinium Pharmaceuticals, Inc. (the “Board”) for use at our 2022 annual meeting of stockholders of the Company (the “Annual Meeting”) to be held on December 8, 2022, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders and at any adjournment(s) or postponement(s) of the Annual Meeting. Voting materials, including this proxy statement and proxy card, are dated November 21, 2022 and are expected to be first made available to stockholders on or about November 21, 2022.

The executive offices of the Company are located at, and the mailing address of the Company is 275 Madison Avenue, 7th Floor, New York, New York 10016.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON December 8, 2022:

This proxy statement, a form of the proxy card and our 2021 annual report to stockholders on Form 10-K (the “Annual Report”) are available for viewing, printing and downloading at http://www.viewproxy.com/actiniumpharma/2022 or by email at: requests@viewproxy.com. To view these materials, please have your control number available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery. Additionally, you can find a copy of our Annual Report, which includes our financial statements at www.sec.gov, or in the “SEC Filings” section of the “Investors” section of our website at www.actiniumpharma.com.

1

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your shares at the Annual Meeting.

What may I vote on at the annual meeting?

At the Annual Meeting, stockholders will consider and vote upon the following matters:

Proposal 1: To elect Ajit S. Shetty as a Class III director to serve for a three-year term that expires at the 2025 Annual Meeting of Stockholders, or until his successor is elected and qualified or until his earlier resignation or removal;

Proposal 2: To approve an amendment to the Actinium Pharmaceuticals’ Inc. 2019 Plan to increase the total number of shares of common stock authorized for issuance under such plan from 5,833,333 by 3,500,000, to a total of 9,333,333 shares to attract and retain the best available personnel and to support planned hiring efforts as the Company grows; and

Proposal 3: To ratify the appointment of Marcum LLP (“Marcum”) as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Proposal 4: To approve, on a non-binding advisory basis, the compensation of our named executive officers.

To consider and act upon any other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

How does the Board recommend that I vote on the proposals?

Our Board unanimously recommends that the stockholders vote “FOR” Proposals 1, 2, 3 and 4 being put before our stockholders at the Annual Meeting.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of the proxy materials (consisting of this proxy statement, the accompanying Notice, our 2021 Annual Report and the proxy card) or voting instruction card. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and also hold shares in a brokerage account, you will receive a copy of the proxy materials, including a proxy card, for shares held in your name and a voting instruction card for shares held in “street name.” Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all of your shares are voted.

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on November 14, 2022 (the “Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date, 25,483,306 shares of common stock were issued and outstanding.

2

Who is entitled to vote at the Annual Meeting?

Holders of common stock at the close of business on the Record Date may vote at the Annual Meeting.

What are the voting rights of the stockholders?

Each holder of common stock is entitled to one vote per share of common stock on each matter to be acted upon at the Annual Meeting. Our Certificate of Incorporation, as amended (the “Charter”) does not provide for cumulative voting rights.

What happens if a change to the Annual Meeting is necessary due to exigent circumstances?

While as of the date of this proxy statement we are intending to hold the Annual Meeting in a physical format, as part of our precautions regarding the COVID-19, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including holding the Annual Meeting by means of remote communications. If we take this step, we will announce the decision to do so as soon as practicable via a press release that will also be filed with the SEC as proxy material, as well as by posting details on our website at https://www.actiniumpharma.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with Action Stock Transfer Corporation, the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. The Notice of Annual Meeting and the accompanying proxy materials have been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The Notice of Annual Meeting and the accompanying proxy materials would have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions for voting.

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and either (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the New York Stock Exchange that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. Proposal 3 is considered a “routine matter.” Therefore, if you do not provide voting instructions to your broker regarding such proposal, your broker will be permitted to exercise discretionary voting authority to vote your shares on such proposal. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposals 1, 2, and 4.

How do I vote?

If you are a record holder, you may vote your shares at the Annual Meeting in person or by proxy. Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares in the manner you indicate. You may specify whether your shares should be voted for or withheld for the nominees for director or should be voted for, against or abstained with respect to the amendment of the 2019 Plan and the ratification of the appointment of the Company’s independent

3

registered public accountants. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our transfer agent, Action Stock Transfer Corporation, or you have stock certificates registered in your name, you may submit a proxy to vote:

• By Internet or by telephone. Stockholders may vote via the Internet at www.AALvote.com/atnm or by phone (as per instructions on the proxy card). You will need the control number included on your proxy card.

• By mail. If you received one or more printed proxy cards by mail, you can vote by mail by completing, signing, dating and returning the enclosed proxy card applicable to your class of stock in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board.

• In person at the Annual Meeting. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. You are required to register in advance of the Annual Meeting if you plan to attend the Annual Meeting in person. If you wish to register in advance of the Annual Meeting, please contact our investor relations office by no later than November 28, 2022, by e-mail to investorrelations@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

Telephone and Internet voting facilities for all stockholders of record will be available 24-hours a day and will close at 11:59 p.m., Eastern Standard Time, on December 7, 2022.

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or proxy card. By completing and submitting it, you will direct the proxies to vote your shares at the Annual Meeting in accordance with your instructions. The Board has appointed Sandesh Seth to serve as the proxy for the Annual Meeting.

If your shares are held in “street name” (held in the name of a bank, broker or other nominee who is the holder of record), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

• By Internet or by telephone. Follow the instructions you receive from the record holder to vote by Internet or telephone.

• By mail. You should receive instructions from the record holder explaining how to vote your shares.

• In person at the Annual Meeting. Contact the broker, bank or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the Annual Meeting. You will not be able to vote at the Annual Meeting unless you have a proxy card from your broker, bank or other nominee.

What happens if additional matters are presented at the Annual Meeting?

Other than the election of directors, the amendment of our 2019 Plan, the ratification of the appointment of our auditor and the advisory vote on the compensation of our named executive officers, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder, Sandesh Seth, our Chairman and Chief Executive Officer will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters and as the proxy holder may determine in his discretion with respect to any other matters properly presented for a vote before the Annual Meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain

4

proposals that are considered as “routine” matters. Proposal 3 — ratification of the appointment of Marcum as our independent registered public accounting firm is considered a routine matter, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposal 3. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 — the election of Ajit S. Shetty as a member to our Board, Proposal 2 — the approval of the amendment to the 2019 Plan, and Proposal 4 — the advisory vote on the compensation of our named executive officers. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

On November 14, 2022, the Record Date for determining which stockholders are entitled to vote, there were 25,483,306 shares of our common stock outstanding, which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted to a vote of our stockholders. Thirty-Four percent (34%) of our outstanding shares of common stock as of the Record Date must be present at the Annual Meeting (in person or represented by proxy) in order to hold the Annual Meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the Annual Meeting, if you are present and vote in person at the Annual Meeting or have properly submitted a proxy card or voted by fax, by phone or by using the Internet. Broker non-votes will be counted for purposes of determining whether a quorum is present.

Who counts the votes?

All votes will be tabulated by Gary Siegel, our Vice President, Controller, the inspector of election appointed for the Annual Meeting. Each proposal will be tabulated separately.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may do this by signing a new proxy card with a later date, by voting on a later date by using the Internet (only your latest Internet proxy submitted prior to the Annual Meeting will be counted), or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote at the Annual Meeting or submit a notice of revocation to the Company addressed to Steve O’Loughlin, at the Company’s address above, which notice must be received before 5:00 p.m., Eastern Time, on November 28, 2022.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except:

• as necessary to meet applicable legal requirements;

• to allow for the tabulation of votes and certification of the vote; and

• to facilitate a successful proxy solicitation.

Any written comments that a stockholder might include on the proxy card will be forwarded to our management.

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by our Inspector of Elections and reported in a Current Report on Form 8-K which we will file with the SEC, within four business days of the date of the Annual Meeting.

5

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one Actinium Pharmaceuticals, Inc. stock account, we are delivering only one proxy statement to certain stockholders who share an address, unless otherwise requested. This practice, known as “householding.” If you share an address with another stockholder and have received only one proxy statement, you may write or call us to request to receive a separate proxy statement. Similarly, if you share an address with another stockholder and have received multiple copies of the proxy statement, you may write or call us at the address and phone number below to request delivery of a single copy of the proxy statement. For future annual meetings of stockholders, you may request separate proxy statements, or request that we send only one proxy statement to you if you are receiving multiple copies, by writing or calling us at:

Actinium Pharmaceuticals, Inc.

Attention: Steve O’Loughlin, Chief Financial Officer

275 Madison Avenue, 7th Floor

New York, New York 10016

Tel: (646) 677-3875

Stockholders who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy statement to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the address or phone number set forth above.

Who pays for the cost of this proxy solicitation?

Our Board is asking for your proxy, and we will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our Board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally, electronically or by telephone. In addition, we have retained Alliance Advisors, LLC (“Alliance”) to assist in the solicitation of proxies for a fee of $10,000 plus customary expenses.

Is this proxy statement the only way that proxies are being solicited?

No. In addition to the solicitation of proxies by use of the mail, officers and employees of the Company, as well as Alliance, the proxy solicitation firm hired by the Company, may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. The fees of Alliance as well as the reimbursement of expenses of Alliance will be borne by the Company. Brokerage houses and other custodians, nominees and fiduciaries, in connection with shares of the common stock registered in their names, will be requested to forward solicitation material to the beneficial owners of shares of common stock.

How can I obtain a copy of Actinium Pharmaceuticals, Inc.’s Annual Report?

This proxy statement and the Annual Report are available for viewing, printing and downloading at www.viewproxy.com/actiniumpharma/2022. To view these materials, please have your 11-digit control number(s) available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report, which includes our financial statements, for the fiscal year ended December 31, 2021 on the website of the SEC, at www.sec.gov, or in the “All SEC Filings” section of the “Investors” section of our website at www.actiniumpharma.com. You may also obtain a printed copy of our Annual Report, including our financial statements, free of charge, from us by sending a written request to: Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016, attention: Chief Financial Officer.

6

What is the voting requirement to elect directors?

Assuming the presence of a quorum, directors are elected by a plurality of the votes cast in person or by proxy at the Annual Meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the Annual Meeting. Abstentions or broker non-votes will not affect the outcome of the election of directors.

What is the voting requirement to approve Proposal 2?

Assuming the presence of a quorum, the proposal to approve the amendment to the 2019 Plan will require approval by a majority of votes cast, with abstentions counting as a vote cast. An abstention is not an “affirmative vote,” but it is considered as a vote cast pursuant to Section 711 of the NYSE American Company Guide. Accordingly, an abstention will have the effect of a vote against Proposal 2. Broker non-votes will have no effect on Proposal 2.

What is the voting requirement to approve Proposal 3?

Assuming the presence of a quorum, the proposal to ratify the appointment of Marcum as our independent registered public accounting firm will be approved if the affirmative vote of a majority of the shares represented in person or by proxy and entitled to vote thereon at the Annual Meeting is obtained. An abstention is not an “affirmative vote,” but an abstaining stockholder is considered “entitled to vote” at the Annual Meeting. Accordingly, an abstention will have the effect of a vote against Proposal 3. Brokers are considered “entitled to vote” because brokers have discretionary voting authority on Proposal 3. Because a broker non-vote is not an “affirmative vote,” a broker non-vote will have the effect of a vote against Proposal 3.

What is the voting requirement to approve Proposal 4?

Assuming the presence of a quorum, the advisory vote on the compensation of our named executive officers will be approved if the affirmative vote of a majority of the shares represented in person or by proxy and entitled to vote thereon at the Annual Meeting is obtained. An abstention is not an “affirmative vote,” but an abstaining stockholder is considered “entitled to vote” at the Annual Meeting. Accordingly, an abstention will have the effect of a vote against Proposal 4. Broker non-votes will have no effect on Proposal 4.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our stockholders with any of the proposals described above to be brought before the Annual Meeting.

How can I communicate with the non-employee directors on the Actinium Pharmaceuticals, Inc. Board of Directors?

Our Board encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of our Chairman and Chief Executive Officer. Stockholders can send communications by mail to:

Sandesh Seth, Chairman and Chief Executive Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th Floor

New York, New York 10016

Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman of the Board or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our Chairman, deals with the functions of our Board or committees thereof or that our Chairman otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board and request copies of any such correspondence.

7

WHO CAN HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by writing, calling or emailing us at:

Steve O’Loughlin

Chief Financial Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th Floor

New York, NY 10016

Email: soloughlin@actiniumpharma.com

Tel: 646-677-3875

8

Board of Directors

The Board oversees our business affairs and monitors the performance of management. In accordance with our corporate governance principles, our Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman and Chief Executive Officer, other key executives, and by reading the reports and other materials that we send them and by participating in Board and committee meetings. Biographical information about our directors is provided in the section “Directors and Executive Officers”.

Term of Office

Our directors are divided into three classes, designated Class I, Class II and Class III. Class I consists of two directors, Class II consists of two directors, and Class III consists of one director.

The term of each director is set forth below or until their successors are duly elected:

|

Director |

Class |

Term Expiration |

||

|

David Nicholson |

Class I |

2023 Annual Meeting |

||

|

Richard I Steinhart |

Class I |

2023 Annual Meeting |

||

|

Sandesh Seth |

Class II |

2024 Annual Meeting |

||

|

Jeffrey W. Chell |

Class II |

2024 Annual Meeting |

||

|

Ajit S. Shetty |

Class III |

2022 Annual Meeting |

Directors elected at each annual meeting are elected for a three-year term. Notwithstanding the foregoing, each director shall serve until his successor is duly elected and qualified, or until his retirement, death, resignation or removal.

Director Independence

We use the definition of “independence” of the NYSE American stock exchange to make this determination. We are listed on the NYSE American under the symbol “ATNM”. NYSE American corporate governance rule Section 803(A)(2) provides that an “independent director” means a person other than an executive officer or employee of the company. No director qualifies as independent unless the issuer’s board of directors affirmatively determines that the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Under the NYSE American director independence rules, Jeffrey W. Chell, David Nicholson, Ajit S. Shetty, and Richard I. Steinhart are independent directors of the Company.

Board Leadership Structure and Role in Risk Oversight

Our Board currently consists of five directors, and the positions of Chairman of the Board and principal executive officer are filled by Mr. Sandesh Seth, coupled with a lead independent director position to further strengthen the leadership structure. The Board acknowledges that there are different leadership structures that could allow it to effectively oversee the management of the risks relating to the Company’s operations. However, our Board believes that having Mr. Seth as the Chairman of the Board and the Chief Executive Officer provides an efficient and effective leadership model for the Company, as such structure allows our independent directors to share responsibility in leading the Board, while allowing Mr. Seth to focus primarily on managing the operations of Company.

David Nicholson has been serving as our lead independent director (the “Lead Independent Director”) since September 2017. Our Lead Independent Director chairs the executive sessions of our Board meetings; provides feedback to the Chairman and Chief Executive Officer; if appropriate, and in coordination with executive management, is available for consultation and direct communication with major stockholders; and leads the Board’s evaluation of the Chairman and Chief Executive Officer. We have a separate chair for each committee of our Board, all of whom are independent directors. The chairs of each committee report on the activities of their committees in fulfilling their responsibilities at the meetings of our Board.

9

Our Board is responsible for overseeing the Company’s risk management processes. The Board receives reports from management concerning the Company’s assessment of risks and considers the Company’s risk profile. The Board focus on the most significant risks facing the Company and the Company’s general risk management strategy. In addition, as part of its oversight of our Company’s executive compensation program, the Board considers the impact of such program, and the incentives created by the compensation awards that it administers, on our Company’s risk profile. In addition, the Board, based on the Compensation Committee’s review of all of our compensation policies and procedures, considers the incentives that they create and factors that may reduce the likelihood of excessive risk taking and determines whether they present a significant risk to our Company. The Board has determined that, for all employees, our compensation programs do not encourage excessive risk and instead encourage behaviors that support sustainable value creation.

Board of Directors Meetings and Attendance

During 2021, our Board held fourteen meetings. Each director attended all of the meetings of our Board and of any committees of which he was a member during the year ended December 31, 2021. It is our policy that directors should make every effort to attend the annual meeting of stockholders. At our 2021 Annual Meeting of stockholders, the Company was represented by our Chief Financial Officer and Vice President, Controller with our Chairman and CEO participating by phone and no other directors in attendance as no shareholders registered to attend in advance of the meeting.

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. The Code of Business Conduct and Ethics addresses, among other things, competition and fair dealing, conflicts of interest, protection and proper use of Company assets, government relations, compliance with laws, rules and regulations and the process for reporting violations of the Code of Business Conduct and Ethics, employee misconduct, improper conflicts of interest or other violations. A copy of the Code of Business Conduct and Ethics is available on the Investor section of our website at www.actiniumpharma.com. We will post on our website any amendment to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers.

Under our Code of Business Conduct and Ethics, no Corporate director, officer or other employee, agent or contractor may, directly or indirectly, sell any equity security, including derivatives, of the Corporation (1) if he or she does not own the security sold, or (2) if he or she owns the security, does not deliver it against such sale (a “short sale against the box”) within twenty days thereafter, or does not within five days after such sale deposit it in the mails or other usual channels of transportation. No Corporate director, officer or other employee, agent or contractor may engage in short sales, which are defined as any transactions whereby one may benefit from a decline in the Corporation’s stock price.

Complaints Regarding Accounting Matters

The Audit Committee has established procedures for:

• the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters; and

• the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Communications with Directors

The Board has approved procedures for stockholders to send communications to individual directors or the non-employee directors as a group. Written correspondence should be addressed to the director or directors in care of Sandesh Seth, Chairman and Chief Executive Officer of Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016. Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman and Chief Executive Officer or his designee, who will regularly forward to the

10

non-employee directors a summary of all such correspondence and copies of all correspondence that, deals with the functions of our Board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board and request copies of any such correspondence. You may also contact individual directors by calling our principal executive offices at (646) 677-3875.

Legal Proceedings

There have been no material legal proceedings that would require disclosure under the federal securities laws that are material to an evaluation of the ability or integrity of our directors or executive officers, or in which any director, officer, nominee or principal stockholder, or any affiliate thereof, is a party adverse to us or has a material interest adverse to us.

11

Committees of the Board of Directors

Our Board has formed three standing committees: Audit, Compensation and Nominating and Corporate Governance. Actions taken by our committees are reported to the full Board. Each of our committees has a charter and each charter is posted on our website.

|

Audit Committee |

Compensation Committee |

Nominating and |

||

|

Richard I. Steinhart* |

David Nicholson* |

Ajit S. Shetty* |

||

|

Jeffrey W. Chell |

Jeffrey W. Chell |

David Nicholson |

||

|

Ajit S. Shetty |

Ajit S. Shetty |

Richard I. Steinhart |

____________

* Indicates committee chair

Audit Committee

Our Audit Committee, which currently consists of three directors, provides assistance to our Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, financial reporting, internal control and compliance functions of the Company. The Board has determined that Mr. Steinhart is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K. Our Audit Committee employs an independent registered public accounting firm to audit the financial statements of the Company and perform other assigned duties. Further, our Audit Committee provides general oversight with respect to the accounting principles employed in financial reporting and the adequacy of our internal controls. In discharging its responsibilities, our Audit Committee may rely on the reports, findings and representations of the Company’s auditors, legal counsel, and responsible officers. Our Board has determined that all members of the Audit Committee are financially literate within the meaning of SEC rules and under the current listing standards of the NYSE American. The Audit Committee met four times during 2021. Each member of the Audit Committee was present at all of the Audit Committee meetings held during such director’s tenure as a member of the Audit Committee.

Compensation Committee

Our Compensation Committee, which currently consists of three directors, establishes executive compensation policies consistent with the Company’s objectives and stockholder interests. The Compensation Committee met three times during 2021. Each member of the Compensation Committee was present at the meeting held in 2021. Our Compensation Committee also reviews the performance of our executive officers and establishes, adjusts and awards compensation, including incentive-based compensation, as more fully discussed below. In addition, our Compensation Committee generally is responsible for:

• establishing and periodically reviewing our compensation philosophy and the adequacy of compensation plans and programs for our directors, executive officers and other employees;

• overseeing our compensation plans, including the establishment of performance goals under the Company’s incentive compensation arrangements and the review of performance against those goals in determining incentive award payouts;

• overseeing our executive employment contracts, special retirement benefits, severance, change in control arrangements and/or similar plans;

• acting as administrator of any company stock option plans; and

• overseeing outside compensation consultants when engaged.

Our Compensation Committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The Compensation Committee also periodically reports to the Board on how our non-employee director compensation practices compare with those of other similarly situated public corporations and, if the Compensation Committee deems it appropriate, recommends changes to our director compensation practices to our Board for approval.

12

Outside consulting firms retained by our compensation committee and management also will, if requested, provide assistance to the Compensation Committee in making its compensation-related decisions. The Compensation Committee paid consultant fees to StreeterWyatt of $22,000 during the year ended December 31, 2021. Streeter Wyatt was instructed to providing support and analyses to the compensation committee and their services included development of a peer group regarding executive and director compensation.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee, which currently consists of three directors, is charged with the responsibility of reviewing our corporate governance policies and proposing potential director nominees to the Board for consideration. Our Board has determined that each member of our Nominating and Corporate Governance Committee qualifies as an “independent” member of the Board as defined by the rules and regulations of the SEC and the NYSE American. The Nominating and Corporate Governance Committee was formed on November 4, 2021 and met one time during 2021.

Our Nominating and Corporate Governance Committee’s primary responsibilities and obligations include, among other things:

• overseeing the administration of our Code of Business Ethics and Conduct and related policies;

• leading the search for and recommending individuals qualified to become members of the Board, and selecting director nominees to be presented for election by the shareholders at each annual meeting;

• ensuring, in cooperation with the Compensation Committee, that no agreements or arrangements are made with directors or relatives of directors for providing professional or consulting services to us or our affiliate or individual officer or one of their affiliated, without appropriate review and evaluation for conflicts of interest;

• assessing the independence of directors annually and report to the Board;

• recommending to the Board for its approval, the leadership structure of the Board, including whether the Board should have an executive or non-executive Chairman, whether the roles of Chairman and Chief Executive Officer should be combined, and whether a Lead Director of the Board should be appointed; provided that such structure shall be subject to the bylaws of the Company then in effect;

• ensuring that Board members do not serve on more than six other for-profit public company boards that have a class of securities registered under the Exchange Act in addition to the Board;

• reviewing the Board’s committee structure and to recommend to the Board for its approval directors to serve as members of each committee as well as recommendations for committee chairs;

• reviewing and recommending changes to procedures whereby shareholders may communicate with the Board;

• reviewing recommendations received from shareholders for persons to be considered for nomination to the Board;

• monitoring compliance with our corporate governance guidelines;

• developing and implementing an annual self-evaluation of the Board, both individually and as a Board, and of its committees;

Our Nominating and Corporate Governance Committee considers all qualified candidates identified by members of the Board, by senior management and by stockholders. The Committee follows the same process and uses the same criteria for evaluating candidates proposed by stockholders, members of the Board and members of senior management. When evaluating a candidate to serve on our Board, the members of our Nominating and Corporate Governance Committee consider items such as experience in the biotechnology sector, experience with public companies, executive managerial experience, operations and commercial experience, fundraising experience and contacts in the investment banking industry, personal and skill set compatibility with current Board members, industry reputation, knowledge of our company generally, and independence.

13