UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §14a-12 |

Actinium Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

October 2021

Dear Actinium Shareholder,

Your team at your company wishes to thank you for your loyal support during an important and exciting period for Actinium. Last year, we articulated the opportunity to build a specialty, radiopharmaceutical company focused on major cancer hospitals to address the unmet medical needs of relapsed, refractory patients with Acute Myeloid Leukemia – AML. The foundation supporting this vision is Iomab-B, our treatment-paradigm changing product candidate for bone marrow conditioning prior to transplant, followed by Actimab-A, which is being developed in therapeutic combinations with potential as a backbone therapy. We also saw opportunities to eliminate or reduce the use of chemotherapy prior to various cellular therapies, with improved conditioning or lymphodepletion via our Iomab-ACT program. We invested more in people and R&D in key areas to ensure your company remains at the forefront of radiopharmaceutical innovation and to ensure the success of our clinical stage programs. I am gratified to report that this year we made material progress on all fronts toward realizing the vision we have articulated.

Most importantly, the team is proud to report that we finished the SIERRA trial this summer – an exercise that until late last year proved to be a herculean one for our small, chronically underfunded company. However, our strengthened balance sheet in 2020 allowed us to revitalize the team with new clinical development leadership who drove the trial to completion. Trial completion has started the clock for an important data update by year-end, topline results in mid-2022, and a BLA or Biologics License Application filing later in the year. To prepare for these events, we promoted Dr. Avinash Desai to Chief Medical Officer, confident that his demonstrated performance with SIERRA enrollment, coupled with his significant clinical development and medical affairs track record with several successful cancer products will enable a timely and successful path forward with Iomab-B. We were also able to attract Dr. Arun Swaminathan as our Chief Business and Commercial Officer to prepare the launch of Iomab-B and steer our partnership efforts. Arun’s blend of commercial and deal-making expertise will enable us to meet our goals in these areas. Short descriptions of their impressive track records are provided in Appendix A.

Actimab-A therapeutic combination trials with CLAG-M and venetoclax are progressing per plan and we expect to update you on these trials as well by year-end at the Annual ASH Meeting. These two trials are important contributors to our strategy of developing Actimab-A as a backbone therapy in the r/r AML setting, which remains underserved despite 9 drug approvals, none of which are effective for prolonged durations, much less curative. Importantly, our R&D team was excited to unveil their work with Actimab-A in combination with a CD47 checkpoint inhibitor, which can pave the way for trials with immunotherapeutics that target this pathway and further build on our backbone therapy strategy. CD47 is an important immune checkpoint target and companies with these relatively early CD47-based clinical programs have recently been purchased for billions of dollars in value. As the CD47-targeting field is crowded and growing, we expect that an Actimab-A combination strategy will enable competitive differentiation and value for us via partnerships.

Our R&D team is working internally and with external collaborators on other approaches intended to explore and exploit synergies between highly targeted internal radiation, delivered safety and effectively with Actimab-A, and other modalities in AML. In addition, we have expanded our R&D focus to solid tumors beyond the work we are doing with our partner, Astellas, and our team is excited to be able to reveal their work with the CD47 target at the upcoming SITC Conference. CD47-targeting companies are aspirational, but limited in their ability to demonstrate viability in the solid tumor setting and we are the first company that is working to demonstrate the synergy between targeted radiation, both alpha and beta, with this immune checkpoint target in solid tumors. Harnessing the power of radio-conjugates to modulate immune pathways is an area where Actinium is staking new ground. We have brought the intellectual property function in-house this year to develop reach through patents in critical areas. The deep immune-oncology experience of our IP and research

1

teams (select bios in Appendix A) will enable us to stock the pipeline with truly innovative advances in the radioimmunotherapy area and build on the strong foundation of Iomab-B’s success.

As we look ahead to the rest of 2021 and 2022, we see a period of immense activity as the team prepares to file a BLA for Iomab-B as soon as possible, post top-line results, prepares for appropriate trial expansion after the Actimab-A proof of concept data with both CLAG-M and venetoclax, expands the Iomab-ACT program trials post proof of concept data from the MSKCC/NIH CAR-T trial, and moves ahead with CD47-directed efforts and solid tumor programs. All this activity is possible not only due to the key milestones we have and will achieve this year, including those highlighted above, but also due to the not-so-visible, internal achievements, such as assembling a strong core team and investments in R&D deployed strategically. Significantly, our strong balance sheet, which supports several years of operations, will enable us to move ahead well through this period and into early commercial launch of Iomab-B.

Your support has and will continue to make our future success possible and TEAM ACTINIUM thanks you, dear shareholder. With strong accomplishments in 2021 thus far, enabled by our accomplished team, capital and vision, we are excited for the future with the goal of bringing value to patients and shareholders alike.

| Sincerely, | |

| /s/ Sandesh Seth | |

| Sandesh Seth | |

| Chairman and Chief Executive Officer |

| Key Achievement in 2021 to Date | Key Upcoming Milestones | ||||

|

Positive SIERRA data at 75% enrollment | SIERRA data update at ASH | 4Q:2021 | ||

|

Completed SIERRA enrollment | Actimab-A + CLAG-M Phase 1 data at ASH | 4Q:2021 | ||

|

Fortified balance sheet - $80 million | Actimab-A + Venetoclax Phase 1 data at ASH | 4Q:2021 | ||

|

Expanded Astellas collaboration | CD47 solid tumor and Actimab-A combination presentations at SITC | 4Q:2021 | ||

|

Announced CD47 radiotherapy combos | Iomab-ACT Phase 1 data | 1H:2022 | ||

|

Solid tumor initiatives | CD47 collaborative initiatives | 1H:2022 | ||

| SIERRA topline data | Mid-2022 | ||||

| Solid tumor initiatives including collaborations | 2H: 2022 | ||||

| CD47 clinical initiatives | 2H:2022 | ||||

| Iomab-B BLA filing | 2H:2022 | ||||

2

Appendix A – Review and Outlook

We outline our vision below for the specialty, hospital-focused, radiopharmaceutical company TEAM ACTINIUM is building by capitalizing on the opportunity afforded to us in conditioning prior to a bone marrow transplant via Iomab-B and with Actimab-A as a backbone of therapeutic combinations for relapsed and refractory AML patients. Also discussed are our Iomab-ACT program, focused on conditioning and lymphodepletion prior to cellular therapies and our R&D activities driven by our AWE platform technology. Our core team, which we have assembled this year, will be material in helping unlock our immense inherent value and it is well qualified to tackle the challenges ahead as evidenced by their highlighted biographies at the end of this report.

Significant Opportunity for Iomab-B in r/r AML Bone Marrow Transplant Conditioning

In recent years, 9 drugs have been approved for AML patients. However, at best, they extend survival for a couple of years or less, depending on when the disease is diagnosed and the age of the patient. The relapse rate remains high and many patients, after several courses of treatment with various agents, are unresponsive to therapy, surviving just a few months with the disease. A Bone Marrow Transplant, or BMT, is the only curative treatment option for many patients with relapsed or refractory AML and indeed for many other blood cancers. BMT procedures have grown and are expected to grow due to improvements across the continuum of care and use in more diseases. However, despite 60 years of progress and growth in the field of BMT, conditioning or preparing the bone marrow niches for donor cells remains reliant on chemotherapy and external radiation. These non-targeted, highly toxic conditioning regimens not only limit access to stronger, medically fit patients who can withstand such treatment and who do not have active disease, they also have sub-optimal outcomes, as BMT success with these regimens is very low. Iomab-B represents a potential paradigm shift as patients with active disease can be effectively conditioned and access a BMT with universal engraftment as seen in clinical data to date.

|

Despite 9 drug approvals AML relapses are the norm, survival has not improved materially and a BMT remains the only curative outcome

|

Iomab-B, if approved, represents a paradigm change to transplant access and outcomes

|

Data updates from SIERRA at ASH, topline data in mid-2022 to support a BLA filing for approval

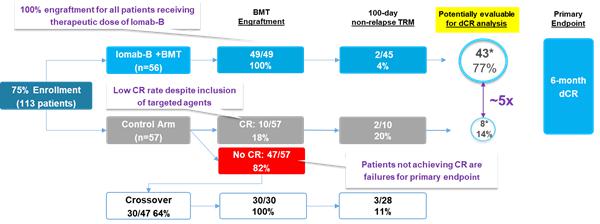

The strong body of clinical data in the SIERRA trial revealed in interim updates at 25%, 50% and 75% enrollment were in line with data from the Proof of Concept – POC trial. POC trial data were generated across generations of leading BMT physicians at the Fred Hutchinson Cancer Research Center, a Nobel Prize winning institution that pioneered the field of BMT. The universal access to BMT with patients receiving Iomab-B and its tolerability/safety profile gives us confidence in Iomab-B’s potential in r/r AML and other BMT conditioning indications. We highlight the positive data points from SIERRA through 75% enrollment and our expectations for upcoming data updates from SIERRA. In our view, the key metric to focus on is 100-day NR-TRM or Non-Relapse Transplant Related Mortality 100 days post-transplant. SIERRA data on this metric from 25%, 50% and 75% of patient enrollment has been remarkably consistent, showing that greater than 5-fold patients in the Iomab-B vs. control arm are eligible for evaluation of the primary endpoint of Durable Complete Response, or dCR, at 6 months post-successful transplant. Based on consistently positive prior results, we look forward to the SIERRA data at the American Society of Hematology (ASH) annual meeting early December.

1

SIERRA Results from 75% Enrollment Presented at ASH 2020 and TCT 2021

| - | 100% of patients receiving Iomab-B were able to proceed to BMT vs. only 18% of patients receiving salvage therapy in the control arm |

| - | Patients receiving Iomab-B were able to receive BMT twice as fast compared to salvage therapy (30 days vs. 67 days) |

| - | 100% of patients that could not access BMT with salvage therapy were able to by crossing-over and receiving Iomab-B |

| - | Lower rates of certain serious adverse events such as sepsis and 100-day non-relapse transplant related mortality were reported in patients receiving Iomab-B vs. salvage therapy |

| - | Greater than 5x more patients potentially eligible for analysis of the primary endpoint of durable Complete Remission at 6 months in patients receiving Iomab-B (77%) vs. salvage therapy (14%) |

Importantly, our team has begun to prepare for a BLA filing to support a potential FDA approval ahead of the topline data expected in mid-2022 which we look forward to presenting.

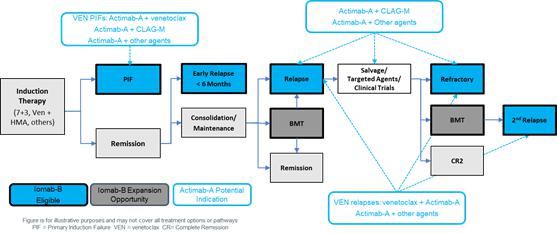

Actimab-A – Potentially A Backbone Therapy in Relapsed Refractory AML

Actimab-A has the potential to be a backbone therapy for AML because it allows the use of precisely targeted internalized radiation in a diffuse blood cancer which cannot be treated with external beam radiation. State of the art cancer treatments feature combination approaches aimed at exploiting synergies between different therapeutic modalities with the goal of increasing efficacy without added toxicity, to improve patient outcomes and quality of life. Actimab-A, which targets CD33, an antigen expressed in virtually all AML patients regardless of their cytogenetics, is ideal for combinations with a variety of drugs currently used to treat AML, as they all have different mechanisms, thus implying an additive effect due to the proven single agent activity of Actimab-A. Additionally, the potential for synergistic effects also exists due to the ionizing alpha radiation emitted by the Actinium-225 isotope of the Actimab-A antibody conjugate. Our data thus far from trials with chemotherapeutics agents (CLAG-M), targeted therapy (venetoclax) and preclinical data with CD47 immunotherapy, (agent to be revealed at the upcoming SITC Conference), are testimony to the validity of our strategy and supportive of further expansion of this approach to other agents.

Ongoing Actimab-A Combination Trials Support Backbone Therapy Strategy, CD47 Initiative is Promising

Our two ongoing combination trials with Actimab-A have produced promising early proof of concept data thus far and we are excited about the work we are doing in combination with a CD47-blocking antibody immunotherapy. The Actimab-A + CLAG-M combination trial has produced 100% complete responses in the most recent cohort, complete responses in 67% of patients (10/15) across all cohorts with 70% of responders (7/10) achieving MRD negativity, meaning there was no detectable AML cancer cells using very sensitive detection methods. The Actimab-A + Venetoclax study produced compelling results in the first cohort, which were presented at ASH last December, showing a 67% overall response rate in the first dose cohort. This was a low dose of Actimab-A, shown to be subtherapeutic as a single agent. We believe these and other potential Actimab-A combinations can produce results not achievable with non-radiotherapy-based approaches, with the data produced thus far comparing favorably with recently approved and late-stage programs for r/r AML patients. We look forward to presenting data on the CD47 combinations at the SITC Conference in November, the clinical trials at ASH in December and also progressing our development plans in 2022.

Attractive r/r AML Opportunity Led by Iomab-B Enables Company Building Vision

2

We aspire to establish Iomab-B as a universal solution for BMT conditioning over time. For the first indication, we focused on elderly patients with active, r/r AML because of the high unmet need and the compelling data with Iomab-B in this patient population. Serendipitously, our Actimab-A program has evolved toward the same disease state but with a larger population which includes both fit and unfit AML patients over the age of eighteen. Of the approximately 21,000 patients diagnosed with AML each year, it is estimated that 50% of patients will become relapsed or refractory, yet less than 500 r/r AML or just 4.5% of patients received a BMT as most cannot withstand toxic conditioning. With survival expectancy of 3-6 months, our focus is on increasing access to BMT and improving patient outcomes via Iomab-B. The initial market for Iomab-B based on the SIERRA patient population is several thousand patients and there are about 10,000 patients with r/r AML potentially treatable with Iomab-B and Actimab-A, assuming development success.

Concentrated treatment centers for BMT and r/r AML treatment creates potential to leverage Iomab-B commercialization efforts for Actimab-A, Iomab-ACT

We believe leveraging our experience developing Iomab-B and then commercializing it successfully will facilitate our therapeutics development, as well as expanding our conditioning program into cell and gene therapy indications, where conditioning is ubiquitous. The Iomab-ACT program is focused on developing a low-dose version of Iomab-B designed specifically for CAR-T and gene therapies. If successful, the commercial market would be primarily comprised of the leading 100 centers that treat a significant majority of the addressable patient population for BMT and cellular therapies, as well as patients with r/r AML. Given that our strong supply chain is already established in over 40 leading BMT and comprehensive cancer centers, we feel confident in our ability to successfully commercialize targeted conditioning agents into this market, should we successfully gain approval.

Actinium R&D Remains Highly Relevant and A Key Innovator in Radioimmunotherapy

As indicated by our name, Actinium Pharmaceuticals has long been an innovator in the field of Ac-225-based radiotherapy. However, informed by our experiences in clinical development, our views have broadened. While we are firm believers in the power of Ac-225, we also believe that other isotopes such as I-131 and Lu-177 have a significant role to play in oncology drug development, each with its own advantages in different indications. Iomab-ACT and Actimab-A combinations have been products of our internal R&D efforts and since last year we have increased investments in our New York City based R&D capabilities – facilities, equipment, and human resources. Our strong scientific talent with extensive knowledge and experience in cancer biology, immunology and radiation sciences are capably executing our strategy as evidenced by the progress we can make public at this time.

Earlier this year Astellas Pharma, Inc. highlighted our collaboration on their earnings call and its emphasis on theranostics – agents that diagnose and treat cancer with radiotherapy, for solid tumor indications. Collaboration with a Top 20 global biopharmaceutical company brings strong independent validation to our technology platform. We are also thrilled to unveil an early peek on certain aspects of our radioimmunotherapy research. At the Society for Immunotherapy for Cancer (SITC) conference in mid-November, we will present data on the combination of targeted radiotherapy with CD47-targeting immunotherapy. To our knowledge, we are the only company exploring the potential of targeted radiotherapy with the CD47 target, which has emerged as one of the more active immunotherapy targets in drug development and the field is becoming increasingly crowded. However, although solid tumors are proving to be a challenging area for companies working in this area, our initial results appear promising. Companies with early clinical

3

programs targeting CD47 have been recently acquired in multi-billion-dollar transactions, namely, Gilead’s purchase of Forty-Seven, Inc. for $4.9 billion and Pfizer’s pending acquisition of Trillium Therapeutics, Inc. for $2.26 billion. It is our intention to collaborate with one or more companies in this area to further the development of Actimab-A. We look forward next year to unveiling more of our R&D efforts that can fill our pipeline beyond Iomab-B and Actimab-A.

Rejuvenated Senior Team Enables Success Oriented Execution

We believe that people make all the difference, and we are extremely proud of the team we have assembled at Actinium. Our differentiated position and leadership in targeted radiotherapy, strong balance sheet and recent accomplishments have enabled us to attract a level of talent not accessible to Actinium previously. Success is a team effort and recent senior appointments give us great confidence that our future is being led by highly accomplished and capable leaders including:

| Leadership Position | Relevant Qualifications, Recent Accomplishments | |

|

Avinash Desai, MD Chief Medical Officer |

25+ years of drug development and medical affairs experience, will lead the BLA filing for Iomab-B, our clinical development strategy and clinical operations execution. Dr. Desai’s leadership led to the enrollment of the last 25% of patients in SIERRA faster than any previous cohort and demonstrates his abilities. Dr. Desai has had integral roles in senior clinical development and medical affairs roles for multiple oncology products including Jevtana at Sanofi, Cyramza at Eli Lilly and Darzalex and Velcade at Johnson & Johnson. Prior to Actinium, Dr. Desai was Vice President, Head of U.S. Medical Affairs – Oncology at Glaxo Smith Kline where he established the U.S. medical affairs oncology team that oversaw the launch readiness plans for three novel oncology products – Blenrep® in multiple myeloma, Zejula® in ovarian cancer, and Jemperli® in endometrial cancer. Having contributed to multiple successful regulatory submissions, Dr. Desai’s capabilities are ideal to lead Actinium through important upcoming regulatory submissions and clinical growth. | |

|

Arun Swaminathan, Ph.D. Chief Business and Commercial Officer |

20+ years of experience in the global biopharmaceutical industries including commercial, business development, and clinical roles. Dr. Swaminathan’s background makes him aptly suited to lead both our commercial planning for Iomab-B, leveraging Dr. Desai’s medical affairs background, and business development track record. Dr. Swaminathan has managed global oncology brands with $2 billion in annual sales across the top 10 global markets and has worked with brands at Bristol-Meyers Squibb including Nulojix®, Orencia® and Eliquis®. He is also an entrepreneur who after his tenure at BMS became CEO and founder of Lynkogen where he licensed assets, raised capital, advanced IND enabling studies and successfully out-licensed to Alteogen, that he then joined as Chief Business Officer. At Alteogen, he led 10 deals totaling $6+ billion in potential value, including agreements with two Top 10 global pharmaceutical companies. During his tenure at Alteogen, the Company’s market value increased from approximately $400 million to $4+ billion. | |

|

Paul Diamond, Ph.D. Vice President, Patent and Legal Counsel |

20+ years of experience in patent law, Ph.D. in molecular and cellular biology at Harvard University, will be imbedded in R&D ensuring our global IP portfolio will protect our next-generation radiotherapies as well current pipeline candidates. | |

|

Helen Kotanides, Ph.D. Vice President, Translational Sciences & Preclinical Research |

25+ years of experience in oncology and immunotherapy R&D, having led several programs at Eli Lilly to successful IND filings. Dr. Kotanides has led our recent facility expansion, CD47 experiments and execution of our collaboration with Astellas. She will be invaluable to leading our next stage of R&D innovation. | |

|

Monideepa Roy, Ph.D. Vice President, Corporate Development, R&D |

20 years as a scientist-entrepreneur including as a cofounder and CEO of a startup. She has a demonstrated track record of building an R&D organization through the identification of technology platforms, infrastructure build out and team building. Dr. Roy will leverage her Ph.D. training molecular biology and corporate development experience to bridge business and R&D here at Actinium to grow our capabilities. |

4

October 18, 2021

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Actinium Pharmaceuticals, Inc. to be held at 9:30 a.m., Eastern Time, on November 9, 2021, at The Garden City Hotel, 45 Seventh St, Garden City, NY 11530.

Annual Meeting Details

Enclosed with this letter are your Notice of Annual Meeting of Stockholders (the “Notice of Annual Meeting”), proxy statement and proxy card. Also provided is the Company’s 2020 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2020. The proxy statement describes the business that will be acted upon at the Annual Meeting. Accordingly, we urge you to review the accompanying material carefully and to promptly return the enclosed proxy card or voting instruction form. Our proxy statement and the 2020 Annual Report are also available at www.viewproxy.com/actiniumpharma/2021.

While as of the date of this proxy statement we are intending to hold the Annual Meeting in a physical format, as part of our precautions regarding the coronavirus, or COVID-19, we are planning for the possibility, if necessary, of a change in the location of the Annual Meeting to hold a hybrid or virtual meeting, which would allow for remote participation by stockholders at the Annual Meeting, as entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings or other public health measures. If we take this step, we will announce the decision to do so as soon as practicable via a press release that will also be filed with the Securities and Exchange Commission (the “SEC”) as proxy material, as well as by posting details on our website at https://www.actiniumpharma.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

You are required to register in advance of the Annual Meeting if you plan to attend the Annual Meeting in person. If you wish to register in advance of the Annual Meeting, please contact our investor relations office by no later than November 2, 2021, by e-mail to investorrelations@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to be present at the Annual Meeting, after receiving the Notice of Annual Meeting please vote as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. As an alternative to voting in person at the Annual Meeting, you may vote via the Internet, by telephone, or by signing, dating and returning the proxy card that is enclosed with the Notice of Annual Meeting. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person at the Annual Meeting. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting. On behalf of the Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the meeting in person.

On behalf of the team at Actinium,

Sincerely,

| /s/ Sandesh Seth |

Sandesh Seth

Chairman and Chief Executive Officer

ii

ACTINIUM PHARMACEUTICALS, INC.

275 Madison Avenue, 7th Floor

New York, New York 10016

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Actinium Pharmaceuticals, Inc. (the “Company”) will be held on Tuesday, November 9, 2021, at 9:30 a.m. (Eastern Time) at The Garden City Hotel, 45 Seventh St, Garden City, NY 11530. You are required to register in advance of the Annual Meeting if you plan to attend the Annual Meeting in person. If you wish to register in advance of the Annual Meeting, please contact our investor relations office by no later than November 2, 2021, by e-mail to investorrelations@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

While as of the date of this proxy statement we are intending to hold the Annual Meeting in a physical format, as part of our precautions regarding the coronavirus, or COVID-19, we are planning for the possibility, if necessary, of a change in the location of the Annual Meeting to hold a hybrid or virtual meeting, which would allow for remote participation by stockholders at the Annual Meeting, as entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings or other public health measures. If we take this step, we will announce the decision to do so as soon as practicable via a press release that will also be filed with the SEC as proxy material, as well as by posting details on our website at https://www.actiniumpharma.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

We are holding the Annual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

| 1. | To elect Sandesh Seth and Jeffrey W. Chell as Class II directors to serve for a three-year term that expires at the 2024 Annual Meeting of Stockholders, or until their successors are elected and qualified or until their earlier resignation or removal; |

| 2. | To approve an amendment to the Actinium Pharmaceuticals’ Inc. 2019 Plan, as amended by the Amendment to Actinium Pharmaceuticals Inc. 2019 Plan, effective November 18, 2020, to increase the total number of shares of common stock authorized for issuance under such plan from 3,083,333 by 2,750,000, to a total of 5,833,333 shares to attract and retain the best available personnel and to support planned hiring efforts as the Company grows; and |

| 3. | To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. |

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. After careful consideration, the Board of Directors recommends a vote “FOR” Proposals 1, 2 and 3.

Only stockholders of record as of September 13, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. For ten calendar days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available during ordinary business hours at our principal executive offices for examination by any stockholder for any purpose relating to the

iii

Annual Meeting. If you want to inspect the stockholder list prior to the meeting, please contact us by e-mail to investorrelations@actiniumpharma.com or by mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016. To the extent office access is impracticable due to the recent COVID-19 pandemic, you may email Alyson Osenenko of Alliance Advisors, LLC, our proxy solicitor, at aosenenko@allianceadvisors.com for alternative arrangements to examine the stockholder list. The email should state the purpose of the request and provide proof of ownership of our voting securities as of the Record Date. Such list of the stockholders will also be available during the Annual Meeting.

Your vote as a Actinium Pharmaceutical, Inc. stockholder is very important. With respect to all matters that will come before the Annual Meeting, each holder of shares of common stock is entitled to one vote for each share of common stock held as of the Record Date. For questions regarding your stock ownership, if you are a registered holder, you can contact our transfer agent, Action Stock Transfer by phone at (801) 274-1088.

If your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the Annual Meeting in person, we request that you vote via the Internet, by telephone, or by signing, dating and returning the enclosed proxy card to ensure that your shares will be represented at the Annual Meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting.

| By Order of our Board of Directors, | |

| /s/ Sandesh Seth | |

| Chairman and Chief Executive Officer | |

| New York, NY | |

| October 18, 2021 |

iv

TABLE OF CONTENTS

Stockholders Should Read the Entire Proxy Statement Carefully Prior to Submitting Their Proxies

v

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

Unless the context otherwise requires, references in this proxy statement to “we,” “us,” “our,” “the Company,” or “Actinium” refer to Actinium Pharmaceuticals, Inc., a Delaware corporation, and its subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our common stock, par value $0.001 per share.

The enclosed proxy is solicited on behalf of the Board of Directors of Actinium Pharmaceuticals, Inc. (the “Board”) for use at our 2021 annual meeting of stockholders of the Company (the “Annual Meeting”) to be held on November 9, 2021, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders and at any adjournment(s) or postponement(s) of the Annual Meeting. Voting materials, including this proxy statement and proxy card, are dated October 18, 2021 and are expected to be first delivered to all or our stockholders on or about October 18, 2021.

The executive offices of the Company are located at, and the mailing address of the Company is 275 Madison Avenue, 7th Floor, New York, New York 10016.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 9, 2021:

This proxy statement, a form of the proxy card and our 2020 annual report to stockholders on Form 10-K (the “Annual Report”) are available for viewing, printing and downloading at http://www.viewproxy.com/actiniumpharma/2021 or by email at: requests@viewproxy.com. To view these materials, please have your control number available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery. Additionally, you can find a copy of our Annual Report, which includes our financial statements at www.sec.gov, or in the “SEC Filings” section of the “Investors” section of our website at www.actiniumpharma.com.

1

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your shares at the Annual Meeting.

What may I vote on at the annual meeting?

At the Annual Meeting, stockholders will consider and vote upon the following matters:

Proposal 1: To elect Sandesh Seth and Jeffrey W. Chell as Class II directors to serve for a three-year term that expires at the 2024 Annual Meeting of Stockholders, or until his successor is elected and qualified or until his earlier resignation or removal;

Proposal 2: To approve an amendment to the Actinium Pharmaceuticals’ Inc. 2019 Plan, as amended by the Amendment to Actinium Pharmaceuticals Inc. 2019 Plan, effective November 18, 2020 (collectively, the “2019 Plan”) to increase the total number of shares of common stock authorized for issuance under such plan from 3,083,333 by 2,750,000, to a total of 5,833,333 shares to attract and retain the best available personnel and to support planned hiring efforts as the Company grows; and

Proposal 3: To ratify the appointment of Marcum LLP (“Marcum”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

To consider and act upon any other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

How does the Board recommend that I vote on the proposals?

Our Board unanimously recommends that the stockholders vote “FOR” Proposals 1, 2 and 3 being put before our stockholders at the Annual Meeting.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of the proxy materials (consisting of this proxy statement, the accompanying Notice, our 2020 Annual Report and the proxy card) or voting instruction card. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and also hold shares in a brokerage account, you will receive a copy of the proxy materials, including a proxy card, for shares held in your name and a voting instruction card for shares held in “street name.” Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all of your shares are voted.

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on September 13, 2021 (the “Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date, 22,024,167 shares of common stock were issued and outstanding.

2

Who is entitled to vote at the Annual Meeting?

Holders of common stock at the close of business on the Record Date may vote at the Annual Meeting.

What are the voting rights of the stockholders?

Each holder of common stock is entitled to one vote per share of common stock on each matter to be acted upon at the Annual Meeting. Our Certificate of Incorporation, as amended (the “Charter”) does not provide for cumulative voting rights.

What happens if a change to the Annual Meeting is necessary due to exigent circumstances?

While as of the date of this proxy statement we are intending to hold the Annual Meeting in a physical format, as part of our precautions regarding the COVID-19, we are planning for the possibility, if necessary, that we change the location of the Annual Meeting to hold a hybrid or virtual meeting, which would allow for remote participation by stockholders at the Annual Meeting, as entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings or other public health measures. If we take this step, we will announce the decision to do so as soon as practicable via a press release that will also be filed with the SEC as proxy material, as well as by posting details on our website at https://www.actiniumpharma.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with Action Stock Transfer Corporation, the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. The Notice of Annual Meeting and the accompanying proxy materials have been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The Notice of Annual Meeting and the accompanying proxy materials would have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions for voting.

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and either (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the New York Stock Exchange that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. Proposal 3 is considered a “routine matter.” Therefore, if you do not provide voting instructions to your broker regarding such proposal, your broker will be permitted to exercise discretionary voting authority to vote your shares on such proposal. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposals 1 and 2.

How do I vote?

If you are a record holder, you may vote your shares at the Annual Meeting in person or by proxy. Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares in the manner you indicate. You may specify whether your shares should be voted for or withheld for the nominees for director or should be voted for, against or abstained with respect to the amendment of the 2019 Plan and the ratification of the appointment of the Company’s independent

3

registered public accountants. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our transfer agent, Action Stock Transfer Corporation, or you have stock certificates registered in your name, you may submit a proxy to vote:

| ● | By Internet or by telephone. Stockholders may vote via the Internet at www.AALvote.com/atnm or by phone (as per instructions on the proxy card). You will need the control number included on your proxy card. |

| ● | By mail. If you received one or more printed proxy cards by mail, you can vote by mail by completing, signing, dating and returning the enclosed proxy card applicable to your class of stock in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board. |

| ● | In person at the Annual Meeting. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. You are required to register in advance of the Annual Meeting if you plan to attend the Annual Meeting in person. If you wish to register in advance of the Annual Meeting, please contact our investor relations office by no later than November 2, 2021, by e-mail to investorrelations@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875. |

Telephone and Internet voting facilities for all stockholders of record will be available 24-hours a day and will close at 11:59 p.m., Eastern Standard Time, on November 8, 2021.

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or proxy card. By completing and submitting it, you will direct the proxies to vote your shares at the Annual Meeting in accordance with your instructions. The Board has appointed Sandesh Seth to serve as the proxy for the Annual Meeting.

If your shares are held in “street name” (held in the name of a bank, broker or other nominee who is the holder of record), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| ● | By Internet or by telephone. Follow the instructions you receive from the record holder to vote by Internet or telephone. |

| ● | By mail. You should receive instructions from the record holder explaining how to vote your shares. |

| ● | In person at the Annual Meeting. Contact the broker, bank or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the Annual Meeting. You will not be able to vote at the Annual Meeting unless you have a proxy card from your broker, bank or other nominee. |

What happens if additional matters are presented at the Annual Meeting?

Other than the election of directors, the amendment of our 2019 Plan and the ratification of the appointment of our auditor, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder, Sandesh Seth, our Chairman and Chief Executive Officer will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters and as the proxy holder may determine in his discretion with respect to any other matters properly presented for a vote before the Annual Meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that

4

are considered as “routine” matters. Proposal 3 — ratification of the appointment of Marcum as our independent registered public accounting firm is considered a routine matter, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposal 3. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 — the election of Sandesh Seth and Jeffrey W. Chell as members to our Board and Proposal 2 — the approval of the amendment to the 2019 Plan. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

On September 13, 2021, the Record Date for determining which stockholders are entitled to vote, there were 22,024,167 shares of our common stock outstanding, which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted to a vote of our stockholders. Thirty-Four percent (34%) of our outstanding shares of common stock as of the Record Date must be present at the Annual Meeting (in person or represented by proxy) in order to hold the Annual Meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the Annual Meeting, if you are present and vote in person at the Annual Meeting or have properly submitted a proxy card or voted by fax, by phone or by using the Internet. Broker non-votes will be counted for purposes of determining whether a quorum is present.

Who counts the votes?

All votes will be tabulated by Gary Siegel, our Vice President, Controller, the inspector of election appointed for the Annual Meeting. Each proposal will be tabulated separately.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may do this by signing a new proxy card with a later date, by voting on a later date by using the Internet (only your latest Internet proxy submitted prior to the Annual Meeting will be counted), or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote at the Annual Meeting or submit a notice of revocation to the Company addressed to Steve O’Loughlin, at the Company’s address above, which notice must be received before 5:00 p.m., Eastern Time, on November 4, 2021.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except:

| ● | as necessary to meet applicable legal requirements; |

| ● | to allow for the tabulation of votes and certification of the vote; and |

| ● | to facilitate a successful proxy solicitation. |

Any written comments that a stockholder might include on the proxy card will be forwarded to our management.

Where can I find the voting results of the Annual Meeting?

5

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by our Inspector of Elections and reported in a Current Report on Form 8-K which we will file with the SEC, within four business days of the date of the Annual Meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one Actinium Pharmaceuticals, Inc. stock account, we are delivering only one proxy statement to certain stockholders who share an address, unless otherwise requested. This practice, known as “householding.” If you share an address with another stockholder and have received only one proxy statement, you may write or call us to request to receive a separate proxy statement. Similarly, if you share an address with another stockholder and have received multiple copies of the proxy statement, you may write or call us at the address and phone number below to request delivery of a single copy of the proxy statement. For future annual meetings of stockholders, you may request separate proxy statements, or request that we send only one proxy statement to you if you are receiving multiple copies, by writing or calling us at:

Actinium Pharmaceuticals, Inc.

Attention: Steve O’Loughlin, Chief Financial Officer

275 Madison Avenue, 7th Floor

New York, New York 10016

Tel: (646) 677-3875

Stockholders who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy statement to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the address or phone number set forth above.

Who pays for the cost of this proxy solicitation?

Our Board is asking for your proxy, and we will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our Board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally, electronically or by telephone. In addition, we have retained Alliance Advisors, LLC (“Alliance”) to assist in the solicitation of proxies for a fee of $10,000 plus customary expenses.

Is this proxy statement the only way that proxies are being solicited?

No. In addition to the solicitation of proxies by use of the mail, officers and employees of the Company, as well as Alliance, the proxy solicitation firm hired by the Company, may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. The fees of Alliance as well as the reimbursement of expenses of Alliance will be borne by the Company. Brokerage houses and other custodians, nominees and fiduciaries, in connection with shares of the common stock registered in their names, will be requested to forward solicitation material to the beneficial owners of shares of common stock.

How can I obtain a copy of Actinium Pharmaceuticals, Inc.’s Annual Report?

This proxy statement and the Annual Report are available for viewing, printing and downloading at www.viewproxy.com/actiniumpharma/2021. To view these materials, please have your 11-digit control number(s) available that appears on your proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

6

Additionally, you can find a copy of our Annual Report, which includes our financial statements, for the fiscal year ended December 31, 2020 on the website of the SEC, at www.sec.gov, or in the “All SEC Filings” section of the “Investors” section of our website at www.actiniumpharma.com. You may also obtain a printed copy of our Annual Report, including our financial statements, free of charge, from us by sending a written request to: Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016, attention: Chief Financial Officer.

What is the voting requirement to elect directors?

Assuming the presence of a quorum, directors are elected by a plurality of the votes cast in person or by proxy at the Annual Meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the Annual Meeting. Abstentions or broker non-votes will not affect the outcome of the election of directors.

What is the voting requirement to approve Proposal 2?

Assuming the presence of a quorum, the proposal to approve the amendment to the 2019 Plan will require approval by a majority of votes cast, with abstentions counting as a vote cast. An abstention is not an “affirmative vote,” but it is considered as a vote cast pursuant to Section 711 of the NYSE American Company Guide. Accordingly, an abstention will have the effect of a vote against Proposal 2. Broker non-votes will have no effect on Proposal 2.

What is the voting requirement to approve Proposal 3?

Assuming the presence of a quorum, the proposal to ratify the appointment of Marcum as our independent registered public accounting firm will be approved if the affirmative vote of a majority of the shares represented in person or by proxy and entitled to vote thereon at the Annual Meeting is obtained. An abstention is not an “affirmative vote,” but an abstaining stockholder is considered “entitled to vote” at the Annual Meeting. Accordingly, an abstention will have the effect of a vote against Proposal 3. Brokers are considered “entitled to vote” because brokers have discretionary voting authority on Proposal 3. Because a broker non-vote is not an “affirmative vote,” a broker non-vote will have the effect of a vote against Proposal 3.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our stockholders with any of the proposals described above to be brought before the Annual Meeting.

How can I communicate with the non-employee directors on the Actinium Pharmaceuticals, Inc. Board of Directors?

Our Board encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of our Chairman and Chief Executive Officer. Stockholders can send communications by mail to:

Sandesh Seth, Chairman and Chief Executive Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th Floor

New York, New York 10016

Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman of the Board or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our Chairman, deals with the functions of our Board or committees thereof or that our Chairman otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board and request copies of any such correspondence.

7

WHO CAN HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by writing, calling or emailing us at:

Steve O’Loughlin

Chief Financial Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th Floor

New York, NY 10016

Email: soloughlin@actiniumpharma.com

Tel: 646-677-3875

8

Board of Directors

The Board oversees our business affairs and monitors the performance of management. In accordance with our corporate governance principles, our Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman and Chief Executive Officer, other key executives, and by reading the reports and other materials that we send them and by participating in Board and committee meetings. Biographical information about our directors is provided in “Directors and Executive Officers” on page 17.

Term of Office

Our directors are divided into three classes, designated Class I, Class II and Class III. Class I consists of two directors, Class II consists of two directors, and Class III consists of one director.

The term of each director is set forth below or until their successors are duly elected:

| Director | Class | Term Expiration | ||

| David Nicholson | Class I | 2023 Annual Meeting | ||

| Richard I Steinhart | Class I | 2023 Annual Meeting | ||

| Sandesh Seth | Class II | 2021 Annual Meeting | ||

| Jeffrey W. Chell | Class II | 2021 Annual Meeting | ||

| Ajit S. Shetty | Class III | 2022 Annual Meeting |

Directors elected at each annual meeting are elected for a three-year term. Notwithstanding the foregoing, each director shall serve until his successor is duly elected and qualified, or until his retirement, death, resignation or removal.

Director Independence

We use the definition of “independence” of the NYSE American stock exchange to make this determination. We are listed on the NYSE American under the symbol “ATNM”. NYSE American corporate governance rule Section 803(A)(2) provides that an “independent director” means a person other than an executive officer or employee of the company. No director qualifies as independent unless the issuer’s board of directors affirmatively determines that the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Under the NYSE American director independence rules, Jeffrey W. Chell, David Nicholson, Ajit S. Shetty, and Richard I. Steinhart are independent directors of the Company.

Board Leadership Structure and Role in Risk Oversight

Our Board currently consists of five directors, and the positions of Chairman of the Board and principal executive officer are filled by Mr. Sandesh Seth, coupled with a lead independent director position to further strengthen the leadership structure. The Board acknowledges that there are different leadership structures that could allow it to effectively oversee the management of the risks relating to the Company’s operations. However, our Board believes that having Mr. Seth as the Chairman of the Board and the Chief Executive Officer provides an efficient and effective leadership model for the Company, as such structure allows our independent directors to share responsibility in leading the Board, while allowing Mr. Seth to focus primarily on managing the operations of Company.

David Nicholson has been serving as our lead independent director (the “Lead Independent Director”) since September 2017. Our Lead Independent Director chairs the executive sessions of our Board meetings; provides feedback to the Chairman and Chief Executive Officer; if appropriate, and in coordination with executive management, is available for consultation and direct communication with major stockholders; and leads the Board’s evaluation of the Chairman and Chief Executive Officer. We have a separate chair for each committee of our Board,

9

all of whom are independent directors. The chairs of each committee report on the activities of their committees in fulfilling their responsibilities at the meetings of our Board.

Our Board is responsible for overseeing the Company’s risk management processes. The Board receives reports from management concerning the Company’s assessment of risks and considers the Company’s risk profile. The Board focus on the most significant risks facing the Company and the Company’s general risk management strategy. In addition, as part of its oversight of our Company’s executive compensation program, the Board considers the impact of such program, and the incentives created by the compensation awards that it administers, on our Company’s risk profile. In addition, the Board, based on the Compensation Committee’s review of all of our compensation policies and procedures, considers the incentives that they create and factors that may reduce the likelihood of excessive risk taking and determines whether they present a significant risk to our Company. The Board has determined that, for all employees, our compensation programs do not encourage excessive risk and instead encourage behaviors that support sustainable value creation.

Board of Directors Meetings and Attendance

During the fiscal year 2020, our Board held fourteen meetings and did not act by unanimous written consent. Each director attended all of the meetings of our Board and of any committees of which he was a member during the year ended December 31, 2020. It is our policy that directors should make every effort to attend the annual meeting of stockholders. At our 2020 Annual Meeting of stockholders, the Company was represented by our Chief Financial Officer and Vice President, Controller with our Chairman and CEO participating by phone and no other directors in attendance.

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. The Code of Business Conduct and Ethics addresses, among other things, competition and fair dealing, conflicts of interest, protection and proper use of Company assets, government relations, compliance with laws, rules and regulations and the process for reporting violations of the Code of Business Conduct and Ethics, employee misconduct, improper conflicts of interest or other violations. A copy of the Code of Business Conduct and Ethics is available on the Investor section of our website at www.actiniumpharma.com. We will post on our website any amendment to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers.

Complaints Regarding Accounting Matters

The Audit Committee has established procedures for:

| ● | the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters; and | |

| ● | the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. |

Communications with Directors

The Board has approved procedures for stockholders to send communications to individual directors or the non-employee directors as a group. Written correspondence should be addressed to the director or directors in care of Sandesh Seth, Chairman and Chief Executive Officer of Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016. Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman and Chief Executive Officer or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, deals with the functions of our Board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board and request copies of any such correspondence. You may also contact individual directors by calling our principal executive offices at (646) 677-3875.

10

Legal Proceedings

There have been no material legal proceedings that would require disclosure under the federal securities laws that are material to an evaluation of the ability or integrity of our directors or executive officers, or in which any director, officer, nominee or principal stockholder, or any affiliate thereof, is a party adverse to us or has a material interest adverse to us.

11

Committees of the Board of Directors

Our Board has formed three standing committees: Audit, Compensation and Corporate Governance. Actions taken by our committees are reported to the full Board. Each of our committees has a charter and each charter is posted on our website.

| Audit Committee | Compensation Committee | Corporate Governance Committee | ||

| Richard I. Steinhart* | David Nicholson* | Ajit S. Shetty* | ||

| Jeffrey W. Chell | Jeffrey W. Chell | David Nicholson | ||

| Ajit S. Shetty | Ajit S. Shetty | Richard I. Steinhart |

| * | Indicates committee chair |

Audit Committee

Our Audit Committee, which currently consists of three directors, provides assistance to our Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, financial reporting, internal control and compliance functions of the Company. The Board has determined that Mr. Steinhart is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K. Our Audit Committee employs an independent registered public accounting firm to audit the financial statements of the Company and perform other assigned duties. Further, our Audit Committee provides general oversight with respect to the accounting principles employed in financial reporting and the adequacy of our internal controls. In discharging its responsibilities, our Audit Committee may rely on the reports, findings and representations of the Company’s auditors, legal counsel, and responsible officers. Our Board has determined that all members of the Audit Committee are financially literate within the meaning of SEC rules and under the current listing standards of the NYSE American. The Audit Committee met four times during 2020. Each member of the Audit Committee was present at all of the Audit Committee meetings held during such director’s tenure as a member of the Audit Committee.

Compensation Committee

Our Compensation Committee, which currently consists of three directors, establishes executive compensation policies consistent with the Company’s objectives and stockholder interests. The Compensation Committee met one time during 2020. Each member of the Compensation Committee was present at the meeting held in 2020. Our Compensation Committee also reviews the performance of our executive officers and establishes, adjusts and awards compensation, including incentive-based compensation, as more fully discussed below. In addition, our Compensation Committee generally is responsible for:

| ● | establishing and periodically reviewing our compensation philosophy and the adequacy of compensation plans and programs for our directors, executive officers and other employees; |

| ● | overseeing our compensation plans, including the establishment of performance goals under the Company’s incentive compensation arrangements and the review of performance against those goals in determining incentive award payouts; |

| ● | overseeing our executive employment contracts, special retirement benefits, severance, change in control arrangements and/or similar plans; |

| ● | acting as administrator of any company stock option plans; and |

| ● | overseeing outside compensation consultants when engaged. |

Our Compensation Committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The Compensation Committee also periodically reports to the Board on how our non-employee director compensation practices compare with those of other similarly situated

12

public corporations and, if the Compensation Committee deems it appropriate, recommends changes to our director compensation practices to our Board for approval.

Outside consulting firms retained by our compensation committee and management also will, if requested, provide assistance to the Compensation Committee in making its compensation-related decisions. We paid consultant fees to StreeterWyatt of $20,000 during the year ended December 31, 2020. We did not pay any compensation consultant or its affiliates in excess of $120,000 during 2020.

Corporate Governance Committee

Corporate Governance Committee, which currently consists of three directors, monitors our corporate governance system. The Corporate Governance Committee met one time during 2020.

Nominating Committee

We do not have a nominating committee or a committee performing similar functions. Our Board does not believe a nominating committee is necessary because Board nominations are selected, or recommended for the Board’s selection, by a majority of the independent directors. Our independent directors include Jeffrey W. Chell, David Nicholson, Richard I. Steinhart and Ajit S. Shetty. These directors are charged with the responsibility of proposing potential director nominees to the Board for consideration. Our independent directors use criteria by which it will seek to evaluate candidates to serve on our Board. The evaluation methodology includes items such as experience in the biotechnology sector, experience with public companies, executive managerial experience, operations and commercial experience, fundraising experience and contacts in the investment banking industry, personal and skill set compatibility with current Board members, industry reputation, knowledge of our company generally, and independence.

Our Board considers all qualified candidates identified by members of the Board, by senior management and by stockholders. The Board follows the same process and uses the same criteria for evaluating candidates proposed by stockholders, members of the Board and members of senior management. We did not pay fees to any third party to assist in the process of identifying or evaluating director candidates.

Our Amended and Restated Bylaws, as amended (the “Bylaws”) contains provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at our annual meetings. To recommend a nominee for election to the Board, a stockholder must submit his or her recommendation to our Secretary at our corporate offices at 275 Madison Avenue, 7th Floor, New York, New York 10016. Such nomination must satisfy the notice, information and consent requirements set forth in our Bylaws and must be received by us prior to the date set forth under “Submission of Future Stockholder Proposals” below. A stockholder’s recommendation must be accompanied by the information with respect to stockholder nominees as specified in our Bylaws, including among other things, the name, age, address and occupation of the recommended person, the proposing stockholder’s name and address, the ownership interests of the proposing stockholder and any beneficial owner on whose behalf the nomination is being made (including the number of shares beneficially owned, any hedging, derivative, short or other economic interests and any rights to vote any shares) and any material monetary or other relationships between the recommended person and the proposing stockholder and/or the beneficial owners, if any, on whose behalf the nomination is being made.

Our approach toward Board diversity takes into consideration the overall composition and diversity of the Board and areas of expertise that director nominees may be able to offer, including business experience, knowledge, abilities, customer relationships and appropriate perspectives on environmental, social and governance matters. Generally, we strive to assemble and maintain a Board that brings to us a variety of perspectives and skills derived from business and professional experience as we may deem are in our and our stockholders’ best interests. In doing so, we also consider candidates with appropriate non-business backgrounds.

13

The following table sets forth the compensation of our non-employee directors for 2020:

| Name | Fees Paid in Cash |

Stock Awards |

Option Awards(1) |

All Other Compensation |

Total | |||||||||||||||

| Jeffrey W. Chell(2) | $ | 51,000 | - | $ | 56,240 | - | $ | 107,240 | ||||||||||||

| David Nicholson | $ | 63,000 | - | $ | 56,240 | - | $ | 119,240 | ||||||||||||

| Ajit S. Shetty | $ | 58,500 | - | $ | 56,240 | - | $ | 114,240 | ||||||||||||

| Richard Steinhart | $ | 63,000 | - | $ | 56,240 | - | $ | 119,240 | ||||||||||||

| (1) | The dollar amounts in this column represent the aggregate grant date fair value of all option awards granted during the indicated year. These amounts have been calculated in accordance with Financial Accounting Standard Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 718, using the Black-Scholes option-pricing model. For a discussion of valuation assumptions, see Note 6 to our financial statements in the Annual Report. |

| (2) | At December 31, 2020, the aggregate number of option awards outstanding for each director was as follows: (i) for Dr. Chell, 21,666, (ii) for Dr. Nicholson, 28,328, (iii) for Dr. Shetty, 21,666, and (iv) for Mr. Steinhart, 26,664. |

Our non-employee directors are paid an annual fee of $40,000 and receive annual option grants. Dr. Nicholson as Lead Director receives an additional annual fee of $10,000. Board committee members receive the following compensation:

| Board Committee | Chairman | Member | ||||||

| Audit | $ | 20,000 | $ | 6,000 | ||||

| Compensation | $ | 10,000 | $ | 5,000 | ||||

| Corporate Governance | $ | 7,500 | $ | 3,000 | ||||

In 2020, we granted each non-employee director options to purchase 8,333 shares of our common stock with an exercise price of $9.55 per share with a term of 10 years. Pursuant to the terms of the 2019 Plan, 2% of the options vest each month from the date of grant.

14

Report of the Audit Committee of the Board of Directors