UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

______________________

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

¨ |

|

Preliminary Proxy Statement |

|

¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x |

|

Definitive Proxy Statement |

|

¨ |

|

Definitive Additional Materials |

|

¨ |

|

Soliciting Material under Rule 14a-12 |

Actinium Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x |

|

No fee required. |

||

|

|

|

|

|

|

|

¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

|

|

|

||

|

|

|

1. |

|

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

2. |

|

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

3. |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

|

4. |

|

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

|

5. |

|

Total fee paid: |

|

|

|

|

|

|

|

|

|

|

|

|

|

¨ |

|

Fee paid previously with preliminary materials. |

||

|

|

|

|

||

|

¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1 1(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

|

|

|

|

|

|

|

1. |

|

Amount Previously Paid: |

|

|

|

|

|

|

|

|

|

2. |

|

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

|

3. |

|

Filing Party: |

|

|

|

|

|

|

|

|

|

4. |

|

Date Filed: |

|

|

|

|

|

|

Letter to Shareholders

November 14, 2017

Dear Actinium Shareholders,

A luminary in biotech once let on to me that the most important thing he always looked for in a biotech company as a predictor of success was the team, as a good team could create value from even mediocre assets. Well, we believe firmly that we have stellar assets, and in the middle of this year, Actinium was afforded the opportunity to refresh and recalibrate the senior team. With the new team in place, we have had one of the most eventful periods for Actinium Pharmaceuticals to date. For example, we have enrolled more patients in the past few months than in the five prior years combined. This improved operational capability is critical as we drive toward the visible clinical milestones that are needed to establish the value of our clinical assets. As this year comes to a close, I would like to review our progress and accomplishments for you and also provide an outlook for what is promising to be a transformational period with significant value creation potential for the Company.

Today, Actinium is actively engaged in conducting three clinical trials with assets that have either first-in-class or best-in-class potential. The high quality of the hospitals and reputation of the doctors involved in our trials are the envy of many larger companies. These trials are all expected to yield visible clinical results during the remainder of this year and in 2018-2019. We have for the first time, fielded, and had accepted, multiple publications at the prestigious American Society of Hematology, or ASH Meeting, that show case the multi-faceted nature of Actinium’s assets and technology platform. We have launched the AWE Program or Actinium Warhead Enabling Program on the back of experimental results that showcase the power of our platform technology in enabling improved cell killing efficacy of daratumumab, or Darzalex®, a blockbuster product in multiple myeloma after it has been coupled with actinium-225. We have successfully manufactured enough antibody drug supply to satisfy our needs for the next couple of years. Importantly, we are bringing to bear the experience of the new team members to clinical drug development. This is clearly evidenced not only by the meaningful progress made in patient enrollment across our trials but also by our ability to smartly think about the data signals we have received in the Actimab-A trial and to exploit those for further development.

This improved productivity in all areas of the company is a direct result of a higher functioning team which we will continue to grow selectively and strengthen. We anticipate that the expected clinical results of Iomab-B, Actimab-A and Actimab-M, the AWE Program, and other clinical programs that we will unveil going forward will facilitate strategic collaborations and help drive value for the Company and you, our loyal shareholders. As a preview, and a harbinger of things to come please read the section on our CD33 program in this letter. We thank you for your support that allows us to work in realizing our vision for this company. It is with a sense of pride that we review our key accomplishments thus far in 2017.

2017 Review

• Iomab-B Pivotal Phase 3 Trial — All is well. Met target of activating the SIERRA trial at 15 leading U.S. bone marrow transplant centers. Growing enrollment expected to yield visible clinical milestones.

• Data Driven Newsflash. Not just Actimab-A, not just Actimab-M but an emerging, industry leading CD33 program applicable to numerous hematologic indications due to the power of our alpha radiation approach.

- Recent Developments. Drug approvals and strategic deals in industry validate our CD33 approach.

- Lightbulb Moments. Potential to build an Industry leading CD33 program based on evidence from current trials.

- Actimab-A Update. Strong single agent activity seen in Phase 2. On track for topline results in 2018.

- Actimab-M Update. Trial expanded due to encouraging initial data and strong interest. On track for topline results in 2018.

• AWE Technology enables AWE Program launch based on AWEsome experimental results.

• Strong balance sheet allows us to execute on value-enhancing milestones.

Going forward, we believe that the clinical progress and data generated in 2017 will enable our strengthened team to deliver on the multiple, significant value-creation milestones expected between now and the end of 2018 and we provide that outlook after the detailed review below.

2017 Review — Company Achievements Enable Multiple Value Creating Events Going Forward

Iomab-B Pivotal Phase 3 Trial — All Is Well. Met Target of Activating the SIERRA Trial at 15 Leading U.S. Bone Marrow Transplant Centers. Growing Enrollment Expected to Yield Visible Clinical Milestones.

Iomab-B is our first-in-class, lead drug product candidate that targets CD-45, an antigen expressed on all proliferating blood cancer and bone marrow cells. The intent of Iomab-B is to safely destroy all cancer and bone marrow cells before a patient can get a potentially curative Bone Marrow Transplant, or BMT. Currently, chemotherapy is used to destroy or condition the bone marrow and due to its toxicity, it is not well tolerated. Often times, chemotherapy cannot be used for elderly patients with relapsed or refractory Acute Myeloid Leukemia for which Iomab-B is intended. As a result, these patients for whom no other conventional chemotherapy works cannot receive a BMT which is potentially curative, and they tend to have a very short life span. Thereby, Iomab-B offers these patients a chance for a BMT and a chance of a cure or longer survival.

At present, the pivotal, Phase 3 SIERRA (Study of Iomab-B in Elderly Relapsed or Refractory AML) trial for Iomab-B is being conducted at 15 leading bone marrow transplant centers in the United States. We are proud to have met this target and believe that we will add selectively another 3-7 premier sites. The sites where the trial is being conducted perform over 30% of the BMT procedures in the U.S. each year. Our team worked tirelessly to initiate the trial at these BMT centers and has done a stellar job educating and supporting their staffs. We have found that once a site has dosed its first patient, the pace of enrollment at that site subsequently increases. At this time, our clinical team is working hard with the sites to ensure that enrollment continues to remain strong and we continue to believe that enrollment of the Iomab-B clinical trial by the end of 2018, along with the interim Data Monitoring Committee readouts at 25 percent, 50 percent and 75 percent of enrollment will be achievable.

In initiating the SIERRA trial at these top BMT centers, we gained invaluable insights into the operations and dynamics at top BMT centers. We will use this to our advantage as we begin to think about the commercialization of Iomab-B. In the U.S., the top 50 centers perform more than 80% of all BMT procedures. Our commercial efforts will focus on implementing Iomab-B at these centers. We are confident that we will succeed in accomplishing this based on the success our team has had in implementing the Iomab-B pivotal trial at centers such as MD Anderson Cancer Center, the Mayo Clinic, Memorial Sloan Kettering Cancer Center, Baylor and many of the other top BMT centers.

Actinium is focused on and committed to enabling safer myeloablation for BMT to drive better outcomes for patients. We are determined to complete the pivotal, Phase 3 SIERRA trial as efficiently as possible and to submit a Biologics License Application (BLA) to the FDA for approval in 2019. We are confident in our ability to build a bone marrow transplant franchise based around Iomab-B that will have commercial operations servicing the top 50 BMT centers in the U.S., which we believe will be an asset in and of itself, as we will embark on life cycle management activities with Iomab-B during this timeframe. As mentioned during the mid-year review and worthwhile repeating, we note that Iomab-B still stands alone as the only induction and conditioning agent currently in clinical development with no visible competition evident in the clinic. This is an important fact to keep in mind.

Finally, we look forward to providing updates on the trial by the end of this year and continuing to provide updates in 2018 as we progress towards the completion of enrollment and prepare for regulatory filings.

Data Driven Newsflash. Not Just Actimab-A, Not Just Actimab-M But an Emerging, Industry Leading CD33 Program Applicable to Numerous Hematologic Indications Due to the Power of Our Technology Platform Using Alpha Radiation Approach.

Recent Development. Drug Approvals and Strategic Deals in Industry Validate Our CD33 Approach.

In the past few months there has been a lot of excitement related to Acute Myeloid Leukemia treatments as four therapies have received approval after decades of stagnation, with just one therapy having been approved in the forty years prior. That therapy was the CD33-targeting Antibody Drug Conjugate (ADC) Mylotarg which had been initially approved under the leadership of our Chief Medical Officer, Dr. Mark Berger, who led its clinical development. Highly relevant to us, the CD33 field in AML has been very active of late with the reapproval of Mylotarg, which had been withdrawn from the market by Pfizer for safety issues, and strategic transactions like Jazz Pharmaceuticals’ $75 million upfront licensing deal with Immunogen, which included their CD33 targeting ADC currently in a Phase 1 trial. We are encouraged about Mylotarg’s reapproval as it represents validation of the CD33 target, which is expressed in virtually all patients with AML. We are also delighted to see strategic partners showing interest in this field, as we believe we have a superior technological approach that will differentiate us from other CD33 targeting therapies and AML therapies. We have been planning and intend to reveal between year-end and mid-2018 various initiatives that will clearly demonstrate the superior potential of our CD33 program.

Lightbulb Moments. Potential to Build an Industry Leading CD33 Program Based on Evidence From Current Trials.

The studies to date using our CD33 targeting antibody linked to alpha radiation (Bismab-A (discontinued), Actimab-A, Actimab-M) have taught us a great deal about the strengths of using our Antibody Radiation Conjugate (ARC) approach and Actinium intends to take advantage of these strengths. We will address three of them here. One of those strengths (as discussed briefly in the paragraph on Actimab-A below) is simply the ability to treat AML, a cancer known to be a radiosensitive, with radiation and produce a response rate that provides clear evidence of the potency of the drug candidate as a single agent. Instead of continuing to add additional cytotoxic chemotherapies to produce combination cytotoxic treatments, adding Actimab-A to intensive cytotoxic treatments would enable us to bring an entirely different treatment modality to the combination. Secondly, as discussed in our ASH abstract for Actimab-A (and in the paragraph below), the dose of Actimab-A initially used as a front-line therapy for older AML patients unfit for intensive chemotherapies in our current Phase 2 trial was associated with myelosuppression that lasted longer than was clinically desirable. We also determined that the safety profile of Actimab-A outside of myelosuppression is extremely benign with no extramedullary (outside the bone marrow) toxicity. Given this profile we believe that Actimab-A would likely also have great clinical potential in situations such as preparation for allogeneic bone marrow transplant, where myelosuppression is not a problem since the bone marrow is going to be replaced. Lastly, we’ve also learned that Actimab-A is most effective when the peripheral blast burden is low, as then it’s able to distribute well to all the AML cells in the bone marrow. So, another potential use for Actimab-A would be after initial therapy has produced a remission, as it’s known that without further therapy, relapse rates will be high. At remission, of course, there are no peripheral blasts, so this may be a fruitful time to use Actimab-A at lower doses given its potency and safety profile, particularly in older patients who cannot tolerate multiple intensive therapies. Again, we intend to reveal between year-end and mid-2018 various initiatives designed to clearly demonstrate the superior potential of our CD33 program compared to the competition.

Actimab-A Update. Strong Single Agent Activity Seen in Phase 2. On Track for Topline Results in 2018.

Our thinking regarding the CD33 program has evolved, in part, due to certain developments in the Actimab-A Phase 2 trial and alluded to in the ASH abstract published November 1, 2017, highlighting preliminary data from the current Phase 2 trial of Actimab-A. Encouragingly, as a single agent administered twice and 7 days apart, Actimab-A at 2 uCi/kg of body weight showed a 56% response rate in patients over the age of 60 who are unfit for intensive chemotherapy. The Actimab-A presentation at ASH will have additional data on this trial. Our target patient population does not have effective treatment options and is very difficult to treat. The patients enrolled in our trial thus far had a median age of 75 with many having unfavorable cytogenetics and prior hematologic diseases like myelodysplastic syndrome, making treatment of these patients even more complex. We are excited to see Actimab-A’s ability to produce responses for these patients as a single agent which clearly demonstrate its efficacy potential and are constructive about the topline results expected in 2018. Equally exciting is that minimal non-hematologic toxicities were observed in patients receiving Actimab-A, particularly lack of veno-occlusive

disease, a liver toxicity that is seen in ADC’s such as Mylotarg and which led to the discontinuation of Seattle Genetics’ high profile CD33 program this year. Based on the Actimab-A results, we are of the view that our CD33 program has the potential to be best in class based on its activity as a single agent and safety profile. We believe that this profile is a function of our technological approach of using an ARC (versus ADC’s). Our targeting agent linked to Actinium-225 does not have to be internalized like ADC’s and can still kill cells from the outside, either by direct binding of the antibody to the cell surface or by cross fire. We believe this characteristic of our product will allow us to expand into other areas and the Actimab-M trial is the first of several that we are planning in order to better exploit the signals we have obtained from our clinical data set.

Actimab-M Update. Trial Expanded Due to Initial Data, Strong Interest. On Track for Topline Results in 2018.

In 2016 we committed to initiating a third clinical program in 2017. We achieved this goal in early February of 2017 with the initiation of our Actimab-M Phase 1 trial which targets CD33 positive, multiple myeloma patients with advanced disease that were relapsed or refractory to several lines of therapy. This is an out-of-the-box idea with a strong scientific, clinical and commercial rationale for targeting multiple myeloma with a CD33 targeting ARC. First, myeloma is a radiation-sensitive cancer which cannot be treated with external radiation due to is diffuse nature, so use of targeted radiation could be promising. There is a sizable segment of multiple myeloma patients that express CD33 at levels in line with AML (80-90%) so using an ARC proven to show efficacy in AML for these patients is supportive of our rationale. Further, the drugs approved to date have low efficacy as single agents and are either chemotherapy or immunotherapy based, none of them are curative, and standard treatment of these patients tends to be combination therapies. Using a different modality such as Actimab-M with current approaches could be promising, assuming we get an efficacy signal from this proof of concept trial. Lastly, the population of multiple myeloma patients that we target with Actimab-M is larger than AML, which assuming an efficacy signal, would make this program an attractive value proposition for a potential partner. At the present time, the Actimab-M trial is enrolling patients and based on interest from leading cancer centers in participating in this trial, we have taken over management of the trial and brought the Investigational New Drug (IND) in-house to facilitate expedited expansion. Preliminary positive safety information has prompted us to revise the protocol to allow for a higher dose level and revised dosing schedule in order to improve the odds of success. Despite these changes, we are projecting that we will be able to meet our objective of topline results in the Actimab-M trial in 2018.

AWE Technology Enables AWE Program Launch Based on AWEsome Experimental Results.

This year, we reinvigorated intellectual property generation using our AWE or Actinium Warhead Enabling technology platform with activity that has brought our portfolio to 72 patents granted, pending or filed in the U.S. and internationally. The time has also come for the Company to leverage its AWE technology platform for external purposes, in addition to pipeline expansion of our own programs. To this end, we have launched the AWE Program by showcasing the ability of using our AWE technology platform to produce superior drug candidates. The ASH poster demonstrating the vastly superior cell killing abilities of Actinium-225 labeled daratumumab compared to unlabeled daratumumab, or Darzalex®, a blockbuster, commercial product for multiple myeloma is the initial validation of the capabilities we have developed this year to support the AWE Program and also for the AWE technology platform. We intend to offer these capabilities in a collaborative fashion to potential partners who are seeking to develop ARC’s for their own pipelines or biobetters of existing drugs. We believe there are myriad opportunities to create biobetters by increasing efficacy, improving safety, dosing or administration and providing companies with commercial drugs the means to manage their products’ lifecycles. We believe that this is a strategy that can create tremendous value, as was recently shown by Novartis’ announced acquisition of Advanced Accelerator Applications Inc. for $3.9 billion in large part because the latter’s radiation-coupled somatostatin analog biobetter Lutathera® is showing a superior profile to Novartis’ blockbuster drug Sandostatin®.

Strong Balance Sheet Allows Us to Execute on Value-Enhancing Milestones

We reported a cash balance of $20.5 million in our 3Q:2017 quarterly filing. We believe this capital will allow us to execute on several value-enhancing milestones that we highlight below. We pride ourselves on being a team of 25 employees that “punch above our weight” and that we keep things lean. Going forward, our team is committed to the development of drug candidates and the progression of clinical trials in the most efficient and cost-effective manner possible. We are confident in our ability to drive value for shareholders by building on our recent progress in team building and product development, leveraging our upgraded expertise and the recent clinical insights.

Company Outlook — Clinical Trial Progress And 2017 Data Will Enable Strengthened Team To Deliver On The Multiple, Significant Value-Creation Milestones Expected in 2018 That Can Transform The Company

Actinium has made tremendous progress in second half of 2017 with the advancement of our three clinical trials, innovative research that we expect will result in new clinical programs and drug candidates, and strategic programs such as AWE aimed at unlocking value. In addition to all that we have highlighted above, we have achieved several milestones and we expect to achieve additional milestones by the end of 2017 and in 2018. We expect 2018 to be a significant year for Actinium as we are focused on completing enrollment for Iomab-B and delivering visible clinical or topline data on all three ongoing trials. Assuming that the early signs bear themselves out and yield positive results, significant and transformative value creation is possible.

Key Value Enhancing Catalysts for the Remainder of 2017 and 2018

• Actimab-A Phase 2 clinical trial update via ASH poster presentation

• CD33 program update and unveiling of new clinical initiative

• Iomab-B SIERRA trial update by year end

• Iomab-B SIERRA trial site expansion and DMC enrollment updates

• Complete enrollment of the pivotal Phase 3 trial by year end

• Actimab-A Phase 2 clinical trial top line data

• Actimab-M Phase 1 clinical trial top line data

• Implementation of fourth clinical program

• Intellectual property generation leveraging our AWE Technology Platform

• AWE Program initiatives designed to facilitate collaborations

• Selective expansion of the team to further bolster clinical development and research & development

• Explore strategic initiatives to enhance our capabilities in supply chain and research & development

In the second half of 2017 our refreshed and recalibrated executive team has come together and is working towards a unified vision for what Actinium Pharmaceuticals will become. Our entire team has never been stronger, more aligned or energized. As a result, we have been able to accomplish a number of meaningful milestones, but perhaps most importantly, we have laid a foundation for 2018 and beyond, where we can finally begin to realize the true potential of Actinium’s assets. We believe a disconnect exists between the value of our drug candidates, technology and know-how, with respect to the value that is being ascribed to the Company in the public markets. We recognize that this is frustrating to you as shareholders and commit to you that we are focused on producing results to eliminate this dislocation of value. All of us at Actinium feel privileged to work on developing such promising therapies and technology, which we confidently believe will have meaningful impacts on the lives of patients with our drug candidates that are either first-in-class or best-in-class. We thank you for your support that allows us to work towards this worthwhile endeavor.

Please send in your completed proxy form as soon as possible as indicated in the proxy materials. We hope that you support the proposals in line with management and the board’s recommendations. We believe these proposals will enable us to best succeed in our goal to build a leading company to develop and deliver transformative medicines for bone marrow transplants and blood cancers by harnessing the power of our proprietary assets and technology and in part by selectively acquiring enhanced capabilities that fit our strategy

Indeed, we are counting on your unfettered support as in the past!

Sincerely and with deep gratitude,

Sandesh Seth

Chairman and CEO

Forward-Looking Statements for Actinium Pharmaceuticals, Inc.

This letter contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and involve risks and uncertainties, which may cause actual results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding product development, product potential, or financial performance. No forward-looking statement can be guaranteed and actual results may differ materially from those projected. Actinium Pharmaceuticals undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

TABLE OF CONTENTS

|

|

|

Page |

|

General |

|

1 |

|

Questions and Answers |

|

1 |

|

Who Can Help Answer Your Questions? |

|

5 |

|

Corporate Governance |

|

6 |

|

Board Committees |

|

9 |

|

Director Compensation |

|

11 |

|

Audit Committee Report |

|

12 |

|

Compensation Committee Report |

|

14 |

|

Directors and Executive Officers |

|

18 |

|

Executive Compensation |

|

22 |

|

Principal Stockholders |

|

29 |

|

Certain Relationships and Related Transactions |

|

31 |

|

Proposal 1 — Election of Directors |

|

32 |

|

Proposal 2 — Ratification of the Appointment of GBH CPAs, PC |

|

34 |

|

Proposal 3: To approve an amendment to the Actinium Pharmaceuticals, Inc. 2013 Amended and Restated Stock Plan, as amended, to increase the shares of our common stock available for issuance thereunder by 5 million shares to support planned hiring efforts as the company grows |

|

35 |

|

Proposal 4: To approve an amendment to our Certificate of Incorporation to increase the number of shares of common stock, par value $0.001 per share, the corporation is authorized to issue to 400,000,000 shares |

|

40 |

|

Other Matters |

|

42 |

|

Annual Report on Form 10-K |

|

42 |

|

Householding of Proxy Materials |

|

42 |

|

Electronic Delivery of Company Stockholder Communications |

|

43 |

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on December 20, 2017 |

|

43 |

|

Proposals of Stockholders |

|

43 |

|

Where You Can Find More Information |

|

43 |

i

Stockholders Should Read the Entire Proxy Statement Carefully Prior to Returning Their Proxies

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors of Actinium Pharmaceuticals, Inc. for use at our annual meeting of stockholders to be held at The Garden City Hotel, 45 Seventh St, Garden City, NY 11530 on December 20, 2017 at 9:30 a.m. Eastern Standard Time. Voting materials, including this proxy statement and proxy card, are expected to be first delivered to all or our stockholders on or about November 13, 2017.

QUESTIONS AND ANSWERS

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

What may I vote on at the annual meeting?

At the annual meeting, stockholders will consider and vote upon the following matters:

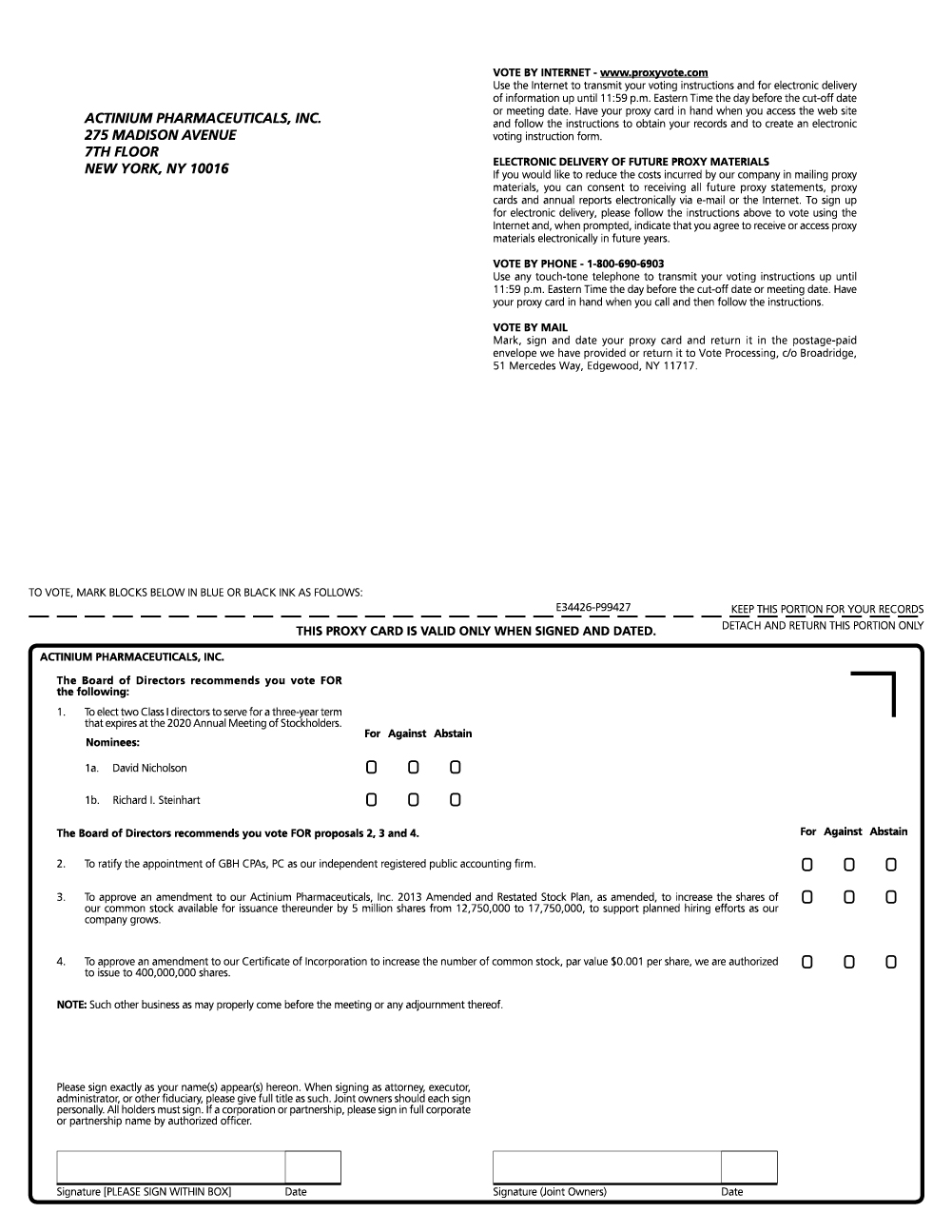

• Proposal 1: To elect David Nicholson and Richard I. Steinhart as Class I directors to serve for a three-year term that expires at the 2020 Annual Meeting of Stockholders, or until his successor is elected and qualified or until his earlier resignation or removal; and

• Proposal 2: To ratify the appointment of GBH CPAs, PC as our independent registered public accounting firm; and

• Proposal 3: To approve an amendment to our Actinium Pharmaceuticals, Inc. 2013 Amended and Restated Stock Plan, as amended, to increase the shares of our common stock available for issuance thereunder by 5 million shares from 12,750,000 to 17,750,000, to support planned hiring efforts as our company grows; and

• Proposal 4: To approve an amendment to our Certificate of Incorporation to increase the number of common stock, par value $0.001 per share, we are authorized to issue to 400,000,000 shares; and

• To consider and act upon any other business as may properly come before the annual meeting or any adjournments thereof.

How does the Board of Directors recommend that I vote on the proposals?

Our Board unanimously recommends that the stockholders vote “FOR” all proposals being put before our stockholders at the Meeting.

How do I vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card applicable to your class of stock, or your “proxies,” will vote your shares in the manner you indicate. You may specify whether your shares: should be voted for or withheld for the nominee for director; should be voted for, against or abstained with respect to the ratification of the appointment of the Company’s independent registered public accounts; should be voted for, against or abstained with respect to approving an amendment to our Actinium Pharmaceuticals, Inc. 2013 Amended and Restated Stock Plan, as amended; and should be voted for, against or abstained with respect to approving an amendment to our Certificate of Incorporation to increase the number of common shares we are authorized to issue to 400,000,000 shares. Voting by proxy will not affect your right to attend the annual meeting. If your shares are

1

registered directly in your name through our transfer agent, Action Stock Transfer Corporation, or you have stock certificates registered in your name, you may submit a proxy to vote:

• By Internet or by telephone. Follow the instructions attached to the proxy card to submit a proxy to vote by Internet or telephone.

• By mail. If you received one or more proxy cards by mail, you can vote by mail by completing, signing, dating and returning the enclosed proxy card applicable to your class of stock in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors.

• In person at the meeting. If you attend the annual meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the annual meeting. You are required to register in advance of the annual meeting if you plan to attend the annual meeting in person. If you wish to register in advance of the annual meeting, please contact our investor relations office by no later than December 13, 2017, by e-mail to soloughlin@actiniumpharma.com, mail to Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, New York 10016, or telephone at (646) 677-3875.

Telephone and Internet voting facilities for all stockholders of record will be available 24-hours a day and will close at 11:59 p.m., Eastern Standard Time, on December 19, 2017.

If your shares are held in “street name” (held in the name of a bank, broker or other nominee who is the holder of record), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

• By Internet or by telephone. Follow the instructions you receive from the record holder to vote by Internet or telephone.

• By mail. You should receive instructions from the record holder explaining how to vote your shares.

• In person at the meeting. Contact the broker, bank or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the annual meeting. You will not be able to vote at the annual meeting unless you have a proxy card from your broker, bank or other nominee.

What happens if additional matters are presented at the annual meeting?

Other than the election of directors, the ratification of the appointment of our auditor, the amendment of our stock plan to increase the number of shares that may be granted under the plan, and approving an amendment to our certificate of incorporation to increase our authorized shares, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder, Sandesh Seth, our Chairman and Chief Executive Officer, or CEO, will have the discretion to vote your shares on any additional matters properly presented for a vote at the annual meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board of Directors, or Board, on all matters and as the proxy holder may determine in his discretion with respect to any other matters properly presented for a vote before the annual meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters. For example, Proposal 2 — ratification of the appointment of GBH CPAs, PC as our independent registered public accounting firm, and Proposal 4 — the amendment to our certificate of incorporation to increase our authorized shares, are considered routine matters, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposals 2 and 4. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred

2

to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 — the election of David Nicholson and Richard I. Steinhart as members to our Board, and Proposal 3 — the increase in shares of our stock plan. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

On November 8, 2017, the Record Date for determining which stockholders are entitled to vote, there were 80,025,073 shares of our common stock outstanding, which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted to a vote of our stockholders. Thirty Four percent (34%) of our outstanding common shares as of the Record Date must be present at the annual meeting (in person or represented by proxy) in order to hold the meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the annual meeting, if you are present and vote in person at the meeting or have properly submitted a proxy card or voted by fax, by phone or by using the Internet.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may do this by signing a new proxy card with a later date, by voting on a later date by using the Internet (only your latest Internet proxy submitted prior to the annual meeting will be counted), or by attending the annual meeting and voting in person. However, your attendance at the annual meeting will not automatically revoke your proxy unless you vote at the annual meeting or specifically request in writing that your prior proxy be revoked.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except:

• as necessary to meet applicable legal requirements;

• to allow for the tabulation of votes and certification of the vote; and

• to facilitate a successful proxy solicitation.

Any written comments that a stockholder might include on the proxy card will be forwarded to our management.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by our Inspector of Elections and reported in a Current Report on Form 8-K which we will file with the Securities and Exchange Commission, or SEC, within four business days of the date of the annual meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one Actinium Pharmaceuticals, Inc. stock account, we are delivering only one Notice to certain stockholders who share an address, unless otherwise requested. If you share an address with another stockholder and have received only one Notice, you may write or call us to request to receive a separate Notice. Similarly, if you share an address with another stockholder and have received multiple copies of the Notice, you may write or call us at the address and phone number below to request delivery of a single copy of this Notice. For future annual meetings, you may request separate Notices, or request that we send only one Notice to you if you are receiving multiple copies, by writing or calling us at:

Actinium Pharmaceuticals, Inc.

Attention: Steve O’Loughlin, Principal Financial Officer

275 Madison Avenue, 7th

Floor

New York, New York 10016

Tel: (646) 677-3875

3

Who pays for the cost of this proxy solicitation?

We will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally, electronically or by telephone.

How can I obtain a copy of Actinium Pharmaceuticals, Inc.’s 2016 Annual Report on Form 10-K?

This proxy statement and our 2016 annual report to stockholders are available for viewing, printing and downloading at www.proxyvote.com. To view these materials, please have your 12-digit control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2016 on the website of the SEC, at www.sec.gov, or in the “All SEC Filings” section of the “Investors” section of our website at www.actiniumpharma.com. You may also obtain a printed copy of our Annual Report on Form 10-K including our financial statements, free of charge, from us by sending a written request to: Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016, attention: Principal Financial Officer.

What is the voting requirement to elect directors?

Directors are elected by a plurality of the votes cast in person or by proxy at the annual meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the meeting. Broker non-votes will not affect the outcome of the election of directors because brokers do not have discretion to cast votes on this proposal without instruction from the beneficial owner of the shares.

What is the voting requirement to approve the other three proposals?

The proposal to ratify the appointment of GBH CPAs, PC as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The proposal to approve an amendment to our 2013 stock plan to increase the shares authorized under the plan will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The proposal to amend the charter to increase the authorized shares of the company will be approved if at least 50% of the issued and outstanding shares votes “FOR” the proposal and this exceeds those cast against the proposal.

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the annual meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the annual meeting.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our shareholders with any of the proposals described above to be brought before the annual meeting of shareholders.

How can I communicate with the non-employee directors on the Actinium Pharmaceuticals, Inc. Board of Directors?

Our Board encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of our Chairman and CEO. Stockholders can send communications by mail to:

Sandesh Seth, Chairman and Chief Executive Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th

Floor

New York, New York 10016

4

Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman of the Board or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our chairman, deals with the functions of our Board or committees thereof or that our chairman otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board and request copies of any such correspondence.

WHO CAN HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by writing, calling or emailing us at:

Steve O’Loughlin

Principal Financial Officer

Actinium Pharmaceuticals, Inc.

275 Madison Avenue, 7th

Floor

New York, NY 10016

Email: soloughlin@actiniumpharma.com

Tel: 646-677-3875

5

CORPORATE GOVERNANCE

Board of Directors

The Board of Directors oversees our business affairs and monitors the performance of management. In accordance with our corporate governance principles, our Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman and CEO, other key executives, and by reading the reports and other materials that we send them and by participating in Board and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve in the capacity of director. Biographical information about our directors is provided in “Election of Directors — Proposal No. 1” on page 32.

Term of Office

Our directors are divided into three classes, designated Class I, Class II and Class III. Class I shall consists of two directors, Class II shall consist of one director, and Class III consists of one director.

The term of each director is set forth below or until their successors are duly elected:

|

Director |

|

Class |

|

Term (from 2017 Annual Meeting, if elected) |

|

David Nicholson |

|

Class I |

|

3 years |

|

Richard I Steinhart |

|

Class I |

|

3 years |

|

Sandesh Seth |

|

Class II |

|

1 year |

|

Ajit S. Shetty |

|

Class III |

|

2 years |

Notwithstanding the foregoing, each director shall serve until his successor is duly elected and qualified, or until his retirement, death, resignation or removal. In order to implement a classified board of directors, Class I shall serve a three year term from the date of the 2017 Annual Shareholders Meeting; Class II shall serve a one year term from the date of the 2017 Annual Shareholders Meeting; and Class III shall serve a two year term from the date the date of the 2017 Annual Shareholders Meeting. Directors elected at each annual meeting are elected for a three year term.

Director Independence

We use the definition of “independence” of the NYSE American stock exchange to make this determination. We are listed on the NYSE American under the symbol “ATNM”. NYSE MKT corporate governance rule Sec. 803(A)(2) provides that an “independent director” means a person other than an executive officer or employee of the company. No director qualifies as independent unless the issuer’s board of directors affirmatively determines that the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The following is a non-exclusive list of persons who shall not be considered independent under NYSE American rules:

• a director who is, or during the past three years was, employed by the company, other than prior employment as an interim executive officer (provided the interim employment did not last longer than one year);

• a director who accepted or has an immediate family member who accepted any compensation from the company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence, other than the following:

(i) compensation for board or board committee service;

(ii) compensation paid to an immediate family member who is an employee (other than an executive officer) of the company,

(iii) compensation received for former service as an interim executive officer (provided the interim employment did not last longer than one year); or

(iv) benefits under a tax-qualified retirement plan, or non-discretionary compensation;

6

• a director who is an immediate family member of an individual who is, or at any time during the past three years was, employed by the company as an executive officer;

• a director who is, or has an immediate family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the company made, or from which the company received, payments (other than those arising solely from investments in the company’s securities or payments under non-discretionary charitable contribution matching programs) that exceed 5% of the organization’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years;

• a director who is, or has an immediate family member who is, employed as an executive officer of another entity where at any time during the most recent three fiscal years any of the issuer’s executive officers serve on the compensation committee of such other entity; or

• a director who is, or has an immediate family member who is, a current partner of the company’s outside auditor, or was a partner or employee of the company’s outside auditor who worked on the company’s audit at any time during any of the past three years.

Under the above-mentioned NYSE American director independence rules, David Nicholson, Ajit S. Shetty, and Richard I. Steinhart are independent directors of the Company.

Board Leadership Structure

In October 2013, Sandesh Seth was appointed Chairman of our Board of Directors and in June 2017 Mr. Seth was named Chief Executive Officer of the Company. In September 2017, David Nicholson was appointed lead independent director of our board of directors (“Lead Independent Director”). Our Lead Independent Director chairs the executive sessions of our board of director meetings; provides feedback to the Chairman and CEO; if appropriate, and in coordination with executive management, be available for consultation and direct communication with major shareholders; and leads the board’s evaluation of the Chairman and CEO. We have a separate chair for each committee of our board of directors, all of whom are independent directors. The chairs of each committee report on the activities of their committees in fulfilling their responsibilities at the meetings of our board of directors.

Board of Directors Meetings and Attendance

During the fiscal year 2016, our Board held 9 meetings. No director attended fewer than 89% of the total number of meetings of our Board and of any committees of which he was a member during the year ended December 31, 2016. It is our policy that directors should make every effort to attend the annual meeting of stockholders, and each of our directors attended the annual meeting of stockholders in 2016.

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. A copy of the Code of Business Conduct and Ethics is available on the Investor section of our website at www.actiniumpharma.com. We will post on our website any amendment to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers.

Complaints Regarding Accounting Matters

The Audit Committee has established procedures for:

• the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters; and

• the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

7

Communications with Directors

The Board of Directors has approved procedures for stockholders to send communications to individual directors or the non-employee directors as a group. Written correspondence should be addressed to the director or directors in care of Sandesh Seth, Chairman and CEO of Actinium Pharmaceuticals, Inc., 275 Madison Avenue, 7th Floor, New York, NY 10016. Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman and CEO or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, deals with the functions of our Board of Directors or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of our Board of Directors and request copies of any such correspondence. You may also contact individual directors by calling our principal executive offices at (646) 677-3875.

Legal Proceedings

There are no legal proceedings to which any director, director nominee or officer of our company, any owner of record or beneficially of more than 5% of common stock, or any associate of any such director, director nominee, officer of our company or major security holder is a party in legal proceedings adverse to our company or has a material interest adverse to us.

Compliance With Section 16(a) of the Exchange Act

Based solely upon a review of copies of such forms filed on Forms 3, 4, and 5, and amendments thereto furnished to us we believe that as of the date of this proxy, our executive officers, directors and greater than 10 percent beneficial owners have complied on a timely basis with all Section 16(a) filing requirements.

8

BOARD COMMITTEES

Committees of the Board of Directors

Our Board of Directors has formed three standing committees: audit, compensation and corporate governance. Actions taken by our committees are reported to the full board. Each of our committees has a charter and each charter is posted on our website.

|

Audit Committee |

|

Compensation Committee |

|

Corporate Governance Committee |

|

Richard I. Steinhart* |

|

David Nicholson* |

|

Ajit S. Shetty* |

|

David Nicholson |

|

Ajit S. Shetty |

|

David Nicholson |

|

Ajit S. Shetty |

|

Richard I. Steinhart |

|

Richard I. Steinhart |

____________

* Indicates committee chair

Audit Committee

Our audit committee, which currently consists of three directors, provides assistance to our board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, financial reporting, internal control and compliance functions of the company. Our audit committee employs an independent registered public accounting firm to audit the financial statements of the company and perform other assigned duties. Further, our audit committee provides general oversight with respect to the accounting principles employed in financial reporting and the adequacy of our internal controls. In discharging its responsibilities, our audit committee may rely on the reports, findings and representations of the company’s auditors, legal counsel, and responsible officers. Our board has determined that all members of the audit committee are financially literate within the meaning of SEC rules and under the current listing standards of the NYSE MKT. Richard I. Steinhart is the chairman of the audit committee. Our audit committee met four times during the year ended December 31, 2016.

Compensation Committee

Our compensation committee, which currently consists of three directors, establishes executive compensation policies consistent with the company’s objectives and stockholder interests. Our compensation committee also reviews the performance of our executive officers and establishes, adjusts and awards compensation, including incentive-based compensation, as more fully discussed below. Our compensation committee met four times during the year ended December 31, 2016.

In addition, our compensation committee generally is responsible for:

• establishing and periodically reviewing our compensation philosophy and the adequacy of compensation plans and programs for our directors, executive officers and other employees;

• overseeing our compensation plans, including the establishment of performance goals under the company’s incentive compensation arrangements and the review of performance against those goals in determining incentive award payouts;

• overseeing our executive employment contracts, special retirement benefits, severance, change in control arrangements and/or similar plans;

• acting as administrator of any company stock option plans; and

• overseeing the outside consultant, if any, engaged by the compensation committee.

Our compensation committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The compensation committee also periodically reports to the board on how our non-employee director compensation practices compare with those of other similarly situated public corporations and, if the compensation committee deems it appropriate, recommends changes to our director compensation practices to our board for approval.

Outside consulting firms retained by our compensation committee and management also will, if requested, provide assistance to the compensation committee in making its compensation-related decisions.

9

Corporate Governance Committee

Our corporate governance committee, which currently consists of three directors, monitors our corporate governance system. Our corporate governance committee met two times during the year ended December 31, 2016.

Nomination of Directors

Board of Director nominations are selected, or recommended for our Board’s selection, by a majority of the independent directors. Our independent directors include David Nicholson, Ajit S. Shetty and Richard I. Steinhart. These directors are charged with the responsibility of proposing potential director nominees to the board of directors for consideration. All of our independent directors are independent directors as defined by the rules of the NYSE MKT. Our independent directors use criteria by which they will seek to evaluate candidates to serve on our Board. The evaluation methodology includes items such as experience in the biotechnology sector, experience with public companies, executive managerial experience, operations and commercial experience, fundraising experience and contacts in the investment banking industry, personal and skill set compatibility with current board members, industry reputation, knowledge of our company generally, and independence.

10

DIRECTOR COMPENSATION

The following table sets forth the compensation of our non-employee directors for the 2016 fiscal year:

|

Name |

|

Fees Earned or Paid in Cash |

|

Stock |

|

Option |

|

All Other Compensation |

|

Total |

||

|

David Nicholson |

|

$ |

59,000 |

|

— |

|

107,090 |

|

— |

|

$ |

166,090 |

|

Richard Steinhart |

|

$ |

63,000 |

|

— |

|

107,090 |

|

— |

|

$ |

170,090 |

|

Sergio Traversa (resigned June 2017) |

|

$ |

58,500 |

|

— |

|

107,090 |

|

— |

|

$ |

165,590 |

____________

(1) At the end of fiscal year 2016, the aggregate number of option awards outstanding for each director was as follows: (i) for Dr. Nicholson, 199,900, (ii) for Mr. Steinhart, 149,950, and (iii) for Mr. Traversa, 169,950.

In accordance with SEC rules, the amounts shown reflect the aggregate grant date fair value of option awards granted to non-employee Directors during 2016, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718.

Our non-employee directors are paid an annual fee of $40,000 and receive annual option grants of 25,000 shares. In addition, the Lead Independent Director will receive $10,000 per year for service in that role. Board committee members will receive the following compensation:

|

BOD Committee |

|

Chairman |

|

Member |

||

|

Audit |

|

$ |

15,000 |

|

$ |

6,000 |

|

Compensation |

|

$ |

10,000 |

|

$ |

5,000 |

|

Corporate Governance |

|

$ |

7,500 |

|

$ |

3,000 |

11

AUDIT COMMITTEE REPORT

Report of the Audit Committee of the Board of Directors

The Audit Committee provides assistance to the Board of Directors in fulfilling its oversight responsibilities relating to our corporate accounting and reporting practices toward assurance of the quality and integrity of our consolidated financial statements. The purpose of the Audit Committee is to serve as an independent and objective party to monitor our financial reporting process and internal control system; oversee, review and appraise the audit activities of our independent registered public accounting firm and internal auditing function, maintain complete, objective and open communication between the Board of Directors, the independent accountants, financial management and the internal audit function.

Our independent registered public accounting firm reports directly to the Audit Committee and the Audit Committee is solely responsible to appoint or replace our independent registered public accounting firm and to assure its independence and to provide oversight and supervision thereof. The Audit Committee determines compensation of the independent registered public accounting firm and has established a policy for approval of non-audit related engagements awarded to the independent registered public accounting firm. Such engagements must not impair the independence of the registered public accounting firm with respect to our company as prescribed by the Sarbanes-Oxley Act of 2002; thus payment amounts are limited and non-audit related engagements must be approved in advance by the Audit Committee. The Audit Committee determines the extent of funding that we must provide to the Audit Committee to carry out its duties and has determined that such amounts were sufficient in 2016.

With respect to the fiscal year ended December 31, 2016, in addition to its other work, the Audit Committee:

• Reviewed and discussed with management our audited consolidated financial statements as of December 31, 2016 and for the year then ended; and

• Discussed with GBH CPAs, PC the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as amended, with respect to its review of the findings of the independent registered public accounting firm during its examination of our financial statements.

The Audit Committee recommended, based on the review and discussion summarized above, that the Board of Directors include the 2016 audited consolidated financial statements in the 2016 Form 10-K for the fiscal year ended December 31, 2016 for filing with the SEC.

|

|

|

Audit Committee of the Board of Directors of Actinium Pharmaceuticals, Inc. |

||

|

|

|

|

|

|

|

|

|

|

|

Richard I. Steinhart, Chairman Ajit S. Shetty David Nicholson |

Information About Our Auditors

Our Audit Committee of our Board appointed GBH CPAs, PC as the independent registered public accounting firm to conduct the audit of our consolidated financial statements for the 2016 fiscal year and to report on our consolidated balance sheets, statements of income and other related statements. GBH CPAs, PC has served as our independent registered public accounting firm since December 2012. The Audit Committee Charter includes the procedures for pre-approval of all fees charged by our independent registered public accounting firm. Under the procedure, our Audit Committee approves the engagement letter with respect to audit and review services. Other fees are subject to pre-approval by our Audit Committee. The audit and audit-related fees paid to the auditors with respect to the 2016 fiscal year were pre-approved by our Audit Committee.

12

Fees and Services

The aggregate fees billed for the fiscal years ended December 31, 2016 and 2015 for professional services rendered by GBH CPAs, PC for the audits of the Company’s annual financial statements included in Form 10-K (“Audit Fees”), tax compliance, advice, and planning (“Tax Fees”), and other products or services provided (“Other Fees”):

|

|

|

Year Ended December 31, 2016 |

|

Year Ended December 31, 2015 |

||

|

Audit Fees |

|

$ |

146,918 |

|

$ |

136,800 |

|

Audit – Related Fees |

|

|

— |

|

|

— |

|

Tax Fees |

|

|

— |

|

|

— |

|

All Other Fees |

|

|

— |

|

|

— |

|

Total |

|

$ |

146,918 |

|

$ |

136,800 |

Pre-Approval Policy

Our Audit Committee adopted policies and procedures for the pre-approval of audit and non-audit services performed by the independent registered public accountants pursuant to which our Audit Committee generally is required to pre-approve the audit and permissible non-audit services performed by the independent registered public accountants in order to ensure that the provision of such services does not impair the registered accountants’ independence.

All audit services and non-audit services and all fees associated with such services performed by our independent registered public accounting firm in the 2016 fiscal year were approved by our Audit Committee. Consistent with these policies and procedures, all future audit services and non-audit services and all fees associated with such services performed by our independent registered public accounting firm will be approved by our Chairperson of our Audit Committee and ratified by our Audit Committee or approved by our full Audit Committee.

13

Compensation Committee Report*

Our Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis (“CD&A”) included in this proxy statement. Based on that review and discussion, the Compensation Committee has recommended to our Board that the CD&A be included in the proxy statement.

Submitted by:

The Compensation Committee of the Board of Directors

/s/ David Nicholson, Chairman

/s/ Ajit S. Shetty

/s/ Richard I. Steinhart

____________

* The information contained in this Compensation Committee Report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that we specifically request that the information be treated as soliciting material or specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

Compensation Discussion and Analysis

Our Compensation Committee of our Board of Directors has the responsibility to review, determine and approve the compensation for our executive officers. Further, our Compensation Committee oversees our overall compensation strategy, including compensation policies, plans and programs that cover all employees. In 2016, our Stockholders voted on an advisory basis with respect to our compensation program for named executive officers. Of the votes cast (excluding abstentions and broker non-votes), 69.0% were cast in support of the program. In light of this, in reviewing the executive compensation program for 2016, our Compensation Committee decided to retain the general overall program design, which ties a significant portion of the executives’ pay closely with our performance. In the future, our Compensation Committee will continue to consider the executive compensation program in light of changing circumstances and stockholder feedback.

We currently employ four executive officers, each of whom serves as a “Named Executive Officer” (or NEO) for purposes of SEC reporting: (1) Sandesh Seth, our Chairman and Chief Executive Officer (who we refer to in this Compensation Discussion and Analysis as our CEO); (2) Steve O’Loughlin, our Principal Financial Officer, (3) Mark Berger, our Chief Medical Officer; and (4) Nitya Ray, our Executive Vice-President, Head of Product Development, Manufacturing and Supply Chain.

This Compensation Discussion and Analysis sets forth a discussion of the compensation for our NEOs as well as a discussion of our philosophies underlying the compensation for our NEOs and our employees generally.

Objectives of Our Compensation Program

The Compensation Committee’s philosophy seeks to align the interests of our stockholders, officers and employees by tying compensation to individual and company performance, both directly in the form of salary or annual cash incentive payments, and indirectly in the form of equity awards. The objectives of our compensation program enhance our ability to:

• attract and retain qualified and talented individuals; and

• provide reasonable and appropriate incentives and rewards to our team for building long-term value within our company, in each case in a manner comparable to companies similar to ours.

In addition, we strive to be competitive with other similarly situated companies in our industry. The process of developing pharmaceutical products and bringing those products to market is a long-term proposition and outcomes may not be measurable for several years. Therefore, in order to build long-term value for our company and its stockholders, and in order to achieve our business objectives, we believe that we must compensate our officers and employees in a competitive and fair manner that reflects current company activities, but also reflects contributions to building long-term value.

14

We utilize the services of StreeterWyatt Governance LLC to review compensation programs of peer companies in order to assist the Compensation Committee in determining the compensation levels for our NEOs, as well as for other employees of our company. StreeterWyatt is a recognized independent consulting company and services clients throughout the United States.

The companies that comprise our peer group are selected and reviewed no less frequently than biennially.

Elements of Our Compensation Program and Why We Chose Each

Main Compensation Components

Our company-wide compensation program, including for our NEOs, is broken down into three main components: base salary, performance cash bonuses and potential long-term compensation in the form of stock options or restricted stock awards. We believe these three components constitute the minimum essential elements of a competitive compensation package in our industry.

Salary

Base salary is used to recognize the experience, skills, knowledge and responsibilities required of our NEOs as well as recognizing the competitive nature of the biopharmaceutical industry. This is determined partially by evaluating our peer companies as well as the degree of responsibility and experience levels of our NEOs and their overall contributions to our company. Base salary is one component of the compensation package for NEOs; the other components being cash bonuses, annual equity grants, and company benefit programs. Base salary is determined in advance whereas the other components of compensation are awarded in varying degrees following an assessment of the performance of a NEO. This approach to compensation reflects the philosophy of our Board and its Compensation Committee to emphasize and reward, on an annual basis, performance levels achieved by our NEOs.

Performance Bonus Plan

We have a performance bonus plan under which bonuses are paid to our NEOs based on achievement of company performance goals and objectives established by the Compensation Committee and/or our Board as well as on individual performance. The bonus program is discretionary and is intended to: (i) strengthen the connection between individual compensation and our company’s achievements; (ii) encourage teamwork among all disciplines within our company; (iii) reinforce our pay-for-performance philosophy by awarding higher bonuses to higher performing employees; and (iv) help ensure that our cash compensation is competitive. Depending on the cash position of the company, the Compensation Committee and our Board have the discretion to not pay cash bonuses in order that we may conserve cash and support ongoing development programs and commercialization efforts. Regardless of our cash position, we consistently grant annual merit-based stock options to continue incentivizing both our senior management and our employees.

Based on their employment agreements, each NEO is assigned a target payout under the performance bonus plan, expressed as a percentage of base salary for the year. Actual payouts under the performance bonus plan are based on the achievement of corporate performance goals and an assessment of individual performance, each of which is separately weighted as a component of such officer’s target payout. For the NEOs, the corporate goals receive the highest weighting in order to ensure that the bonus system for our management team is closely tied to our corporate performance. Each employee also has specific individual goals and objectives as well that are tied to the overall corporate goals. For employees, mid-year and end-of-year progress is reviewed with the employees’ managers.

Equity Incentive Compensation

We view long-term compensation, currently in the form of stock options and restricted stock generally vesting in annual increments over four years, as a tool to align the interests of our NEOs and employees generally with the creation of stockholder value, to motivate our employees to achieve and exceed corporate and individual objectives and to encourage them to remain employed by the company. While cash compensation is a significant component of employees’ overall compensation, the Compensation Committee and our Board (as well as our NEOs) believe that the driving force of any employee working in a small biotechnology company should be strong equity participation. We believe that this not only creates the potential for substantial longer term corporate value but also serves to motivate employees and retain their loyalty and commitment with appropriate personal compensation.

15

Other Compensation

In addition to the main components of compensation outlined above, we also provide contractual severance and/or change in control benefits to our Chairman and CEO. The change in control benefits for all applicable persons have a “double trigger.” A double trigger means that the executive officers will receive the change in control benefits described in the agreements only if there is both (1) a Change in Control of our company (as defined in the agreements) and (2) a termination by us of the applicable person’s employment “without cause” or a resignation by the applicable persons for “good reason” (as defined in the agreements) within a specified time period prior to or following the Change in Control. We believe this double trigger requirement creates the potential to maximize stockholder value because it prevents an unintended windfall to management, as no benefits are triggered solely in the event of a Change in Control, while providing appropriate incentives to act in furtherance of a change in control that may be in the best interests of the stockholders. We believe these severance or change in control benefits are important elements of our compensation program that assist us in retaining talented individuals at the executive and senior managerial levels and that these arrangements help to promote stability and continuity of our executives and senior management team. Further, we believe that the interests of our stockholders will be best served if the interests of these members of our management are aligned with theirs. We believe that providing change in control benefits lessens or eliminates any potential reluctance of members of our management to pursue potential change in control transactions that may be in the best interests of the stockholders. We also believe that it is important to provide severance benefits to members of our management, to promote stability and focus on the job at hand.