UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

Actinium Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1 1(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

November 16, 2018

Dear Fellow Shareholders:

It has been a critical year for Actinium as your management team have developed a new strategy and focus for your company. This refocused strategy has been driven in large part by a strengthened leadership team, valuable clinical data and a good deal of foresight.

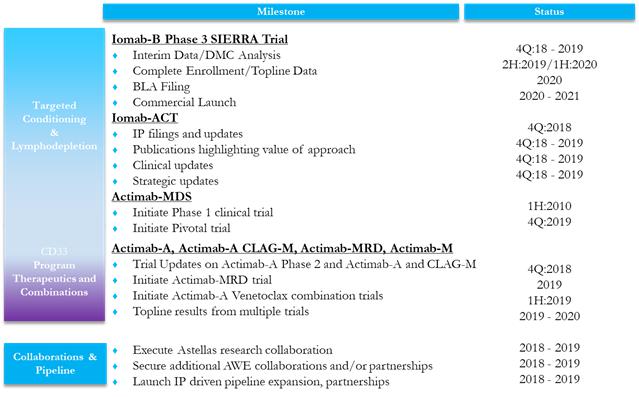

Today, Actinium’s pipeline is refocused on two key areas: first, targeted conditioning prior to adoptive cell therapies such as BMT or bone marrow transplant and CAR-T; and second, on therapeutic combinations with our ARCs or Antibody Radiation Conjugates. We are optimistic that executing toward key milestones across a multi-asset, multi-disease pipeline will provide clinically positive outcomes and yield positive returns for shareholders. We encourage you to read the list of Actinium’s expected milestones in 2019 in Appendix A that have been made possible by our many accomplishments in 2018 which we have highlighted in Appendix B.

We recognize that the SIERRA trial has taken longer than originally expected and understand how this could create angst for our shareholders. We share your frustration and we thank you for your continued support and greatly appreciate your patience. Without appearing sanguine, we believe that the SIERRA trial is on solid footing under a stronger team after we have restructured and rebuilt various aspects of the company, particularly the clinical organization. This has occurred while simultaneously forging ahead on multiple fronts across our pipeline, which has resulted in a much stronger strategic focus for the company in 2018. Let us also take comfort in the heartening interim feasibility and safety data from the Iomab-B SIERRA trial that has been accepted for oral presentation at the American Society of Hematology (ASH) Annual Meeting in early December. Today, we feel confident that we have the right team in place and that the changes we have made were necessary to deliver the positive data we look forward to presenting. Overall, we are proud of our accomplishments in 2018 and are energized by our refocused vision and the opportunities that have been created.

In 2018 we were able to build the leading franchise in targeted conditioning. With our Phase 3 Iomab-B as the foundation, we added two new programs: Iomab-ACT for lymphodepletion prior to CAR-T and near-pivotal Actimab-MDS for conditioning high-risk patients with myelodysplastic syndrome prior to a BMT. These additions afford us a multi-asset, multi-disease pipeline that is unrivalled in the industry. Each of these programs offers the potential to improve patient access and outcomes based on the superior ability of our ARCs to safely and efficiently deliver the appropriate dose of radiation needed to condition the marrow or lymph system compared to chemotherapy. Chemotherapy, which currently is used as the standard of care, has side effects as a result of being non-targeted. These side effects limit both outcomes and eligibility of patients, especially older adults. What is most exciting is that these new programs not only hold the potential to treat a significant unmet medical need in a broad population, but they provide Actinium with the potential for multiple product launches and label expansion initiatives in the two to three years starting in 2020.

At ASH, we will demonstrate that Iomab-B feasibility and safety interim results look very promising during our high-visibility, oral presentation for our Phase 3 SIERRA trial. There are multiple interim milestones for safety and efficacy for Iomab-B through next year, including trial completion. In addition, we are preparing for Actimab-MDS to enter a pivotal trial after a short dose-confirmatory Phase 1 trial planned in 2019. We also have several Iomab-ACT clinical events planned as outlined in our key milestones section in Appendix B. These value creating events also will afford us important opportunities to engage in discussions with various constituencies who can support our goals, including potential collaborators. We believe that the highly differentiated focus of our pipeline, the lack of visible competition, and the high-value potential of our products presents a very real opportunity for Actinium to play a leadership role in addressing this area of high unmet medical need.

The therapeutic combinations approach affords us yet another opportunity to use the potential of our ARCs in combination with other chemotherapeutic or immuno-oncology-based drugs. Examples are the trials we are doing with Actimab-A and the CLAG-M regimen and with the high-profile drug Venclexta or venetoclax. Combination approaches to oncology drug development have are increasingly common, especially with larger companies in the immuno-oncology field. Radiation therapy is used effectively in solid tumors, but it is not a viable option for blood cancers, which are too diffuse to be treated with external radiation that cannot be targeted. Our ARCs have the ability to target the radiation to be delivered in a safe manner. The possibility of adding a highly-effective, potentially synergistic modality such as radiation to immuno-oncology drugs via an ARC, as we have demonstrated pre-clinically with Actimab-A and venetoclax, has the potential to lead to superior combinations and superior outcomes. We look forward to the several data events from our combination trials and other CD33 program expansion trials, and to making our technology and CD33 program available to collaborators as part of our value-creating strategy.

Our new strategy has been enabled in part due to our Antibody Warhead Enabling, or AWE, platform in combination with a revitalized research capability that we built this year at Actinium. As a result, we were able to enter into a collaboration with the Top-20 big-pharma company Astellas. Further, in a few short months, we were able to conduct validating experiments that supported the Iomab-ACT program for CAR-T and combination trials with venetoclax, file the patents to protect these ideas, and make these programs known publicly. As a result of these and other research activities, we will continue to strengthen our leading AWE technology platform and we expect it to be a profit center for the company along with the Iomab-ACT program. Recent strategic activity in the radiopharmaceutical space is contributing to growing recognition and acceptance of the value of targeted radiation among large and medium-sized biopharma companies. Actinium is well positioned to address these needs “in the age of Radiopharma 2.0”. (Please see Appendix C for a list of FAQs that we think put in perspective the rapid pace of Actinium’s accomplishments and the positive impact we anticipate these changes will support).

Certainly, it was no small feat to develop a new strategic focus, launch new clinical trials, advance existing trials toward clinical milestones while simultaneously recruiting for and restructuring our small, 30-person team. Today, we have successfully reinvigorated Actinium’s research team. We also have made advances in securing our intellectual property and have entered into an important and validating collaboration. We are proud that a 30-person company, with a just-in-time, personalized medicine supply chain, can support not only an ongoing Phase 3 trial that is showing great promise, but also several phase 1/proof of concept trials, all boding well for truly transformational results.

Due to our efforts this year, Actinium is well-positioned for an exciting future built on strong science, positive clinical data, and a committed and talented team. We want to reiterate that besides our differentiated focus on targeted conditioning with a multi-asset, late-stage pipeline with visible and promising clinical data, our technological leadership extends to expertise in alpha-radiation with the work we are doing in our Ac-225 isotope program. The scarcity value of independent companies, which is the result of a number of acquisitions in the space, also contributes to a much more attractive profile for our company. These factors are only just becoming apparent to investors and strategic players as we have only recently completed the refocusing and have now begun an extensive and months-long process of educating people about the “new Actinium.” Taking this into account, we are requesting your support for all of our proposals in the proxy card, some of which are being requested to enable the company to be in the best position to protect shareholder interests in the event certain strategic actions occur.

We are pleased to be able to report that progress has been made to set up the pipeline for success with multiple value-generating drivers before year-end, into 2019 and beyond. We thank you for your continued support and belief in our drug candidates, technologies and efforts, and hope you are as excited and optimistic as the team at Actinium is about the year ahead and the longer-term future of your company.

On behalf of Team Actinium.

Respectfully,

Sandesh Seth

Chairman and Chief Executive Officer

Appendix A – Key Milestones for 2019

Appendix B – Key Achievements in 2018

Significantly strengthened our leadership team and capabilities bringing decades of experience to Actinium resulting in a new level of execution across the Company

| - | Enhanced Transplant Expertise to Support Strategic Refocus: Added significant bone marrow transplant expertise to our clinical development team to support our strategic focus in targeted conditioning. This has allowed us to expand and develop a franchise opportunity with three targeted conditioning programs including Iomab-ACT for CAR-T that progressed from conceptualization to launch in less than a year, near-pivotal Actimab-MDS for conditioning high-risk patients with myelodysplastic syndrome prior to a BMT and Phase 3 Iomab-B as the foundation. | |

| - | Strengthened Clinical Operations to Strengthen Trial Execution and Pipeline Expansion: We have made key hires including a head of clinical operations as a new function within Actinium. The strengthened team is dedicated to the efficient, timely and cost-effective execution of our clinical trials and in a short time has developed and is implementing initiatives designed to complete enrollment of the SIERRA trial as quickly as possible. | |

| - | Established Research Team: Reinvigorated our research efforts by establishing a research group. This enabled our work with Ac-225 labeled daratumumab and led to our first publication at AACR and new patent filings that extend our IP portfolio in line with our strategic vision. Our research team is working in alignment with our clinical development team resulting in highly supportive data for our Iomab-ACT program and the Actimab-A plus Venetoclax combination trials. The improved internal alignment also benefits our business development efforts. |

Executed our first AWE platform partnership with Astellas Pharma, Inc., a Top 20 global biopharma company

| - | Validates the utility of our technology platform and its potential value to large biopharma companies as well as our leadership position with the Ac-225 isotope. |

Began a combination trial with Actimab-A and CLAG-M

| - | This trial studies our ARC approach with other modalities, in this case chemotherapy, where we expect to see synergies that can improve patient outcomes. |

Launched the Actimab-A MRD trial for a significant unmet need and potentially large market opportunity

| - | Aligns our clinical development with key advancements in the field as minimal residual disease or MRD is becoming an increasingly important biomarker and emerging endpoint. Success of this trial implies a large market opportunity as frequent dosing of Actimab-A could be required to maintain a disease free or MRD negative AML state. |

Initiated our Iomab-ACT program for targeted lymphodepletion for CAR-T therapies

| - | Builds on our targeted conditioning strategy by leveraging our clinical experience with Iomab-B to position us as a potentially universal solution for targeted lymphodepletion with improved access and outcomes. Actinium is at the forefront with this solution for the large and rapidly growing CAR-T industry. |

Successfully completed the Actimab-A Phase 2 trial as a single agent in a difficult-to-treat patient population with identification of an attractive future development pathway

| - | Strong single agent activity and minimal extramedullary toxicities in the Phase 2 Actimab-A AML trial paved the way for key opinion leaders to support our Actimab-MDS trial for targeted conditioning and our two Actimab-A plus Venetoclax combination trials. This pathway forward differentiates the asset and provides an attractive and high-value route for further development compared to a high-risk, controlled Phase 3 trial for AML patients. |

Announced two clinical trials that will study Actimab-A with Venetoclax, a targeted therapy

| - | Further aligns Actinium with the most recent advancements in the AML field and with the support of thought leading physicians from MD Anderson Cancer Center and UCLA Medical Center. |

Positive outcomes from our interactions with the FDA regarding Actimab-MDS

| - | Resulted in an accelerated regulatory pathway that will now consist of a small dose finding Phase 1 trial before moving to a pivotal trial for our second targeted conditioning indication. Also resulted in a broader patient population than what was proposed to FDA. |

Multiple abstracts accepted at for ASH including the acceptance of preliminary feasibility and safety results of the Iomab-B Phase 3 SIERRA trial for oral presentation

| - | Gives Iomab-B and the ongoing SIERRA trial significant exposure at ASH, the largest blood cancer-focused medical conference in the world, where only approximately 10% of accepted abstracts are elevated to oral presentations. |

Appendix C – FAQ’s or Frequently Asked Questions

How has Actinium transformed itself from a year ago? What is the new focus?

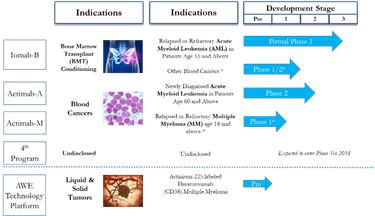

November 2017 Pipeline

At this time last year, we had 3 trials in our pipeline, 1 targeted conditioning trial and 2 single-agent therapeutic trials.

|

♦ Iomab-B was our only targeted conditioning program with the Phase 3 trial in the early stages of enrollment ♦ Our CD33 program had just been expanded to Multiple Myeloma ♦ Early efforts with our AWE platform had been initiated

|

November 2018 Pipeline

Fast forward to today and we are advancing 3 targeted conditioning trials (1 pivotal and 1 near-pivotal) 3 therapeutic combination trials and 2 single-agent therapeutic trials in highly differentiated indications.

|

♦ Targeted conditioning program expanded to 3 trials including Iomab-ACT for CAR-T and near pivotal Actimab-MDS ♦ SIERRA trial reached 25% enrollment with interim data to be presented in oral presentation at ASH ♦ CD33 program expanded to best in class with the largest addressable patient population and breadth of applications ♦ AWE platform validation via our collaboration with Astellas and expanded research efforts

|

We have expanded our pipeline efficiently and cost-effectively by leveraging the strengths of our ARC candidates without undertaking significant de novo development by utilizing our AWE platform and enhanced R&D capabilities to support these new initiatives. Because our CD45 and CD33 targets are applicable to multiple diseases and indications, each of our ARCs become a pipeline within a drug. We believe there is much more still to come. Given our ARC approach, we can utilize a high-dose to facilitate targeted conditioning and low-dose strategy to leverage the proven modality of radiation for novel therapeutic combinations.

Targeted Conditioning Related FAQs

Why Is Targeted Conditioning so attractive?

We focus on targeted conditioning because it enables treatments that are potentially curative in nature, such as BMT and CAR-T, for a significant number of patients with a range of diseases. In advance of BMT or CAR-T, patients must have their bone marrow and immune system conditioned to make room for the new cells. This is done today with non-targeted chemotherapy and external beam radiation. Our targeted conditioning approach delivers potent radiation to specific cells to enable more effective conditioning while at the same time minimizing effects to normal cells with the hopes of having the strongest and healthiest patient prior to their BMT or CAR-T. Our focus on targeted conditioning sets us apart as we believe we are the only company with a multi-disease, multi-target, late-stage pipeline for targeted conditioning. Further, we are not aware of any other company with a focus on targeted conditioning that is as advanced as we are in clinical trials. Our antigen targets CD45 and CD33 are widely expressed in many hematologic indications. We believe there is an opportunity to expand the addressable patient population for our programs. For example, CD45 is expressed on leukemia cells, lymphoma cells and multiple myeloma cells and significant data has been generated in these indications at the Fred Hutchinson Cancer Research Center which we can use for label expansion of Iomab-B. With CD33 we are targeting high-risk MDS patients with the Actimab-MDS program. Because the addressable market for our targeted conditioning drug candidates is limited to 50-100 medical centers that perform a majority of BMT and CAR-T procedures, we believe we have a tremendous opportunity to create a leading, independent organization in this space that has little competition.

What was accomplished via the Iomab-B and the SIERRA Trial? What can we expect in future?

We have strong talent supporting the SIERRA trial. Our team includes a transplant physician who has more than 20 years of clinical experience and a Head of Clinical Operations, a new position, who brings to Actinium more than 25 years of experience. Both of these clinical experts are focused on the trial’s execution and completion. In addition, a third M.D. and a nurse educator who has significant oncology drug experience are focused on providing training and support to trial sites. Finally, we have two clinical research associates dedicated to the operations of the SIERRA trial. Effectively, the clinical team was restructured in April of this year and the average tenure for the team members is seven months. In this short time, this new team has positively impacted execution of the SIERRA trial and we have great confidence in their capabilities.

We expect to achieve the following milestones going forward as indicated in Appendix B and below. We look forward to updating you as each of these milestones is reached and believe the analyzed data at each point will provide many valuable insights into this important trial.

| ● | Enrollment of the 70th patient – an efficacy and safety analysis may occur when the 70th patient reaches the primary endpoint | |

| ● | 50% Enrollment – a DMC safety analysis will occur just like the analysis that occurred after 25% of patients were enrolled | |

| ● | Enrollment of the 110th patient – a second efficacy and safety analysis may occur when the 110th patient reaches the primary endpoint | |

| ● | 75% Enrollment – the third and final safety analysis | |

| ● | Completion of Enrollment – a major milestone in any trial but perhaps more so with SIERRA as it is the only trial focused on targeted conditioning for older patients with active, relapsed or refractory AML. |

What is the value of the Iomab-ACT program?

We believe our Iomab-ACT program has the potential to offer a chemotherapy-free conditioning regimen prior to CAR-T that can effectively achieve lymphodepletion in a single-dose and in an outpatient setting. Current approaches for lymphodepletion rely on chemotherapy, typically the combination of fludarabine and cyclophosphamide or Fly/Cy, which is non-specific, toxic and sub-optimal. We believe that lymphodepletion with the Iomab-ACT construct will result in superior outcomes from CAR-T including improved patient responses and long-term outcomes, increased access to CAR-T and reduced toxicities associated with CAR-T. We believe the Iomab-ACT program can be a universal solution for all CAR-T therapies and a potentially valuable expansion of our targeted conditioning franchise. In addition, the Iomab-ACT program represents the new level of innovation and execution that exists within Actinium as this concept went from ideation to existence in rapid fashion by leveraging the deep clinical experience and data of our CD45 program and the expanded research capabilities of the company. As we have done with all of our latest initiatives, we have generated an intellectual property portfolio which in this case currently encompasses six patents pertaining to the Iomab-ACT program. We are committed to improving patient outcomes and generating value from our Iomab-ACT program in a rapid fashion with this being a top priority for Actinium in 2019.

What is Actimab-MDS expected to add?

We believe it is rare for a 30-person biotech company to have the opportunity to have not just one but two pivotal trials in a field by itself. This is the opportunity created by Actinium in 2018 by adding Actimab-MDS to our clinical pipeline. Just as we did with the Iomab-ACT program where we leveraged our experience with CD45 and Iomab-B, with Actimab-MDS, we leveraged the extensive experience with CD33, the isotope Ac-225 and Actimab-A to develop this exciting opportunity.

The vision that brought the Actimab-MDS into a clinical trial was the result of our team and our collaborators’ ability to take the seeming limitation of Actimab-A - namely prolonged myelosuppression - and consider the possibility that it could be a useful attribute in a setting in which myelosuppression is not a limitation but a desired outcome. This was in the context of using highly myelosuppressive doses of the construct to myeloablate or “burn out” the bone marrow prior to a bone marrow transplant. A great deal of credit is due to Dr. Gail Roboz, Director of Leukemia at Weill-Cornell Medical Center, who conceptualized the idea after serving as an investigator in our Actimab-A Phase 2 trial. This trial enrolled patients whose MDS had progressed to AML. As we have reported, Actimab-A had potent myelosuppression capabilities with minimal toxicities outside of the bone marrow. Recognizing that a bone marrow transplant is the only potentially curative treatment option for patients with high-risk MDS and that myelosuppression can be alleviated with a bone marrow transplant, the decision to advance this trial was made.

Having been guided toward a significantly faster regulatory pathway by the FDA than we had originally expected, we plan to conduct a pivotal trial after completing a small Phase 1 trial to confirm the myeloablative dose. Originally, we had proposed a 60-80 patient Phase 2 trial that would then be followed by a pivotal trial. Also, we had originally proposed a patient population limited to only those patients with a specific mutation to the TP53 gene, but the FDA guided that we should expand the addressable patient population to intermediate and high-risk MDS patients. In 2019, we look forward to working with Dr. Roboz and her colleagues from the MDS Clinical Research Consortium to complete the Phase 1 trial, with the goal of moving toward Actinium’s second pivotal trial.

Actimab-A AML Phase 2 Trial and CD33 Program Questions

What did the Actimab-A Phase 2 trial in AML yield? What happens next?

We are excited that the Actimab-A Phase 2 AML trial demonstrated the potent single-agent activity of the Ac-225 – lintuzumab targeting agent. However, in the older unfit patient population enrolled in the Phase 2 trial, myelosuppression proved challenging. Rather than move ahead into a large, lengthy and expensive Phase 3 trial in the increasingly crowded field of AML therapies, we made the decision to follow the signals the drug candidate was giving us and move into what we believe to be more attractive opportunities with this agent at different doses in targeted conditioning and in combination with other drugs. This decision led to our Actimab-MDS trial giving us our second targeted conditioning asset. Actimab-MDS will utilize a high dose of the Ac-225 – lintuzumab construct to achieve effective myeloablation for high-risk MDS patients prior to a bone marrow transplant.

At a lower dose of the construct, we see the opportunity to use Actimab-A in combination with chemotherapies, targeted therapies and immunotherapies. We have already begun executing on this strategy with our three exciting combination trials. As a result, we have aligned Actinium with targeted therapies that will allow us to generate additional data that could prove valuable to potential partners. We have seen increased activity in targeted radiation both in terms of company acquisitions and research publication volume that we believe is creating a ground swell of interest for this approach amongst the industry. We believe we are solidly positioned at this opportune time given the breadth of our pipeline, versatility of our platform and strong IP portfolio.

What is the attractiveness of combinations? Why does the industry care?

Therapies based on the combination of two or more agents have long been used in the treatment of patients with cancer with the goal that a synergistic effect would emerge and the use of combination therapies continues to grow rapidly. Our ARC drug candidates utilize the power of radiation, which is a proven therapeutic modality that is used to treat more than half of all cancer patients. However, we harness the powers of radiation inside the body in a targeted manner, thereby eliminating the side effects that come with delivering radiation to cancer cells from outside the body. It has been demonstrated that radiation causes cancer cell DNA and a tumor’s microenvironment to work in synergy with other agents. We believe better outcomes are possible through Ac-225 – Lintuzumab in certain cancers cells that express the CD33 antigen because it delivers radiation in a way no other drug candidate can to these cancer cells that are radiation sensitive. This is the basis for our combination trials with Venetoclax and CLAG-M, both of which are grounded in strong scientific rationales as well as preclinical and clinical data.

We feel that demonstrating the synergy of our ARCs with other therapeutic modalities will increase their attractiveness to potential partners. For instance, if we could demonstrate that Ac-225 can make cancer cells and or tumors “hot,” that is to say more noticeable to the immune system, we believe that would be of interest to the large universe of big pharma companies that have strong immuno-oncology franchises.

How do you support your claim that you have a CD33 Program that is best in class? What can we expect from this program?

The CD33 field is largely dominated by big pharma and biotech companies that are partnered with larger biopharma firms. These companies are focused on AML and employ antibody drug conjugate, bispecific antibody and naked antibody approaches. Actinium is the only company utilizing an antibody radiation conjugate.

CD33 AML Programs

Through our ARC approach we have expanded our CD33 program from a single trial in AML to now six trials that are ongoing or planned for 2019. Our ARC technology allows us to move into indications that other CD33 program sponsors have not been able to address because of the inherent limitations of their technological approaches. We believe our CD33 program is best in class because it not only addresses three diseases; AML, MDS and Multiple Myeloma, which is the broadest in scope compared to competing CD33 focused programs and provides for the largest addressable patient population or market opportunity. Further, it is the only CD33 program for patients with Multiple Myeloma and the only CD33 program for targeted conditioning.

Actinium’s Multi-Disease, Multi-Indication CD33 Program

Given our extensive experience and clinical data from our CD33 program, we believe this can be leveraged to move into new indications and start new trials in a cost-effective manner without having to fund de novo development. We will continue to identify applications and indications for our CD33 program that build on its best-in-class profile. Given that our CD33 program is the most advanced and has the broadest scope, companies seeking to enter this area may find our program very attractive. Further, our focus on therapeutic combinations allows us to engage with potential partners who are interested in the radiation modality for combinations with their therapeutic modalities, which we believe can leveraged strategically to drive value.

How does the AWE Platform add value?

Our AWE platform is an engine that can drive growth in our pipeline as well as collaborations and partnerships. We view the AWE platform as an immensely valuable asset that is now being leveraged properly under the stewardship of our dedicated, talented and experienced research team. Our AWE platform underpins our clinical programs and is supported by extensive preclinical data, clinical data and 75 patents. We will continue to build our intellectual property portfolio to further bolster AWE’s profile as we seek to monetize it.

We believe AWE can drive partnerships in numerous ways including our biobetter strategy. This strategy takes an established biologic drug and using a radioisotope like Ac-255, we demonstrate enhanced potency, efficacy or improved administration. We demonstrated this with our work labeling daratumumab, the blockbuster CD38 antibody therapy for multiple myeloma that is marketed as Darzalex by Johnson & Johnson. In this case, we were able to increase cell killing and demonstrate efficacy on cell lines that displayed resistance to unlabeled daratumumab.

Another approach is to find antibodies or other targeting agents that are no longer being pursued by their pharma or biotech sponsor and reinvigorate them given that ARC’s cell killing capabilities, which are not dependent on genetic factors, high antigen density, and do not require internalization of the target. These attributes are major differentiators from other modalities like antibody drug conjugates or ADCs. Finally, we can work with collaborators to research our radioisotope-based warhead payloads in conjunction with novel targeting agents. We have already established a track record in this regard through our research collaboration with Astellas that resulted in non-dilutive capital from Astellas and ongoing funding.

Why do you say the Astellas transaction was “particularly validating”?

The decision by Astellas to collaborate with Actinium is the first instance of corporate validation of our alpha platform technology. We are very pleased and honored to work with a leading innovator and science-driven company like Astellas. Astellas had previously prioritized ADC or Antibody Drug Conjugate technology with its purchase of Agensys Inc. for over $400MM. Subsequently, Astellas appears to have disinvested in this approach and has announced a wind-down of this effort. We believe that the decision to pursue an ARC development approach by a knowledgeable company like Astellas who certainly has considerable experience with alternative ADC technology is a tacit acknowledgement of the inherent advantages of ARC technology as a targeting agent. Further, the selection of Actinium by such an experienced player is a testimony to our AWE platform for sure but also our research capabilities and due to our not being a part of a larger company. Other factors that were considerations in selection of Actinium that will be relevant for future AWE partnerships are the clinical validation of the safety and efficacy of our linker technology and our years of experience in handling the isotope Ac-225 and the patent portfolio surrounding it. Further, we believe that our stage-appropriate supply chain, which has the demonstrated capability of manufacturing and supplying radiolabeled drug to top cancer centers across the U.S. is a major point of differentiation for Actinium and will be a consideration for most partners unless they wish to invest years and millions of dollars to acquire such a capability.

How is the R back in R&D at Actinium? What can we expect going forward?

Prior to the last 12 months, Actinium’s efforts focused largely on clinical development of existing trials. In 2018, with our renewed focus on research we have generated new IP, demonstrated the utility of our AWE platform, signed our first collaboration with a top 20 pharma company, supported the launch of Iomab-ACT and supported our Actimab-A and Venetoclax combination trials.

We believe that our platform has immense potential for liquid and solid tumors with the flexibility to attenuate our dose for desired outcomes like our high-dose myeloablation/low-dose lymphodepletion strategy with Iomab. We will continue to explore new indications for our existing focus on CD45 and CD33 and CD38 targets, file new IP and work towards additional collaborations and partnerships.

We have heard the phrase “it is the age of Radiopharma 2.0 now” being used recently? Please explain and what does it mean for Actinium?

In the last 12 months alone, we have seen two multi-billion-dollar acquisitions of companies with radiopharmaceutical-based therapies. The first being Advanced Accelerator Applications, Inc., acquired by Novartis for $3.9 billion and the most recent being Endocyte, also acquired by Novartis, for $2.1 billion. These follow Algeta that was acquired by Bayer in 2013 for $2.9 billion. There are also a growing number of publications demonstrating the utility of radiotherapy in combination with other modalities which is creating further interest in this technology.

As a result of these acquisitions, there are just a few unpartnered radiopharmaceutical therapies remaining, creating a scarcity of assets in the field. From our assessment of the landscape, we believe we have the broadest, most late-stage pipeline which addresses a large patient population with unmet or underserved needs. Iomab-B, Actimab-MDS and the Iomab-ACT program provide Actinium the only multi-disease, multi-target pipeline for targeted conditioning that is intended to improve access and outcomes to potentially curative cellular therapies such as bone marrow transplant and CAR-T.

We believe that our targeted conditioning pipeline allows Actinium a viable pathway to commercialize these drug candidates as an independent company and without a partner. However, we also recognize that at the right time our pipeline may be recognized as a strategic business unit opportunity for a strategic partner. Further, our best in class CD33 therapeutics program which will also have multiple data readouts in the 2019-2020 timeframe may further increase attractiveness as a partner for larger companies seeking a revenue base with differentiated assets which we have in plenty along with our AWE platform which can generate further opportunities.

TABLE OF CONTENTS

| Page | |

| General | 1 |

| Questions and Answers | 1 |

| Who Can Help Answer Your Questions? | 5 |

| Corporate Governance | 5 |

| Board Committees | 7 |

| Director Compensation | 9 |

| Audit Committee Report | 9 |

| Compensation Committee Report | 11 |

| Directors and Executive Officers | 15 |

| Executive Compensation | 20 |

| Principal Stockholders | 27 |

| Certain Relationships and Related Transactions | 29 |

| Proposal 1 — Election of Directors | 29 |

| Proposal 2 — Ratification of the Appointment of Marcum LLP | 31 |

| Proposal 3: To approve an amendment to the Actinium Pharmaceuticals, Inc. 2013 Amended and Restated Stock Plan, as amended, to increase the shares of our common stock available for issuance thereunder by 5 million shares to support planned hiring efforts as the company grows | 32 |

| Proposal 4: To approve an amendment to our Certificate of Incorporation to increase the number of shares of common stock, par value $0.001 per share, the corporation is authorized to issue by 200,000,000 shares | 36 |

| Other Matters | 38 |

| Annual Report on Form 10-K | 38 |

| Householding of Proxy Materials | 38 |

| Electronic Delivery of Company Stockholder Communications | 38 |

| Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on December 18, 2018 | 39 |

| Proposals of Stockholders | 39 |

| Where You Can Find More Information | 39 |

Stockholders Should Read the Entire Proxy Statement Carefully Prior to Returning Their Proxies

i

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors of Actinium Pharmaceuticals, Inc. for use at our annual meeting of stockholders to be held at The Garden City Hotel, 45 Seventh St, Garden City, NY 11530 on December 18, 2018 at 9:30 a.m. Eastern Standard Time. Voting materials, including this proxy statement and proxy card, are expected to be first delivered to all or our stockholders on or about November 8, 2018.

QUESTIONS AND ANSWERS

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

What may I vote on at the annual meeting?

At the annual meeting, stockholders will consider and vote upon the following matters:

Proposal 1: To elect Sandesh Seth and Jeffrey W. Chell, M.D. as Class II directors to serve for a three-year term that expires at the 2021 Annual Meeting of Stockholders, or until his successor is elected and qualified or until his earlier resignation or removal; and

Proposal 2: To ratify the appointment of Marcum LLP as our independent registered public accounting firm; and

Proposal 3: To approve an amendment to our Actinium Pharmaceuticals, Inc. 2013 Amended and Restated Stock Plan, as amended, to increase the shares of our common stock available for issuance thereunder by 5 million shares, to support planned hiring efforts as our company grows; and

Proposal 4: To approve an amendment to our Certificate of Incorporation to increase the number of common stock, par value $0.001 per share, we are authorized to issue by 200,000,000 shares; and

To consider and act upon any other business as may properly come before the annual meeting or any adjournments thereof.

How does the Board of Directors recommend that I vote on the proposals?

Our Board unanimously recommends that the stockholders vote “FOR” all proposals being put before our stockholders at the Meeting.

How do I vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card applicable to your class of stock, or your “proxies,” will vote your shares in the manner you indicate. You may specify whether your shares: should be voted for or withheld for the nominee for director; should be voted for, against or abstained with respect to the ratification of the appointment of the Company’s independent registered public accounts; should be voted for, against or abstained with respect to approving an amendment to our Actinium Pharmaceuticals, Inc. 2013 Amended and Restated Stock Plan, as amended; and should be voted for, against or abstained with respect to approving an amendment to our Certificate of Incorporation to increase the number of common shares we are authorized to issue to 600,000,000 shares. Voting by proxy will not affect your right to attend the annual meeting. If your shares are registered directly in your name through our transfer agent, Action Stock Transfer Corporation, or you have stock certificates registered in your name, you may submit a proxy to vote:

By Internet or by telephone. Follow the instructions attached to the proxy card to submit a proxy to vote by Internet or telephone.

| 1 |

By mail. If you received one or more proxy cards by mail, you can vote by mail by completing, signing, dating and returning the enclosed proxy card applicable to your class of stock in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors.

In person at the meeting. If you attend the annual meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the annual meeting. You are required to register in advance of the annual meeting if you plan to attend the annual meeting in person. If you wish to register in advance of the annual meeting, please contact our investor relations office by no later than December 11, 2018, by e-mail to soloughlin@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

Telephone and Internet voting facilities for all stockholders of record will be available 24-hours a day and will close at 11:59 p.m., Eastern Standard Time, on December 17, 2018.

If your shares are held in “street name” (held in the name of a bank, broker or other nominee who is the holder of record), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

By Internet or by telephone. Follow the instructions you receive from the record holder to vote by Internet or telephone.

By mail. You should receive instructions from the record holder explaining how to vote your shares.

In person at the meeting. Contact the broker, bank or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the annual meeting. You will not be able to vote at the annual meeting unless you have a proxy card from your broker, bank or other nominee.

What happens if additional matters are presented at the annual meeting?

Other than the election of directors, the ratification of the appointment of our auditor, the amendment of our stock plan to increase the number of shares that may be granted under the plan, and approving an amendment to our certificate of incorporation to increase our authorized shares, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder, Sandesh Seth, our Chairman and Chief Executive Officer, or CEO, will have the discretion to vote your shares on any additional matters properly presented for a vote at the annual meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board of Directors, or Board, on all matters and as the proxy holder may determine in his discretion with respect to any other matters properly presented for a vote before the annual meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters. For example, Proposal 2 — ratification of the appointment of Marcum LLP as our independent registered public accounting firm, and Proposal 4 — the amendment to our certificate of incorporation to increase our authorized shares, are considered routine matters, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposals 2 and 4. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 — the election of Sandesh Seth and Jeffrey W. Chell, M.D. as members to our Board, and Proposal 3 — the increase in shares of our stock plan. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

| 2 |

What is the quorum requirement for the annual meeting?

On October 24, 2018, the Record Date for determining which stockholders are entitled to vote, there were 114,698,044 shares of our common stock outstanding, which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted to a vote of our stockholders. Thirty Four percent (34%) of our outstanding common shares as of the Record Date must be present at the annual meeting (in person or represented by proxy) in order to hold the meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the annual meeting, if you are present and vote in person at the meeting or have properly submitted a proxy card or voted by fax, by phone or by using the Internet.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may do this by signing a new proxy card with a later date, by voting on a later date by using the Internet (only your latest Internet proxy submitted prior to the annual meeting will be counted), or by attending the annual meeting and voting in person. However, your attendance at the annual meeting will not automatically revoke your proxy unless you vote at the annual meeting or specifically request in writing that your prior proxy be revoked.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except:

as necessary to meet applicable legal requirements;

to allow for the tabulation of votes and certification of the vote; and

to facilitate a successful proxy solicitation.

Any written comments that a stockholder might include on the proxy card will be forwarded to our management.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by our Inspector of Elections and reported in a Current Report on Form 8-K which we will file with the Securities and Exchange Commission, or SEC, within four business days of the date of the annual meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one Actinium Pharmaceuticals, Inc. stock account, we are delivering only one Notice to certain stockholders who share an address, unless otherwise requested. If you share an address with another stockholder and have received only one Notice, you may write or call us to request to receive a separate Notice. Similarly, if you share an address with another stockholder and have received multiple copies of the Notice, you may write or call us at the address and phone number below to request delivery of a single copy of this Notice. For future annual meetings, you may request separate Notices, or request that we send only one Notice to you if you are receiving multiple copies, by writing or calling us at:

Actinium Pharmaceuticals, Inc.

Attention: Steve O’Loughlin, Principal Financial Officer

275 Madison Avenue, 7th Floor

New York, New York 10016

Tel: (646) 677-3875

| 3 |

Who pays for the cost of this proxy solicitation?

We will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally, electronically or by telephone.

How can I obtain a copy of Actinium Pharmaceuticals, Inc.’s 2017 Annual Report on Form 10-K?

This proxy statement and our 2017 annual report to stockholders are available for viewing, printing and downloading at www.proxyvote.com. To view these materials, please have your 12-digit control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2017 on the website of the SEC, at www.sec.gov, or in the “All SEC Filings” section of the “Investors” section of our website at www.actiniumpharma.com. You may also obtain a printed copy of our Annual Report on Form 10-K including our financial statements, free of charge, from us by sending a written request to: Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016, attention: Principal Financial Officer.

What is the voting requirement to elect directors?

Directors are elected by a plurality of the votes cast in person or by proxy at the annual meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the meeting. Broker non-votes will not affect the outcome of the election of directors because brokers do not have discretion to cast votes on this proposal without instruction from the beneficial owner of the shares.

What is the voting requirement to approve the other three proposals?

The proposal to ratify the appointment of Marcum LLP as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The proposal to approve an amendment to our 2013 stock plan to increase the shares authorized under the plan will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The proposal to amend the charter to increase the authorized shares of the company will be approved if at least 50% of the issued and outstanding shares votes “FOR” the proposal and this exceeds those cast against the proposal.

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the annual meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the annual meeting.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our shareholders with any of the proposals described above to be brought before the annual meeting of shareholders.

How can I communicate with the non-employee directors on the Actinium Pharmaceuticals, Inc. Board of Directors?

Our Board encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of our Chairman and CEO. Stockholders can send communications by mail to:

Sandesh Seth, Chairman and Chief Executive

Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th Floor

New York, New York 10016

Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman of the Board or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our chairman, deals with the functions of our Board or committees thereof or that our chairman otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board and request copies of any such correspondence.

| 4 |

WHO CAN HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by writing, calling or emailing us at:

Steve O’Loughlin

Principal Financial Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th Floor

New York, NY 10016

Email: soloughlin@actiniumpharma.com

Tel: 646-677-3875

CORPORATE GOVERNANCE

Board of Directors

The Board of Directors oversees our business affairs and monitors the performance of management. In accordance with our corporate governance principles, our Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman and CEO, other key executives, and by reading the reports and other materials that we send them and by participating in Board and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve in the capacity of director. Biographical information about our directors is provided in “Election of Directors — Proposal No. 1” on page 29.

Term of Office

Our directors are divided into three classes, designated Class I, Class II and Class III. Class I shall consists of two directors, Class II shall consists of two directors, and Class III consists of one director.

The term of each director is set forth below or until their successors are duly elected:

| Director | Class | Term (from 2018 Annual Meeting, if elected) | ||

| David Nicholson | Class I | 2 years | ||

| Richard I Steinhart | Class I | 2 years | ||

| Sandesh Seth | Class II | 3 years | ||

| Jeffrey W. Chell | Class II | 3 years | ||

| Ajit S. Shetty | Class III | 1 year |

Notwithstanding the foregoing, each director shall serve until his successor is duly elected and qualified, or until his retirement, death, resignation or removal. In order to implement a classified board of directors, Class I serves a two year term from the date of the 2018 Annual Shareholders Meeting; Class II serves a three year term from the date of the 2018 Annual Shareholders Meeting; and Class III serves a one year term from the date the date of the 2018 Annual Shareholders Meeting. Directors elected at each annual meeting are elected for a three year term.

Director Independence

We use the definition of “independence” of the NYSE American stock exchange to make this determination. We are listed on the NYSE American under the symbol “ATNM”. NYSE MKT corporate governance rule Sec. 803(A)(2) provides that an “independent director” means a person other than an executive officer or employee of the company. No director qualifies as independent unless the issuer’s board of directors affirmatively determines that the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The following is a non-exclusive list of persons who shall not be considered independent under NYSE American rules:

a director who is, or during the past three years was, employed by the company, other than prior employment as an interim executive officer (provided the interim employment did not last longer than one year);

| 5 |

a director who accepted or has an immediate family member who accepted any compensation from the company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than the following:

| (i) | compensation for board or board committee service; |

| (ii) | compensation paid to an immediate family member who is an employee (other than an executive officer) of the company, |

| (iii) | compensation received for former service as an interim executive officer (provided the interim employment did not last longer than one year); or |

| (iv) | benefits under a tax-qualified retirement plan, or non-discretionary compensation; |

a director who is an immediate family member of an individual who is, or at any time during the past three years was, employed by the company as an executive officer;

a director who is, or has an immediate family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the company made, or from which the company received, payments (other than those arising solely from investments in the company’s securities or payments under non-discretionary charitable contribution matching programs) that exceed 5% of the organization’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years;

a director who is, or has an immediate family member who is, employed as an executive officer of another entity where at any time during the most recent three fiscal years any of the issuer’s executive officers serve on the compensation committee of such other entity; or

a director who is, or has an immediate family member who is, a current partner of the company’s outside auditor, or was a partner or employee of the company’s outside auditor who worked on the company’s audit at any time during any of the past three years.

Under the above-mentioned NYSE American director independence rules, Jeffrey W. Chell, David Nicholson, Ajit S. Shetty, and Richard I. Steinhart are independent directors of the Company.

Board Leadership Structure

In October 2013, Sandesh Seth was appointed Chairman of our Board of Directors and in June 2017 Mr. Seth was named Chief Executive Officer of the Company. In September 2017, David Nicholson was appointed lead independent director of our board of directors (“Lead Independent Director”). Our Lead Independent Director chairs the executive sessions of our board of director meetings; provides feedback to the Chairman and CEO; if appropriate, and in coordination with executive management, be available for consultation and direct communication with major shareholders; and leads the board’s evaluation of the Chairman and CEO. We have a separate chair for each committee of our board of directors, all of whom are independent directors. The chairs of each committee report on the activities of their committees in fulfilling their responsibilities at the meetings of our board of directors.

Board of Directors Meetings and Attendance

During the fiscal year 2017, our Board held 15 meetings. No director attended fewer than 93% of the total number of meetings of our Board and of any committees of which he was a member during the year ended December 31, 2017. It is our policy that directors should make every effort to attend the annual meeting of stockholders, and each of our directors attended the annual meeting of stockholders in 2017.

| 6 |

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. A copy of the Code of Business Conduct and Ethics is available on the Investor section of our website at www.actiniumpharma.com. We will post on our website any amendment to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers.

Complaints Regarding Accounting Matters

The Audit Committee has established procedures for:

the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters; and

the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Communications with Directors

The Board of Directors has approved procedures for stockholders to send communications to individual directors or the non-employee directors as a group. Written correspondence should be addressed to the director or directors in care of Sandesh Seth, Chairman and CEO of Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016. Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman and CEO or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, deals with the functions of our Board of Directors or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board of Directors and request copies of any such correspondence. You may also contact individual directors by calling our principal executive offices at (646) 677-3875.

Legal Proceedings

There are no legal proceedings to which any director, director nominee or officer of our company, any owner of record or beneficially of more than 5% of common stock, or any associate of any such director, director nominee, officer of our company or major security holder is a party in legal proceedings adverse to our company or has a material interest adverse to us.

Compliance With Section 16(a) of the Exchange Act

Based solely upon a review of copies of such forms filed on Forms 3, 4, and 5, and amendments thereto furnished to us we believe that as of the date of this proxy, our executive officers, directors and greater than 10 percent beneficial owners have complied on a timely basis with all Section 16(a) filing requirements, with the exception of a Form 4 filed by Dr. Berger on March 19, 2018 for a transaction on March 6, 2018.

BOARD COMMITTEES

Committees of the Board of Directors

Our Board of Directors has formed three standing committees: audit, compensation and corporate governance. Actions taken by our committees are reported to the full board. Each of our committees has a charter and each charter is posted on our website.

| Audit Committee | Compensation Committee | Corporate Governance Committee | ||

| Richard I. Steinhart* | David Nicholson* | Ajit S. Shetty* | ||

| Jeffrey W. Chell | Jeffrey W. Chell | David Nicholson | ||

| Ajit S. Shetty | Ajit S. Shetty | Richard I. Steinhart |

| * | Indicates committee chair |

| 7 |

Audit Committee

Our audit committee, which currently consists of three directors, provides assistance to our board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, financial reporting, internal control and compliance functions of the company. Our audit committee employs an independent registered public accounting firm to audit the financial statements of the company and perform other assigned duties. Further, our audit committee provides general oversight with respect to the accounting principles employed in financial reporting and the adequacy of our internal controls. In discharging its responsibilities, our audit committee may rely on the reports, findings and representations of the company’s auditors, legal counsel, and responsible officers. Our board has determined that all members of the audit committee are financially literate within the meaning of SEC rules and under the current listing standards of the NYSE MKT. Richard I. Steinhart is the chairman of the audit committee. Our audit committee met four times during the year ended December 31, 2017.

Compensation Committee

Our compensation committee, which currently consists of three directors, establishes executive compensation policies consistent with the company’s objectives and stockholder interests. Our compensation committee also reviews the performance of our executive officers and establishes, adjusts and awards compensation, including incentive-based compensation, as more fully discussed below. Our compensation committee met two times during the year ended December 31, 2017.

In addition, our compensation committee generally is responsible for:

establishing and periodically reviewing our compensation philosophy and the adequacy of compensation plans and programs for our directors, executive officers and other employees;

overseeing our compensation plans, including the establishment of performance goals under the company’s incentive compensation arrangements and the review of performance against those goals in determining incentive award payouts;

overseeing our executive employment contracts, special retirement benefits, severance, change in control arrangements and/or similar plans;

acting as administrator of any company stock option plans; and

overseeing the outside consultant, if any, engaged by the compensation committee.

Our compensation committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The compensation committee also periodically reports to the board on how our non-employee director compensation practices compare with those of other similarly situated public corporations and, if the compensation committee deems it appropriate, recommends changes to our director compensation practices to our board for approval.

Outside consulting firms retained by our compensation committee and management also will, if requested, provide assistance to the compensation committee in making its compensation-related decisions.

Corporate Governance Committee

Our corporate governance committee, which currently consists of three directors, monitors our corporate governance system. Our corporate governance committee met two times during the year ended December 31, 2017.

Nomination of Directors

Board of Director nominations are selected, or recommended for our Board’s selection, by a majority of the independent directors. Our independent directors include Jeffrey W. Chell, David Nicholson, Ajit S. Shetty and Richard I. Steinhart. These directors are charged with the responsibility of proposing potential director nominees to the board of directors for consideration. All of our independent directors are independent directors as defined by the rules of the NYSE MKT. Our independent directors use criteria by which they will seek to evaluate candidates to serve on our Board. The evaluation methodology includes items such as experience in the biotechnology sector, experience with public companies, executive managerial experience, operations and commercial experience, fundraising experience and contacts in the investment banking industry, personal and skill set compatibility with current board members, industry reputation, knowledge of our company generally, and independence.

| 8 |

DIRECTOR COMPENSATION

The following table sets forth the compensation of our non-employee directors for the 2017 fiscal year:

| Name | Fees Earned or Paid in Cash | Stock Awards | Option (1) | All Other Compensation | Total | |||||||||||||||

| David Nicholson (2) | $ | 59,000 | - | 73,430 | - | $ | 132,430 | |||||||||||||

| Ajit J. Shetty (3) | 39,694 | - | 82,903 | - | $ | 122,597 | ||||||||||||||

| Richard Steinhart | $ | 63,000 | - | 73,430 | - | $ | 136,430 | |||||||||||||

| Sergio Traversa (4) | $ | 58,500 | - | 73,430 | - | $ | 131,930 | |||||||||||||

| (1) | At the end of fiscal year 2017, the aggregate number of option awards outstanding for each director was as follows: (i) for Dr. Nicholson, 274,900, (ii) for Dr. Shetty, 75,000, (iii) for Mr. Steinhart, 224,950, and (iv) for Mr. Traversa, 172,950. |

| (2) | Mr. Nicholson was named Lead Director in September 2017 and receives an additional $10,000 per year for his role as Lead Director. |

| (3) | Dr. Shetty was appointed a director on March 28, 2017. |

| (4) | Mr. Traversa resigned from the company on June 6, 2017. |

In accordance with SEC rules, the amounts shown reflect the aggregate grant date fair value of option awards granted to Non-Employee Directors during 2017, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718.

Our non-employee directors are paid an annual fee of $40,000 and receive annual option grants. Board committee members will receive the following compensation:

| BOD Committee | Chairman | Member | ||||||

| Audit | $ | 20,000 | $ | 6,000 | ||||

| Compensation | $ | 10,000 | $ | 5,000 | ||||

| Corporate Governance | $ | 7,500 | $ | 3,000 | ||||

AUDIT COMMITTEE REPORT

Report of the Audit Committee of the Board of Directors

The Audit Committee provides assistance to the Board of Directors in fulfilling its oversight responsibilities relating to our corporate accounting and reporting practices toward assurance of the quality and integrity of our consolidated financial statements. The purpose of the Audit Committee is to serve as an independent and objective party to monitor our financial reporting process and internal control system; oversee, review and appraise the audit activities of our independent registered public accounting firm and internal auditing function, maintain complete, objective and open communication between the Board of Directors, the independent accountants, financial management and the internal audit function.

Our independent registered public accounting firm reports directly to the Audit Committee and the Audit Committee is solely responsible to appoint or replace our independent registered public accounting firm and to assure its independence and to provide oversight and supervision thereof. The Audit Committee determines compensation of the independent registered public accounting firm and has established a policy for approval of non-audit related engagements awarded to the independent registered public accounting firm. Such engagements must not impair the independence of the registered public accounting firm with respect to our company as prescribed by the Sarbanes-Oxley Act of 2002; thus payment amounts are limited and non-audit related engagements must be approved in advance by the Audit Committee. The Audit Committee determines the extent of funding that we must provide to the Audit Committee to carry out its duties and has determined that such amounts were sufficient in 2017.

| 9 |

With respect to the fiscal year ended December 31, 2017, in addition to its other work, the Audit Committee:

Reviewed and discussed with management our audited consolidated financial statements as of December 31, 2017 and for the year then ended; and

Discussed with GBH CPAs, PC the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as amended, with respect to its review of the findings of the independent registered public accounting firm during its examination of our financial statements.

The Audit Committee recommended, based on the review and discussion summarized above, that the Board of Directors include the 2017 audited consolidated financial statements in the 2017 Form 10-K for the fiscal year ended December 31, 2017 for filing with the SEC.

| Audit Committee of the Board of Directors of Actinium Pharmaceuticals, Inc. | ||

Richard I. Steinhart, Chairman Jeffrey W. Chell Ajit S. Shetty | ||

Information About Our Auditors

Our Audit Committee of our Board appointed GBH CPAs, PC as the independent registered public accounting firm to conduct the audit of our consolidated financial statements for the 2017 fiscal year and to report on our consolidated balance sheets, statements of income and other related statements. GBH CPAs, PC served as our independent registered public accounting firm since December 2012. In August 2018, we appointed Marcum LLP as our independent registered public accounting firm due to a merger between GBH CPAs, PC and Marcum LLP. The Audit Committee Charter includes the procedures for pre-approval of all fees charged by our independent registered public accounting firm. Under the procedure, our Audit Committee approves the engagement letter with respect to audit and review services. Other fees are subject to pre-approval by our Audit Committee. The audit and audit-related fees paid to the auditors with respect to the 2017 fiscal year were pre-approved by our Audit Committee.

Fees and Services

The aggregate fees billed for the fiscal years ended December 31, 2017 and 2016, respectively, for professional services rendered by GBH CPAs, PC for the audits of the Company’s annual financial statements included in Form 10-K, or Audit Fees, tax compliance, advice, and planning, or Tax Fees, and all other fees:

| Year Ended December 31, 2017 | Year Ended December 31, 2016 | |||||||

| Audit Fees | $ | 116,500 | $ | 123,168 | ||||

| Audit – Related Fees | 60,800 | 23,750 | ||||||

| Tax Fees | - | - | ||||||

| All Other Fees | - | - | ||||||

| Total | $ | 177,300 | $ | 146,918 | ||||

Pre-Approval Policy

In 2015, the Audit Committee adopted policies and procedures for the pre-approval of audit and non-audit services performed by the independent registered public accountants pursuant to which the Audit Committee generally is required to pre-approve the audit and permissible non-audit services performed by the independent registered public accountants in order to ensure that the provision of such services does not impair the registered accountants’ independence.

| 10 |

Compensation Committee Report*

Our Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis (“CD&A”) included in this proxy statement. Based on that review and discussion, the Compensation Committee has recommended to our Board that the CD&A be included in the proxy statement.

Submitted by:

The Compensation Committee of the Board of Directors

/s/ David Nicholson, Chairman

/s/ Jeffrey W. Chell

/s/ Ajit S. Shetty

| * | The information contained in this Compensation Committee Report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that we specifically request that the information be treated as soliciting material or specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act. |

Compensation Discussion and Analysis

Our Compensation Committee of our Board of Directors has the responsibility to review, determine and approve the compensation for our executive officers. Further, our Compensation Committee oversees our overall compensation strategy, including compensation policies, plans and programs that cover all employees. In 2016, our Stockholders voted on an advisory basis with respect to our compensation program for named executive officers. Of the votes cast (excluding abstentions and broker non-votes), 69.0% were cast in support of the program. In light of this, in reviewing the executive compensation program for 2016, our Compensation Committee decided to retain the general overall program design, which ties a significant portion of the executives’ pay closely with our performance. In the future, our Compensation Committee will continue to consider the executive compensation program in light of changing circumstances and stockholder feedback.